UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-Q

QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF

REGISTERED MANAGEMENT INVESTMENT COMPANY

Investment Company Act file number: 811-7852

Exact Name of Registrant as Specified in Charter: USAA MUTUAL FUNDS TRUST

Address of Principal Executive Offices and Zip Code: 9800 FREDERICKSBURG ROAD

SAN ANTONIO, TX 78288

Name and Address of Agent for Service: ADYM W. RYGMYR

USAA MUTUAL FUNDS TRUST

9800 FREDERICKSBURG ROAD

SAN ANTONIO, TX 78288

Registrant's Telephone Number, Including Area Code: (210) 498-0226

Date of Fiscal Year End: JULY 31

|

Date of Reporting Period: OCTOBER 31, 2012

ITEM 1. SCHEDULE OF INVESTMENTS.

USAA MUTUAL FUNDS TRUST - 1ST QUARTER REPORT - PERIOD ENDED OCTOBER 31, 2012

[LOGO OF USAA]

USAA(R)

PORTFOLIO OF INVESTMENTS

1ST QUARTER

USAA GROWTH & INCOME FUND

OCTOBER 31, 2012

(Form N-Q)

48451-1212 (C)2012, USAA. All rights reserved.

PORTFOLIO OF INVESTMENTS

USAA GROWTH & INCOME FUND

October 31, 2012 (unaudited)

MARKET

NUMBER VALUE

OF SHARES SECURITY (000)

--------------------------------------------------------------------------------

EQUITY SECURITIES (98.4%)

COMMON STOCKS (98.2%)

CONSUMER DISCRETIONARY (10.7%)

------------------------------

APPAREL RETAIL (0.3%)

31,294 Buckle, Inc. $ 1,414

76,600 Chico's FAS, Inc. 1,425

79,900 Express, Inc.* 889

----------

3,728

----------

APPAREL, ACCESSORIES & LUXURY GOODS (0.7%)

90,500 Hanesbrands, Inc.* 3,029

34,600 Polo Ralph Lauren Corp. 5,318

10,800 True Religion Apparel, Inc. 277

----------

8,624

----------

BROADCASTING (0.3%)

125,010 CBS Corp. "B" 4,050

----------

CABLE & SATELLITE (0.7%)

232,540 Comcast Corp. "A" 8,723

----------

CASINOS & GAMING (0.4%)

180,300 International Game Technology 2,315

45,000 Las Vegas Sands Corp. 2,090

----------

4,405

----------

COMPUTER & ELECTRONICS RETAIL (0.1%)

44,800 Rent-A-Center, Inc. 1,493

----------

DEPARTMENT STORES (0.7%)

181,000 Macy's, Inc. 6,891

16,275 Nordstrom, Inc. 924

----------

7,815

----------

EDUCATION SERVICES (0.1%)

57,050 ITT Educational Services, Inc.* 1,226

----------

GENERAL MERCHANDISE STORES (0.5%)

58,855 Dollar General Corp.* 2,861

44,500 Target Corp. 2,837

----------

5,698

----------

HOME IMPROVEMENT RETAIL (0.8%)

54,962 Home Depot, Inc. 3,373

182,766 Lowe's Companies, Inc. 5,918

----------

9,291

----------

HOMEBUILDING (0.4%)

200,200 D.R. Horton, Inc. 4,196

----------

|

1 | USAA Growth & Income Fund

MARKET

NUMBER VALUE

OF SHARES SECURITY (000)

--------------------------------------------------------------------------------

HOMEFURNISHING RETAIL (0.2%)

50,600 Bed Bath & Beyond, Inc.* $ 2,919

----------

HOTELS, RESORTS & CRUISE LINES (0.7%)

94,400 Carnival Corp. 3,576

101,900 Royal Caribbean Cruises Ltd. 3,431

29,145 Starwood Hotels & Resorts Worldwide, Inc. 1,511

----------

8,518

----------

HOUSEWARES & SPECIALTIES (0.1%)

28,500 Newell Rubbermaid, Inc. 588

----------

INTERNET RETAIL (3.0%)

102,230 Amazon.com, Inc.* 23,801

203,650 Blue Nile, Inc.* 7,692

142,703 Homeaway, Inc.* 3,669

----------

35,162

----------

LEISURE PRODUCTS (0.3%)

59,100 Hasbro, Inc. 2,127

31,810 Mattel, Inc. 1,170

----------

3,297

----------

MOTORCYCLE MANUFACTURERS (0.1%)

