FONAR Corporation (NASDAQ: FONR), The Inventor of MR Scanning™,

reported its 3rd quarter fiscal 2013 and nine month financial

results today, for the period ended March 31, 2013. The Company's

two industry segments are: Development, manufacturing and servicing

of the UPRIGHT® Multi-Position™ MRI, and management of 23 Stand-Up®

MRI, (UPRIGHT® MRI) centers.

Third Quarter Highlights

During the quarter the Company's subsidiary, HMCA, entered into

an agreement with outside investors to acquire a 50.5% controlling

interest in a newly formed limited liability company, Health

Diagnostics Management, LLC (HDM). HMCA contributed $20.2 million

to HDM and the group of outside investors contributed $19.8 million

for its non-controlling membership interest.

On March 5, 2013, HDM purchased from Health Diagnostics, LLC and

certain of its subsidiaries (HD), a business managing 12 Stand-Up®

MRI centers and two other scanning centers located in the states of

New York and Florida.

With the purchase of HD, the Company increased total assets to

$73.3 million at March 31, 2013. This compares to total assets of

$33.6 million at June 30, 2012, an increase of 118%. Meanwhile,

total liabilities increased to $38.3 million at March 31, 2013 as

compared to $22.5 million on June 30, 2012, an increase of 70%.

Stockholder's equity increased to $35.0 million at March 31, 2013

from $11.1 million on June 30, 2012, an increase of 216%.

FONAR continued on its surge of profitable quarters where net

income was greater than $1.5 million, climbing to seven straight

quarters. The Company has had 13 straight quarters of income from

operations.

Revenues increased 22% to $11.6 million for the quarter ended

March 31, 2013, an increase of 21% from $9.6 million for the

preceding quarter ending December 31, 2012. The revenues for this

quarter are the largest quarterly revenue since the Nation's 2008

financial crisis. Approximately $2.8 million of revenue was from

the acquisition of HD.

Statement of Operations Items

Net income for the quarters ended March 31, 2013 and March 31,

2012 was $1.6 million. Net income for the nine months ended March

31, 2013 was $5.0 million, as compared to $5.1 million for the

nine-month period ended March 31, 2012. Net income for the quarter

ended March 31, 2013 included only 3 weeks of the net income of HDM

which was acquired on March 5, 2013.

Income from operations for the quarters ended March 31, 2013 and

March 31, 2012, was $1.6 million. Income from operations for the

nine months ended March 31, 2013, was $5.2 million, as compared to

$5.3 million, for the nine-month period ended March 31, 2012.

Total revenues, for the quarter ended March 31, 2013, increased

22% to $11.6 million, as compared to the quarter ended March 31,

2012, when total revenues were $9.5 million. Total revenues, for

the nine months ended March 31, 2013, increased 8% to $30.8

million, as compared to the nine months ended March 31, 2012, when

total revenues were $28.5 million.

Basic net income per common share for the quarter ended March

31, 2013, was $0.17, as compared to $0.21 for the quarter ended

March 31, 2012. Diluted net income per common share for the quarter

ended March 31, 2013, was $0.17, as compared to $0.20 for the

quarter ended March 31, 2012.

Basic net income per common share for the nine months ended

March 31, 2013, was $0.61, as compared to $0.71 for the nine months

ended March 31, 2012. Diluted net income per common share for the

nine months ended March 31, 2013, was $0.60, as compared to $0.69

for the nine months ended March 31, 2012.

Revenues from the HMCA management and other fees segment which

manages the FONAR UPRIGHT® Multi-Position™ MRI diagnostic imaging

centers, increased 42% to $7.4 million for the three months ended

March 31, 2013, from $5.2 million for the three-month period ended

March 31, 2012. In addition, revenues from a new category called

Patient Revenue - Net were $965,000. Patient revenue represents

revenues generated by the acquisition of HD on March 5, 2013.

Costs related to HMCA management and other fees segment for the

three months ended March 31, 2013, were $3.5 million. For the

three-month period ended March 31, 2012, costs were $3.3 million.

Costs related to patient revenue - net were $791,000 for the

quarter ended March 31, 2013.

