Australian Dollar ETF Falls on Rate Cut - ETF News And Commentary

May 08 2013 - 6:07AM

Zacks

In Australia, investors have seen tame inflation, lower credit

demand, and soft economic growth over the past few months. Still,

the Australian dollar has remained firm, hurting exports across the

board.

If that wasn’t enough we also saw weaker retail sales in the

country along with brewing concerns over a housing bubble in the

nation. In an attempt to alleviate the economy from these worries,

the Reserve Bank of Australia slashed interest rates by 25 bps to a

record low of 2.75%.

This is the first time that the interest rates have breached the

3% level in the country, and it comes as somewhat of a surprise as

most were expecting no change from the central bank. As a result

the rate cut has pushed down the Aussie dollar, as represented by

the CurrencyShares Australian Dollar Trust ETF

(FXA) by roughly 0.7% (read: What's Next for Currency

ETFs?).

Aussie Economy Outlook

Australia has enjoyed more than 20 years of continuous growth,

though at a slower pace in recent years. The economy maintains a

favorable balance of trade, strong per capita income (one of the

highest in the world), low unemployment, low budget deficit and

high levels of economic freedom.

The country has always been a commodity powerhouse and major

exporter of commodities – base metals, coal and agricultural

products. As a result, the falling commodity prices have gone a

long way in hurting the Australian economy.

Also, adding to its woes is the generic slowdown and continuous

decrease in industrial production in the world’s second largest

economy and one of its largest trading partners — China.

Further, the country has been deeply lacking in one area, which

is oil. However, a recent massive shale oil discovery could

dramatically alter this scenario going forward (read: Australia

ETFs to Play the Coming Shale Boom).

Australian Dollar ETF in Focus

The Australian Dollar ETF tracks the relative movement of the

AUD relative to the USD. The funds in this product are denominated

in AUD and kept in a bank account, and the interest thus received

is used to pay for the expenses and fees of the fund.

The fund looks to generate returns through the bank interest and

any capital appreciation that may occur on account of AUD

appreciating versus the USD.

The ETF has amassed $551.6 million in its asset base since its

introduction in June 2006 and yields a decent 1.71% in annual

dividends. FXA has lost 1.56% in the year-to-date time frame

though, with more short-term losses possibly after the slide (read:

Time to Buy the Australian Dollar ETF?).

Still, we believe the longer term outlook is relatively bright

for this ETF as we currently have a Zacks ETF Rank of 2 or ‘Buy’ on

FXA going forward. The product remains one of the best options for

investing in the space, charging just 40 bps in fees and possessing

a relatively high average trading volume as well.

So for investors who believe in the Aussie economy’s resilience

now might be an interesting time to consider FXA. The product has

been beaten down over the past few weeks, but it could rise back up

soon as carry trade investors seek the haven that is the Aussie

dollar, especially when compared to the yen.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

CRYSHS-AUS DOLR (FXA): ETF Research Reports

PWRSH-DB US$ BU (UUP): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

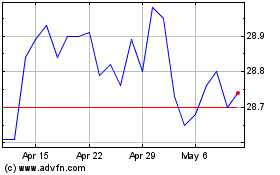

Invesco DB US Dollar Ind... (AMEX:UUP)

Historical Stock Chart

From Mar 2024 to Apr 2024

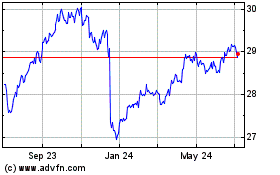

Invesco DB US Dollar Ind... (AMEX:UUP)

Historical Stock Chart

From Apr 2023 to Apr 2024