28,600 Harley-Davidson, Inc. 1,337

----------

MOVIES & ENTERTAINMENT (0.8%)

135,100 Time Warner, Inc. 5,870

76,000 Viacom, Inc. "B" 3,897

----------

9,767

----------

RESTAURANTS (0.5%)

139,700 Starbucks Corp. 6,412

----------

SPECIALIZED CONSUMER SERVICES (0.0%)

35,900 Service Corp. International 504

----------

Total Consumer Discretionary 127,753

----------

CONSUMER STAPLES (7.1%)

----------------------

BREWERS (0.4%)

94,632 SABMiller plc ADR 4,097

----------

DRUG RETAIL (0.6%)

34,400 CVS Caremark Corp. 1,596

154,795 Walgreen Co. 5,454

----------

7,050

----------

HOUSEHOLD PRODUCTS (1.5%)

45,703 Clorox Co. 3,304

57,800 Colgate-Palmolive Co. 6,067

118,025 Procter & Gamble Co. 8,172

----------

17,543

----------

HYPERMARKETS & SUPER CENTERS (0.2%)

30,400 Wal-Mart Stores, Inc. 2,281

----------

PACKAGED FOODS & MEAT (0.9%)

739,641 Danone S.A. ADR 9,098

86,900 Green Mountain Coffee Roasters, Inc.* 2,099

----------

11,197

----------

PERSONAL PRODUCTS (0.2%)

46,800 Herbalife Ltd. 2,403

----------

SOFT DRINKS (0.5%)

53,530 Coca-Cola Co. 1,990

|

Portfolio of Investments | 2

MARKET

NUMBER VALUE

OF SHARES SECURITY (000)

--------------------------------------------------------------------------------

56,280 PepsiCo, Inc. $ 3,897

----------

5,887

----------

TOBACCO (2.8%)

122,300 Altria Group, Inc. 3,889

23,700 Imperial Tobacco Group plc ADR 1,790

24,400 Lorillard, Inc. 2,831

251,820 Philip Morris International, Inc. 22,301

71,500 Reynolds American, Inc. 2,977

----------

33,788

----------

Total Consumer Staples 84,246

----------

ENERGY (9.3%)

------------

COAL & CONSUMABLE FUELS (0.0%)

15,400 Peabody Energy Corp. 430

----------

INTEGRATED OIL & GAS (2.2%)

95,100 BP plc ADR 4,079

12,300 Chevron Corp. 1,355

79,830 Exxon Mobil Corp. 7,278

149,700 Hess Corp. 7,823

49,300 Occidental Petroleum Corp. 3,893

52,650 Petroleo Brasileiro S.A. ADR 1,117

----------

25,545

----------

OIL & GAS DRILLING (1.3%)

31,700 Atwood Oceanics, Inc.* 1,515

288,825 Noble Corp. 10,900

83,400 SeaDrill Ltd. 3,365

----------

15,780

----------

OIL & GAS EQUIPMENT & SERVICES (2.3%)

107,600 Baker Hughes, Inc. 4,516

29,800 Cameron International Corp.* 1,509

230,900 Halliburton Co. 7,456

397,100 McDermott International, Inc.* 4,253

129,644 Schlumberger Ltd. 9,014

----------

26,748

----------

OIL & GAS EXPLORATION & PRODUCTION (3.0%)

50,780 Anadarko Petroleum Corp. 3,494

120,400 Cabot Oil & Gas Corp. 5,656

65,900 ConocoPhillips 3,812

40,800 EOG Resources, Inc. 4,753

97,100 EQT Corp. 5,887

110,000 Marathon Oil Corp. 3,307

51,900 Newfield Exploration Co.* 1,408

44,500 Southwestern Energy Co.* 1,544

131,700 Ultra Petroleum Corp.* 3,004

79,500 Whiting Petroleum Corp.* 3,341

----------

36,206

----------

OIL & GAS REFINING & MARKETING (0.2%)

43,900 Phillips 66 Co. 2,070

----------

OIL & GAS STORAGE & TRANSPORTATION (0.3%)

120,750 Spectra Energy Corp. 3,486

----------

Total Energy 110,265

----------

FINANCIALS (19.3%)

-----------------

ASSET MANAGEMENT & CUSTODY BANKS (3.3%)

95,665 Ameriprise Financial, Inc. 5,584

10,130 BlackRock, Inc. "A" 1,922

|

3 | USAA Growth & Income Fund

MARKET

NUMBER VALUE

OF SHARES SECURITY (000)