Balance Sheet Items

Total assets doubled for the quarter ended March 31, 2013 to

$73.3 million, a 118% increase, as compared to $33.6 million at

June 30, 2012.

Total liabilities at March 31, 2013 were $38.3 million, a 70%

increase as compared to $22.5 million at June 30, 2012.

Total current assets at March 31, 2013 were $39.7 million, a 54%

increase as compared to $25.9 million at June 30, 2012.

At March 31, 2013, total cash and cash equivalents were $9.2

million, as compared to $12.0 million at June 30, 2012. This $2.8

million reduction was primarily due to the $6.2 million used in the

acquisition of HDM.

Total current liabilities at March 31, 2013 were $24.3 million,

a 15% increase as compared to $21.1 million at June 30, 2012.

Significant Events

The Company will hold its annual meeting on June 24, 2013. Dr.

Raymond Damadian, president and chairman of FONAR Corporation, has

issued his annual shareholder letter which can be seen on the

Company's Web site at www.fonar.com/shareholder_letter.htm.

On March 5, 2013, the Company and its subsidiary, Health

Management Corporation of American (HMCA), acquired a majority

interest (50.5%) in a newly formed limited liability company,

Health Diagnostics Management (HDM). Prior to the acquisition, HMCA

was managing 11 STAND-UP® MRI diagnostic centers -- 8 in New York

and 3 in Florida, collectively completing 45,000 scans in 2012. In

one giant step, HMCA grew by 14 MRI facilities under HMCA

management -- 10 in New York and 4 in Florida, 12 of them equipped

with STAND-UP® MRIs. Those 14 centers completed 68,000 MRI scans in

2012. Together the two groups of centers completed 113,000 scans in

2012, a strong indicator of the patient throughput run rate that is

expected for HMCA going forward.

During the third quarter, the Company installed a new FONAR

UPRIGHT®, Weight-Bearing, Multi-Position™ MRI in Texarkana, Texas.

The Company has now installed 157 UPRIGHT® Multi-Position™ MRI

scanners and they have performed approximately 2.75 million

UPRIGHT® MRI scans worldwide.

On May 1, 2013, the Company repaid a portion of the Class A

Stockholders capital contribution in the amount of $1.2 million.

The Company's subsidiary, HMCA, now owns an 85% interest in

Imperial Management Services.

Management Commentary

Dr. Raymond Damadian, M.D., president and chairman of Fonar

Corporation, said: "The acquisition of HDM is expected to be a

significant source of profitability. With this acquisition we

doubled the assets of the Company and tripled our stockholder's

equity and book value. Funds were obtained for the $40 million

acquisition from a commercial bank at a low interest rate."

"There are more reasons why this acquisition makes a lot of

sense," continued Dr. Damadian. "By combining the resources of HMCA

and HDM, we will enjoy the benefits of economies of scale, shared

administrative and technical expertise and capabilities, and joint

marketing strategies. HMCA's 11 STAND-UP® MRIs together with HDM's

12 form a network of 23 STAND-UP® MRIs, the largest in the

world."

"Of course, we're not finished growing," said Dr. Damadian. "We

will continue to pursue additional management contracts, primarily

in New York and Florida."

"This past April 6th we held 'Symposium 2013' in New York City.

The symposium was called 'The Cranio-Cervical Syndrome (CCS): The

Vulnerability of the Human Neck and Its Impact on Cerebrospinal

Fluid (CSF) Flow'," said Dr. Damadian. "There is a pandemic

dimension of injuries of the neck and head, including 1.2 million

whiplash injuries each year in the United States, and the principal

purpose of Symposium 2013 was to bring the existence of this

Cranio-Cervical Syndrome to the medical community and general

populace. We will publish, before year-end, a monograph containing

the complete presentation of the eight faculty who presented at the

conference. We will also place their presentations online."