--------------------------------------------------------------------------------

29,556 Franklin Resources, Inc. $ 3,777

220,200 Invesco Ltd. 5,355

152,716 Legg Mason, Inc. 3,891

578,071 SEI Investments Co. 12,648

61,800 State Street Corp. 2,755

84,500 Waddell & Reed Financial, Inc. "A" 2,816

----------

38,748

----------

CONSUMER FINANCE (2.6%)

180,604 American Express Co. 10,109

131,700 Capital One Financial Corp. 7,924

181,435 Discover Financial Services 7,439

325,600 SLM Corp. 5,724

----------

31,196

----------

DIVERSIFIED BANKS (2.5%)

219,100 U.S. Bancorp 7,276

658,290 Wells Fargo & Co. 22,178

----------

29,454

----------

INSURANCE BROKERS (0.2%)

78,400 Willis Group Holdings Ltd. plc 2,640

----------

INVESTMENT BANKING & BROKERAGE (1.8%)

266,960 Greenhill & Co., Inc. 12,739

474,800 Morgan Stanley 8,252

----------

20,991

----------

LIFE & HEALTH INSURANCE (1.5%)

158,065 AFLAC, Inc. 7,868

204,000 Lincoln National Corp. 5,057

154,400 MetLife, Inc. 5,480

----------

18,405

----------

OTHER DIVERSIFIED FINANCIAL SERVICES (3.6%)

353,820 Bank of America Corp. 3,297

523,910 Citigroup, Inc. 19,589

466,625 JPMorgan Chase & Co. 19,449

----------

42,335

----------

PROPERTY & CASUALTY INSURANCE (0.6%)

149,312 Assured Guaranty Ltd. 2,074

24,600 Chubb Corp. 1,894

111,180 XL Group plc 2,750

----------

6,718

----------

REGIONAL BANKS (0.5%)

225,300 Fifth Third Bancorp 3,274

46,400 PNC Financial Services Group, Inc. 2,700

----------

5,974

----------

REITs - MORTGAGE (0.8%)

250,500 American Capital Agency Corp. 8,271

91,000 Annaly Capital Management, Inc. 1,469

----------

9,740

----------

REITs - OFFICE (0.4%)

80,900 Digital Realty Trust, Inc. 4,970

----------

REITs - RESIDENTIAL (0.2%)

14,800 Essex Property Trust, Inc. 2,220

----------

SPECIALIZED FINANCE (0.9%)

82,400 CME Group, Inc. 4,609

224,505 MSCI, Inc. "A"* 6,048

----------

10,657

----------

|

Portfolio of Investments | 4

MARKET

NUMBER VALUE

OF SHARES SECURITY (000)

--------------------------------------------------------------------------------

THRIFTS & MORTGAGE FINANCE (0.4%)

219,800 New York Community Bancorp, Inc. $ 3,046

176,200 People's United Financial, Inc. 2,120

----------

5,166

----------

Total Financials 229,214

----------

HEALTH CARE (12.9%)

------------------

BIOTECHNOLOGY (1.8%)

130,900 Acorda Therapeutics, Inc.* 3,135

100,600 Alnylam Pharmaceuticals, Inc.* 1,627

110,765 Amgen, Inc. 9,586

59,600 Cubist Pharmaceuticals, Inc.* 2,557

65,700 Gilead Sciences, Inc.* 4,412

----------

21,317

----------

HEALTH CARE DISTRIBUTORS (0.4%)

110,315 Cardinal Health, Inc. 4,537

----------

HEALTH CARE EQUIPMENT (3.3%)

162,300 Baxter International, Inc. 10,165

35,660 Covidien plc 1,960

313,755 Medtronic, Inc. 13,046

135,940 St. Jude Medical, Inc. 5,201

144,376 Zimmer Holdings, Inc. 9,270

----------

39,642

----------

HEALTH CARE FACILITIES (0.1%)

26,600 Universal Health Services, Inc. "B" 1,101

----------

HEALTH CARE SERVICES (0.3%)

95,100 Omnicare, Inc. 3,284

----------

LIFE SCIENCES TOOLS & SERVICES (0.6%)

34,500 Agilent Technologies, Inc. 1,241

32,500 Bio-Rad Laboratories, Inc. "A"* 3,294

136,400 Bruker Corp.* 1,649

15,300 Waters Corp.* 1,252

----------

7,436

----------

MANAGED HEALTH CARE (2.0%)

14,700 Centene Corp.* 558

155,545 CIGNA Corp. 7,933

167,200 UnitedHealth Group, Inc. 9,363

105,228 WellPoint, Inc. 6,449

----------

24,303

----------

PHARMACEUTICALS (4.4%)

41,500 Allergan, Inc. 3,732

69,285 Eli Lilly and Co. 3,369

110,100 Hospira, Inc.* 3,379

55,500 Johnson & Johnson 3,930

347,279 Merck & Co., Inc. 15,846

123,363 Novartis AG ADR 7,459

199,086 Pfizer, Inc. 4,951

42,000 Sanofi ADR 1,842

160,480 Teva Pharmaceutical Industries Ltd. ADR 6,487

14,100 Watson Pharmaceuticals, Inc.* 1,212

----------

52,207

----------

Total Health Care 153,827

----------

INDUSTRIALS (10.5%)

------------------

AEROSPACE & DEFENSE (2.4%)

6,200 BE Aerospace, Inc.* 280

|

5 | USAA Growth & Income Fund

MARKET

NUMBER VALUE

OF SHARES SECURITY (000)

--------------------------------------------------------------------------------

108,700 Boeing Co. $ 7,657

27,400 Exelis, Inc. 303

126,500 General Dynamics Corp. 8,612

81,540 Honeywell International, Inc. 4,993

38,500 L-3 Communications Holdings, Inc. 2,841

66,100 Raytheon Co. 3,739

----------

28,425

----------

AIR FREIGHT & LOGISTICS (1.4%)

249,637 Expeditors International of Washington, Inc. 9,139

99,318 United Parcel Service, Inc. "B" 7,275

----------

16,414

----------

AIRLINES (0.3%)

202,500 Spirit Airlines, Inc.* 3,554

----------

BUILDING PRODUCTS (0.2%)

195,900 Masco Corp. 2,956

----------

CONSTRUCTION & FARM MACHINERY & HEAVY TRUCKS (0.4%)

20,700 AGCO Corp.* 942

68,585 Joy Global, Inc. 4,283

----------

5,225

----------

ELECTRICAL COMPONENTS & EQUIPMENT (0.4%)

47,790 Belden, Inc. 1,711

51,500 Emerson Electric Co. 2,494

----------

4,205

----------

HUMAN RESOURCE & EMPLOYMENT SERVICES (0.1%)

46,400 Manpower, Inc. 1,760

----------

INDUSTRIAL CONGLOMERATES (0.6%)

340,510 General Electric Co. 7,171

----------

INDUSTRIAL MACHINERY (2.5%)

105,535 Eaton Corp. 4,983

21,625 Flowserve Corp. 2,930

159,000 Illinois Tool Works, Inc. 9,752

7,950 ITT Corp. 165

73,200 Pentair Ltd. 3,092

29,200 SPX Corp. 2,003

86,900 Stanley Black & Decker, Inc. 6,022

31,600 Xylem, Inc. 767

----------

29,714

----------

RAILROADS (0.7%)

142,300 Norfolk Southern Corp. 8,730

----------

TRADING COMPANIES & DISTRIBUTORS (0.3%)

50,600 WESCO International, Inc.* 3,283

----------

TRUCKING (1.2%)

601,800 Hertz Global Holdings, Inc.* 7,986

126,700 Ryder System, Inc. 5,717

----------

13,703

----------

Total Industrials 125,140

----------

INFORMATION TECHNOLOGY (21.9%)

-----------------------------

APPLICATION SOFTWARE (2.0%)

280,100 Adobe Systems, Inc.* 9,523

193,202 Autodesk, Inc.* 6,152

85,791 FactSet Research Systems, Inc. 7,768

----------

23,443

----------

|

Portfolio of Investments | 6

MARKET

NUMBER VALUE

OF SHARES SECURITY (000)

--------------------------------------------------------------------------------

COMMUNICATIONS EQUIPMENT (3.0%)

1,020,149 Cisco Systems, Inc. $ 17,485

132,300 JDS Uniphase Corp.* 1,282

278,300 Juniper Networks, Inc.* 4,612

215,076 QUALCOMM, Inc. 12,598

----------

35,977

----------

COMPUTER HARDWARE (2.9%)

58,735 Apple, Inc. 34,953

----------

COMPUTER STORAGE & PERIPHERALS (1.2%)