"Our understanding of the Cranio-Cervical Syndrome (CCS) and the

vulnerability of the human neck and its impact on cerebrospinal

fluid (CSF) flow began with our research and findings on multiple

sclerosis. On September 20, 2011, I and co-author, FONAR scientist

David Chu, PhD., published a paper titled 'The Possible Role of

Cranio-Cervical Trauma and Abnormal CSF Hydrodynamics in the

Genesis of Multiple Sclerosis,' in the journal Physiological

Chemistry and Physics and Medical NMR (Sept. 20, 2011, 41: 1-17),

found at http://www.fonar.com/. With this new understanding of the

role that cervical trauma plays in the etiology of disease, it is

imperative to certify that the sustained neck or head injuries of

professional athletes such as NFL football players, whiplash

patients and others with severe neck trauma, have not resulted in

any obstructions of CSF flow, which would eventually lead to the

symptomatology we have reported as related to the Cranio-Cervical

Syndrome," said Dr. Damadian.

"The Company is fortunate to have as its flagship product the

FONAR UPRIGHT® Multi-Position™ MRI," continued Dr. Damadian. "This

is truly a unique technology producing exquisite images in all

positions of the body. It not only yields a whole new treasure of

new medical applications in such calamitous medical categories as

multiple sclerosis, and other dementia, but it also possesses the

strong potential to provide fresh new insights into the

debilitating chronic consequences of sports injuries, the current

epidemic of automobile whiplash injuries, all spine injuries, and

more diseases yet to be unearthed."

About FONAR

FONAR (NASDAQ: FONR), Melville, NY, The Inventor of MR

Scanning™, was incorporated in 1978, and is the first, oldest and

most experienced MRI company in the industry. FONAR introduced the

world's first commercial MRI in 1980, and went public in 1981.

Since its inception, nearly 300 recumbent-OPEN MRIs and 157

UPRIGHT® Multi-Position™ MRI scanners have been installed

worldwide. FONAR's stellar product is the UPRIGHT® MRI (also known

as the Stand-Up® MRI), the only whole-body MRI that performs

Position™ imaging (pMRI™) and scans patients in numerous

weight-bearing positions, i.e. standing, sitting, in flexion and

extension, as well as the conventional lie-down position. The FONAR

UPRIGHT® MRI often sees the patient's problem that other scanners

cannot because they are lie-down only. The patient-friendly

UPRIGHT® MRI has a near-zero claustrophobic rejection rate by

patients. As a FONAR customer states, "If the patient is

claustrophobic in this scanner, they'll be claustrophobic in my

parking lot." Approximately 85% of patients are scanned sitting

while they watch a 42" flat screen TV. FONAR is headquartered on

Long Island, New York.

UPRIGHT® and STAND-UP® are registered trademarks and The

Inventor of MR Scanning™, Full Range of Motion™, Multi-Position™,

Upright Radiology™, The Proof is in the Picture™, True Flow™,

pMRI™, Spondylography™, Dynamic™, Spondylometry™, CSP™, and

Landscape™, are trademarks of FONAR Corporation.

This release may include forward-looking statements from the

company that may or may not materialize. Additional information on

factors that could potentially affect the company's financial

results may be found in the company's filings with the Securities

and Exchange Commission.

FONAR CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(000's OMITTED, except shares and per share data)

(UNAUDITED)

ASSETS

March 31, June 30,

Current Assets: 2013 2012

----------- -----------

Cash and cash equivalents $ 9,243 $ 12,032

Accounts receivable - net 4,993 5,095

Accounts receivable - related party 30 -

Medical receivables - net 4,513 -

Management and other fees receivable - net 14,820 3,782

Management and other fees receivable - related

medical practices - net 2,396 1,311

Costs and estimated earnings in excess of billings

on uncompleted contracts 488 1,129

Inventories 2,284 2,195

Current portion of notes receivable - net 118 116

Prepaid expenses and other current assets 837 206

----------- -----------

Total Current Assets 39,722 25,866

----------- -----------

Property and equipment - net 17,713 3,173

Notes receivable 192 276

Goodwill 1,667 -

Other intangible assets - net 12,796 3,835

Other assets 1,191 465

----------- -----------

Total Assets $ 73,281 $ 33,615

=========== ===========

LIABILITIES AND STOCKHOLDERS' EQUITY

March 31, June 30,

Current Liabilities: 2013 2012

----------- -----------

Current portion of long-term debt and capital

leases $ 2,517 $ 1,854

Accounts payable 2,639 2,077

Other current liabilities 8,680 7,693

Unearned revenue on service contracts 5,681 5,475

Unearned revenue on service contracts - related

party 28 -

Customer advances 4,763 3,881

Income tax payable - 100

----------- -----------

Total Current Liabilities 24,308 21,080

Long-Term Liabilities:

Accounts payable, non current - 47

Due to related medical practices 231 229

Long-term debt and capital leases, less current

portion 13,404 777

Other liabilities 362 401

----------- -----------

Total Long-Term Liabilities 13,997 1,454

----------- -----------

Total Liabilities 38,305 22,534

----------- -----------

FONAR CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(000's OMITTED, except shares and per share data)

(UNAUDITED)

LIABILITIES AND STOCKHOLDERS' EQUITY (Continued)

LIABILITIES AND STOCKHOLDERS' EQUITY (continued)

March 31, June 30,

STOCKHOLDERS' EQUITY: 2013 2012

----------- -----------

Class A non-voting preferred stock $.0001 par

value; 453,000 shares authorized at March 31,

2013 and June 30, 2012, 313,438 issued and

outstanding at March 31, 2013 and June 30, 2012 - -

Preferred stock $.001 par value; 567,000 shares

authorized at March 31, 2013 and June 30, 2012,

issued and outstanding - none - -

Common Stock $.0001 par value; 8,500,000 shares

authorized at March 31, 2013 and June 30, 2012,

5,977,905 and 5,912,905 issued at March 31, 2013

and June 30, 2012, respectively; 5,966,262 and

5,901,262 outstanding at March 31, 2013 and June

30, 2012, respectively 1 1

Class B Common Stock (10 votes per share) $.0001

par value; 227,000 shares authorized at March

31, 2013 and June 30, 2012, 158 issued and

outstanding at March 31, 2013 and June 30, 2012 - -

Class C Common Stock (25 votes per share) $.0001

par value; 567,000 shares authorized at March

31, 2013 and June 30, 2012, 382,513 issued and

outstanding at March 31, 2013 and June 30, 2012 - -

Paid-in capital in excess of par value 174,478 174,084

Accumulated other comprehensive loss (15) (20)

Accumulated deficit (164,457) (168,334)

Notes receivable from employee stockholders (57) (71)

Treasury stock, at cost - 11,643 shares of common

stock at March 31, 2013 and June 30, 2012 (675) (675)

Non controlling interests 25,701 6,096

----------- -----------

Total Stockholders' Equity 34,976 11,081

----------- -----------

Total Liabilities and Stockholders' Equity $ 73,281 $ 33,615

=========== ===========

FONAR CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED)

(000's OMITTED, except shares and per share data)

FOR THE THREE MONTHS ENDED

REVENUES MARCH 31,

2013 2012

------------ ------------

Product sales - net $ 416 $ 1,309

Service and repair fees - net 2,867 3,008

Service and repair fees - related parties -

net 27 27

Patient revenue - net 965 -

Management and other fees - net 5,402 3,601

Management and other fees - related medical

practices - net 1,965 1,571

------------ ------------

Total Revenues - Net 11,642 9,516

------------ ------------

COSTS AND EXPENSES

Costs related to product sales 498 962

Costs related to service and repair fees 819 891

Costs related to service and repair fees -

related parties 8 8

Costs related to patient revenue 791 -

Costs related to management and other fees 2,606 2,390

Costs related to management and other fees -

related medical practices 900 953

Research and development 381 315

Selling, general and administrative 3,774 2,224

Provision for bad debts 235 170

------------ ------------

Total Costs and Expenses 10,012 7,913

------------ ------------

Income From Operations 1,630 1,603

Interest Expense (79) (103)