110,510 EMC Corp.* 2,699

245,100 NetApp, Inc.* 6,593

110,900 SanDisk Corp.* 4,631

----------

13,923

----------

DATA PROCESSING & OUTSOURCED SERVICES (1.7%)

53,585 Automatic Data Processing, Inc. 3,097

41,108 Global Payments, Inc. 1,757

78,930 Visa, Inc. "A" 10,952

230,575 Western Union Co. 2,928

23,400 WEX, Inc.* 1,727

----------

20,461

----------

ELECTRONIC MANUFACTURING SERVICES (0.2%)

116,600 Molex, Inc. 3,028

----------

INTERNET SOFTWARE & SERVICES (3.1%)

50,210 eBay, Inc.* 2,425

166,973 Facebook, Inc. "A"* 3,526

28,831 Google, Inc. "A"* 19,598

44,390 IAC/InterActiveCorp. 2,146

311,452 VistaPrint N.V.* 9,490

----------

37,185

----------

IT CONSULTING & OTHER SERVICES (0.9%)

124,870 iGATE Corp.* 2,004

15,100 International Business Machines Corp. 2,937

619,500 ServiceSource International* 5,582

----------

10,523

----------

SEMICONDUCTORS (3.2%)

13,983 Altera Corp. 426

49,541 Analog Devices, Inc. 1,938

271,930 Arm Holdings plc ADR 8,797

729,300 Atmel Corp.* 3,402

147,200 Avago Technologies Ltd. 4,862

132,600 Freescale Semiconductor Ltd.* 1,185

59,200 Intel Corp. 1,280

38,608 Linear Technology Corp. 1,207

62,800 Microchip Technology, Inc. 1,969

943,300 Micron Technology, Inc.* 5,117

26,900 NXP Semiconductors N.V.* 653

193,500 Skyworks Solutions, Inc.* 4,528

99,000 Texas Instruments, Inc. 2,781

----------

38,145

----------

SYSTEMS SOFTWARE (3.5%)

120,900 CA, Inc. 2,723

58,700 Check Point Software Technologies Ltd.* 2,614

430,030 Microsoft Corp. 12,271

533,717 Oracle Corp. 16,572

407,400 Symantec Corp.* 7,410

----------

41,590

----------

|

7 | USAA Growth & Income Fund

MARKET

NUMBER VALUE

OF SHARES SECURITY (000)

--------------------------------------------------------------------------------

TECHNOLOGY DISTRIBUTORS (0.2%)

52,300 Arrow Electronics, Inc.* $ 1,843

-----------

Total Information Technology 261,071

-----------

MATERIALS (2.0%)

---------------

DIVERSIFIED CHEMICALS (0.5%)

200,400 Dow Chemical Co. 5,872

-----------

DIVERSIFIED METALS & MINING (0.3%)

52,467 Compass Minerals International, Inc. 4,137

-----------

FERTILIZERS & AGRICULTURAL CHEMICALS (0.1%)

11,400 Agrium, Inc. 1,203

-----------

GOLD (0.4%)

108,605 Barrick Gold Corp. 4,399

-----------

PAPER PACKAGING (0.2%)

71,100 Sonoco Products Co. 2,213

-----------

PAPER PRODUCTS (0.2%)

83,100 International Paper Co. 2,977

-----------

SPECIALTY CHEMICALS (0.3%)

83,800 Celanese Corp. "A" 3,184

-----------

Total Materials 23,985

-----------

TELECOMMUNICATION SERVICES (2.0%)

--------------------------------

INTEGRATED TELECOMMUNICATION SERVICES (1.0%)

250,510 AT&T, Inc. 8,665

70,500 Verizon Communications, Inc. 3,147

-----------

11,812

-----------

WIRELESS TELECOMMUNICATION SERVICES (1.0%)

328,600 MetroPCS Communications, Inc.* 3,355

736,000 NII Holdings, Inc. "B"* 5,866

90,000 Vodafone Group plc ADR 2,450

-----------

11,671

-----------

Total Telecommunication Services 23,483

-----------

UTILITIES (2.5%)

---------------

ELECTRIC UTILITIES (1.4%)

98,600 Edison International 4,628

27,300 Entergy Corp. 1,981

100,385 NextEra Energy, Inc. 7,033

45,700 Pinnacle West Capital Corp. 2,421

-----------

16,063

-----------

GAS UTILITIES (0.1%)

34,200 ONEOK, Inc. 1,618

-----------

MULTI-UTILITIES (1.0%)

132,000 CenterPoint Energy, Inc. 2,860

19,000 Dominion Resources, Inc. 1,003

31,400 National Grid plc ADR 1,790

99,300 PG&E Corp. 4,222

84,300 Xcel Energy, Inc. 2,382

-----------

12,257

-----------

Total Utilities 29,938

-----------

Total Common Stocks (cost: $1,013,657) 1,168,922

-----------

|

Portfolio of Investments | 8

MARKET

NUMBER VALUE

OF SHARES SECURITY (000)

--------------------------------------------------------------------------------

EXCHANGE-TRADED FUNDS (0.2%)

17,200 MidCap SPDR Trust Series 1 (cost: $2,332) $ 3,066

------------

Total Equity Securities (cost: $1,015,989) 1,171,988

------------

MONEY MARKET INSTRUMENTS (1.4%)

MONEY MARKET FUNDS (1.4%)

16,250,510 State Street Institutional Liquid Reserve Fund, 0.19%

(a) (cost: $16,251) 16,251

------------

TOTAL INVESTMENTS(COST: $1,032,240) $ 1,188,239

============

|

($ IN 000s) VALUATION HIERARCHY

-------------------

(LEVEL 1) (LEVEL 2) (LEVEL 3)

QUOTED PRICES OTHER SIGNIFICANT

IN ACTIVE SIGNIFICANT UNOBSERVABLE

MARKETS OBSERVABLE INPUTS

FOR IDENTICAL INPUTS

ASSETS ASSETS TOTAL

-------------------------------------------------------------------------------------------------------

Equity Securities:

Common Stocks $ 1,168,922 $ -- $ -- $ 1,168,922

Exchange-Traded Funds 3,066 -- -- 3,066

Money Market Instruments:

Money Market Funds 16,251 -- -- 16,251

-------------------------------------------------------------------------------------------------------

Total $ 1,188,239 $ -- $ -- $ 1,188,239

-------------------------------------------------------------------------------------------------------

|

For the period of August 1, 2012, through October 31, 2012, there were no

transfers of securities between levels. The Fund's policy is to recognize any

transfers into and out of the levels as of the beginning of the period in which

the event or circumstance that caused the transfer occurred.

9 | USAA Growth & Income Fund

NOTES TO PORTFOLIO OF INVESTMENTS

October 31, 2012 (unaudited)

GENERAL NOTES

USAA MUTUAL FUNDS TRUST (the Trust), registered under the Investment Company Act

of 1940 (the 1940 Act), as amended, is an open-end management investment company

organized as a Delaware statutory trust consisting of 50 separate funds. The

information presented in this quarterly report pertains only to the USAA Growth

& Income Fund (the Fund), which is classified as diversified under the 1940 Act.

The Fund has two classes of shares: Growth & Income Fund Shares (Fund Shares)

and Growth & Income Fund Adviser Shares (Adviser Shares). Each class of shares

has equal rights to assets and earnings, except that each class bears certain

class-related expenses specific to the particular class. These expenses include

administration and servicing fees, transfer agent fees, postage, shareholder

reporting fees, distribution and service (12b-1) fees, and certain registration

and custodian fees. Expenses not attributable to a specific class, income, and

realized gains or losses on investments are allocated to each class of shares

based on each class's relative net assets. Each class has exclusive voting

rights on matters related solely to that class and separate voting rights on

matters that relate to both classes. The Adviser Shares permit investors to

purchase shares through financial intermediaries, banks, broker-dealers,

insurance companies, investment advisers, plan sponsors, and financial

professionals that provide various administrative and distribution services.

A. SECURITY VALUATION -- The Trust's Board of Trustees (the Board) has

established the Valuation Committee (the Committee), and subject to Board

oversight, the Committee administers and oversees the Fund's valuation policies

and procedures which are approved by the Board. Among other things, these

policies and procedures allow the Fund to utilize independent pricing services,

quotations from securities dealers, and a wide variety of sources and

information to establish and adjust the fair value of securities as events occur

and circumstances warrant.

The Committee reports to the Board on a quarterly basis and makes

recommendations to the Board as to pricing methodologies and services used by

the Fund and presents additional information to the Board regarding application

of the pricing and fair valuation policies and procedures during the preceding

quarter.

The Committee meets as often as necessary to make pricing and fair value

determinations. In addition, the Committee holds regular monthly meetings to

review prior actions taken by the Committee and USAA Asset Management Company

(the Manager). Among other things, these monthly meetings include a review and

analysis of back testing reports, pricing service quotation comparisons,

illiquid securities and fair value determinations, pricing movements, and daily

stale price monitoring.