Investment Income 55 53

------------ ------------

Income Before Provision for Income Taxes 1,606 1,553

Provision for Income Taxes 25 -

------------ ------------

Net Income 1,581 1,553

Net Income - Non Controlling Interests 505 261

------------ ------------

Net Income - Controlling Interests $ 1,076 $ 1,292

============ ============

Net Income Available to Common Stockholders $ 1,005 $ 1,206

============ ============

Net Income Available to Class A Non-Voting

Preferred Stockholders $ 53 $ 64

============ ============

Net Income Available to Class C Common

Stockholders $ 18 $ 22

============ ============

Basic Net Income Per Common Share Available to

Common Stockholders $ 0.17 $ 0.21

============ ============

Diluted Net Income Per Common Share Available to

Common Stockholders $ 0.17 $ 0.20

============ ============

Basic and Diluted Income Per Share-Common C $ 0.05 $ 0.06

============ ============

Weighted Average Basis Shares Outstanding 5,937,096 5,836,229

============ ============

Weighted Average Diluted Shares Outstanding 6,064,600 5,963,733

============ ============

Weighted Average Basic Shares Outstanding -

Class C Common 382,513 382,513

============ ============

Weighted Average Diluted Shares Outstanding -

Class C Common 382,513 382,513

============ ============

FONAR CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED)

(000's OMITTED, except shares and per share data)

FOR THE NINE MONTHS ENDED

REVENUES MARCH 31,

2013 2012

------------ ------------

Product sales - net $ 2,536 $ 4,699

Service and repair fees - net 8,341 8,720

Service and repair fees - related parties -

net 83 83

Patient revenue - net 965 -

Management and other fees - net 12,946 10,238

Management and other fees - related medical

practices - net 5,895 4,712

------------ ------------

Total Revenues - Net 30,766 28,452

------------ ------------

COSTS AND EXPENSES

Costs related to product sales 2,457 3,608

Costs related to service and repair fees 2,579 2,572

Costs related to service and repair fees -

related parties 26 24

Costs related to patient revenue 791 -

Costs related to management and other fees 7,013 6,462

Costs related to management and other fees -

related medical practices 2,568 2,673

Research and development 1,031 938

Selling, general and administrative 8,338 6,261

Provision for bad debts 735 655

------------ ------------

Total Costs and Expenses 25,538 23,193

------------ ------------

Income From Operations 5,228 5,259

Interest Expense (258) (333)

Investment Income 174 178

Other (Expense) Income (13) 55

------------ ------------

Income Before Provision for Income Taxes 5,131 5,159

Provision for Income Taxes 152 21

------------ ------------

Net Income 4,979 5,138

Net Income - Non Controlling Interests 1,103 796

------------ ------------

Net Income - Controlling Interests $ 3,876 $ 4,342

============ ============

Net Income Available to Common Stockholders $ 3,621 $ 4,051

============ ============

Net Income Available to Class A Non-voting

Preferred Stockholders $ 190 $ 217

============ ============

Net Income Available to Class C Common

Stockholders $ 65 $ 74

============ ============

Basic Net Income Per Common Share Available to

Common Stockholders $ 0.61 $ 0.71

============ ============

Diluted Net Income Per Common Share Available to

Common Stockholders $ 0.60 $ 0.69

============ ============

Basic and Diluted Income Per Share-Common C $ 0.17 $ 0.19

============ ============

Weighted Average Basic Shares Outstanding 5,921,540 5,744,506

============ ============

Weighted Average Diluted Shares Outstanding 6,049,044 5,872,010

============ ============

Weighted Average Basic Shares Outstanding -

Class C Common 382,513 382,513

============ ============

Weighted Average Diluted Shares Outstanding -

Class C Common 382,513 382,513

============ ============

Contact: Daniel Culver Director of Communications FONAR

Corporation Tel: 631-694-2929 Fax: 631-390-1709

http://www.fonar.com Email Contact

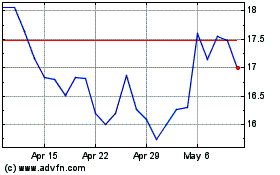

Fonar (NASDAQ:FONR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Fonar (NASDAQ:FONR)

Historical Stock Chart

From Apr 2023 to Apr 2024