10 | USAA Growth & Income Fund

The value of each security is determined (as of the close of trading on the New

York Stock Exchange (NYSE) on each business day the NYSE is open) as set forth

below:

1. Equity securities, including exchange-traded funds (ETFs), except as

otherwise noted, traded primarily on a domestic securities exchange or the

Nasdaq over-the-counter markets, are valued at the last sales price or official

closing price on the exchange or primary market on which they trade. Equity

securities traded primarily on foreign securities exchanges or markets are

valued at the last quoted sales price, or the most recently determined official

closing price calculated according to local market convention, available at the

time the Fund is valued. If no last sale or official closing price is reported

or available, the average of the bid and asked prices generally is used.

2. Equity securities trading in various foreign markets may take place on days

when the NYSE is closed. Further, when the NYSE is open, the foreign markets may

be closed. Therefore, the calculation of the Fund's net asset value (NAV) may

not take place at the same time the prices of certain foreign securities held by

the Fund are determined. In most cases, events affecting the values of foreign

securities that occur between the time of their last quoted sales or official

closing prices and the close of normal trading on the NYSE on a day the Fund's

NAV is calculated will not be reflected in the value of the Fund's foreign

securities. However, the Manager, an affiliate of the Fund, and one of the

Fund's subadvisers, if applicable, will monitor for events that would materially

affect the value of the Fund's foreign securities. The Fund's subadvisers have

agreed to notify the Manager of significant events they identify that would

materially affect the value of the Fund's foreign securities. If the Manager

determines that a particular event would materially affect the value of the

Fund's foreign securities, then the Manager, under valuation procedures approved

by the Trust's Board of Trustees, will consider such available information that

it deems relevant to determine a fair value for the affected foreign securities.

In addition, the Fund may use information from an external vendor or other

sources to adjust the foreign market closing prices of foreign equity securities

to reflect what the Fund believes to be the fair value of the securities as of

the close of the NYSE. Fair valuation of affected foreign equity securities may

occur frequently based on an assessment that events that occur on a fairly

regular basis (such as U.S. market movements) are significant.

3. Investments in open-end investment companies, hedge, or other funds, other

than ETFs, are valued at their NAV at the end of each business day.

4. Debt securities purchased with original or remaining maturities of 60 days or

less may be valued at amortized cost, which approximates market value.

5. Debt securities with maturities greater than 60 days are valued each business

day by a pricing service (the Service) approved by the Trust's Board of

Trustees. The Service uses an evaluated mean between quoted bid and asked prices

or the last sales price to price securities when, in the Service's judgment,

these prices are readily available and are representative of the securities'

market values. For many securities, such prices are not readily available. The

Service generally prices these securities based on methods that include

consideration of yields or prices of securities of comparable quality, coupon,

maturity, and type; indications as to values from dealers in securities; and

general market conditions.

11 | USAA Growth & Income Fund

6. Repurchase agreements are valued at cost, which approximates market value.

7. Securities for which market quotations are not readily available or are

considered unreliable, or whose values have been materially affected by events

occurring after the close of their primary markets but before the pricing of the

Fund, are valued in good faith at fair value, using methods determined by the

Manager in consultation with the Fund's subadvisers, if applicable, under

valuation procedures approved by the Trust's Board of Trustees. The effect of

fair value pricing is that securities may not be priced on the basis of

quotations from the primary market in which they are traded and the actual price

realized from the sale of a security may differ materially from the fair value

price. Valuing these securities at fair value is intended to cause the Fund's

NAV to be more reliable than it otherwise would be.

Fair value methods used by the Manager include, but are not limited to,

obtaining market quotations from secondary pricing services, broker-dealers, or

widely used quotation systems. General factors considered in determining the

fair value of securities include fundamental analytical data, the nature and

duration of any restrictions on disposition of the securities, and an evaluation

of the forces that influenced the market in which the securities are purchased

and sold.

B. FAIR VALUE MEASUREMENTS -- Fair value is defined as the price that would be

received to sell an asset or paid to transfer a liability in an orderly

transaction between market participants at the measurement date. The three-level

valuation hierarchy disclosed in the portfolio of investments is based upon the

transparency of inputs to the valuation of an asset or liability as of the

measurement date. The three levels are defined as follows:

Level 1 -- inputs to the valuation methodology are quoted prices (unadjusted) in

active markets for identical securities.

Level 2 -- inputs to the valuation methodology are other significant observable

inputs, including quoted prices for similar securities, inputs that are

observable for the securities, either directly or indirectly, and

market-corroborated inputs such as market indices.

Level 3 -- inputs to the valuation methodology are unobservable and significant

to the fair value measurement, including the Manager's own assumptions in

determining the fair value.

The inputs or methodologies used for valuing securities are not necessarily an

indication of the risks associated with investing in those securities.

C. As of October 31, 2012, the cost of securities, for federal income tax

purposes, was approximately the same as that reported in the portfolio of

investments. Gross unrealized appreciation and depreciation of investments as of

October 31, 2012, were $201,613,000 and $45,614,000, respectively, resulting in

net unrealized appreciation of $155,999,000.

D. The portfolio of investments category percentages shown represent the

percentages of the investments to net assets, which were $1,190,327,000 at

October 31, 2012, and, in total, may not equal 100%. A category percentage of

0.0% represents less than 0.1% of net assets. Investments in foreign securities

were 8.9% of net assets at October 31, 2012.

Notes to Portfolio of Investments | 12

E. The Fund may rely on certain Securities and Exchange Commission (SEC)

exemptive orders or rules that permit funds meeting various conditions to invest

in an exchange-traded fund (ETF) in amounts exceeding limits set forth in the

Investment Company Act of 1940 that would otherwise be applicable.

PORTFOLIO ABBREVIATION(S) AND DESCRIPTION(S)

ADR American depositary receipts are receipts issued by a U.S. bank

evidencing ownership of foreign shares. Dividends are paid in U.S.

dollars.

REIT Real estate investment trust

|

SPECIFIC NOTES

(a) Rate represents the money market fund annualized seven-day yield at October

31, 2012.

* Non-income-producing security.

13 | USAA Growth & Income Fund

ITEM 2. CONTROLS AND PROCEDURES

The principal executive officer and principal financial officer of USAA Mutual

Funds Trust (Trust) have concluded that the Trust's disclosure controls and

procedures are sufficient to ensure that information required to be disclosed by

the Trust in this Form N-Q was recorded, processed, summarized and reported

within the time periods specified in the Securities and Exchange Commission's

rules and forms, based upon such officers' evaluation of these controls and

procedures as of a date within 90 days of the filing date of the report.

There were no significant changes or corrective actions with regard to

significant deficiencies or material weaknesses in the Trust's internal controls

or in other factors that could significantly affect the Trust's internal

controls subsequent to the date of their evaluation.

ITEM 3. EXHIBITS.

Certification pursuant to Rule 30a-2(a) under the Investment Company Act of 1940

(17 CFR 270.30a-2(a)) is filed and attached hereto as Exhibit 99.CERT.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the

Investment Company Act of 1940, the registrant has duly caused this report to be

signed on its behalf by the undersigned, thereunto duly authorized.

Registrant: USAA MUTUAL FUNDS TRUST - Period Ended October 31, 2012

By:* /S/ ADYM W. RYGMYR

--------------------------------------------------------------

Signature and Title: Adym W. Rygmyr, Secretary

Date: 12/19/2012

-------------------------------

|

Pursuant to the requirements of the Securities Exchange Act of 1934 and the

Investment Company Act of 1940, this report has been signed below by the

following persons on behalf of the registrant and in the capacities and on the

dates indicated.

By:* /S/ DANIEL S. MCNAMARA

--------------------------------------------------------------

Signature and Title: Daniel S. McNamara, President

Date: 12/19/2012

------------------------------

By:* /S/ ROBERTO GALINDO, JR.

-----------------------------------------------------

Signature and Title: Roberto Galindo, Jr., Treasurer

Date: 12/19/2012

------------------------------

|

*PRINT THE NAME AND TITLE OF EACH SIGNING OFFICER UNDER HIS OR HER SIGNATURE.

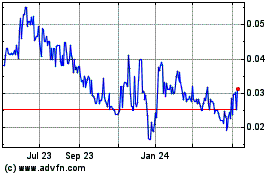

Cytta (QB) (USOTC:CYCA)

Historical Stock Chart

From Mar 2024 to Apr 2024

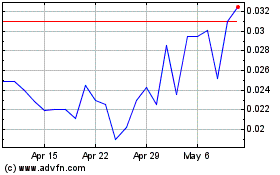

Cytta (QB) (USOTC:CYCA)

Historical Stock Chart

From Apr 2023 to Apr 2024