El Paso Electric (NYSE:EE):

Overview

- For the fourth quarter of 2011, EE

reported net income of $5.5 million, or $0.14 basic and $0.13

diluted earnings per share, respectively. In the fourth quarter of

2010, EE reported net income of $7.5 million, or $0.18 and $0.17

basic and diluted earnings per share, respectively.

- For the twelve months ended December

31, 2011, EE reported net income of $103.5 million, or $2.49 and

$2.48 basic and diluted earnings per share, respectively. Net

income for the twelve months ended December 31, 2010 was $100.6

million, or $2.32 and $2.31 basic and diluted earnings per share,

respectively and income before extraordinary item for the same

period was $90.3 million, or $2.08 and $2.07 basic and diluted

earnings per share, respectively.

“We were pleased with our earnings for the twelve months ended

December 31, 2011. Revenues from retail customers increased 6.3%

primarily resulting from the hotter than normal summer weather our

service territory experienced this year and the continued growth in

the number of customers served,” said David W. Stevens, Chief

Executive Officer. “Fourth quarter 2011 earnings declined relative

to fourth quarter 2010 earnings largely as the result of increased

maintenance at our local generating plants and a reduction of

capitalized carrying charges due to placing Newman 5, Phase II in

service earlier in the year.”

Earnings Summary

The table and explanations below present the major factors

affecting 2011 net income relative to 2010 income before the

extraordinary item in 2010.

Quarter Ended Twelve Months Ended

Pre-TaxEffect

After-TaxIncome

BasicEPS

Pre-TaxEffect

After-TaxIncome

BasicEPS

December 31, 2010 $ 7,466 $ 0.18 $ 90,317 $ 2.08 Changes in: Retail

non-fuel base revenue $ 2,120 1,336 0.03 $ 33,647 21,198 0.51

Transmission revenues 354

223

− 5,075 3,197 0.08 Operations and maintenance at

fossilfuel generating plants (3,652 ) (2,301 ) (0.06 ) (5,913 )

(3,725 ) (0.09 ) AFUDC (2,460 ) (2,087 ) (0.05 ) (4,478 ) (3,804 )

(0.09 ) Customer care expense (1,545 ) (973 ) (0.02 ) (3,284 )

(2,069 ) (0.05 )

Transmission and distribution

operationsand maintenance expense

(416 ) (262 ) (0.01 ) (3,117 ) (1,964 ) (0.05 ) Retained off-system

sales margins (158 ) (100 )

− (6,247 ) (3,935 ) (0.10 )

Elimination of Medicare Part D taxbenefit

− −

− − 4,787 0.11 Other

2,151

0.06 (463 )

(0.01 ) Total changes

(2,013 )

(0.05 )

13,222

0.31 December 31, 2011

$

5,453 0.13

$ 103,539

2.39

Change in weighted average

number of shares

0.01

0.10

December 31, 2011

$ 0.14

$ 2.49

Fourth Quarter 2011

Earnings for the quarter ended December 31, 2011 when compared

to the same period last year were positively affected by:

- Increased retail non-fuel base revenues

due to a 2.5% increase in kWh sales to retail customers reflecting

increased sales primarily to our large commercial and industrial

customers as compared to the same period in 2010 and 1.3% growth in

the average number of retail customers served.

Earnings for the quarter ended December 31, 2011 when compared

to the same period last year was negatively affected by:

- Increased planned maintenance outages

at our local fossil fuel generating plants and freeze protection

upgrades.

- Decreased allowance for funds used

during construction (“AFUDC”) primarily due to lower balances of

construction work in progress subject to AFUDC.

- Increased customer care expense

primarily due to an increase in uncollectible customer accounts and

increased costs for customer-related activities.

Year to Date

Earnings for the twelve months ended December 31, 2011, when

compared to the same period last year, were positively affected

by:

- Increased retail non-fuel base revenues

due to a 3.1% increase in kWh sales to retail customers reflecting

hotter summer weather when we have higher non-fuel base summer

rates and 1.4% growth in the average number of retail customers

served in 2011 as compared to the same period in 2010. During the

twelve months ended December 31, 2011, cooling degree days were 14%

above the same period in 2010 and 30% above the 30-year

average.

- Lower income taxes in 2011 due to a

one-time charge to income tax expense in 2010 to recognize a change

in tax law enacted in the Patient Protection and Affordable Care

Act to eliminate the tax benefit related to the Medicare Part D

subsidies.

- A decrease in the weighted average

number of shares outstanding as a result of our common stock

repurchase program resulting in an increase in basic earnings per

share of $0.10.

- Increased transmission revenues

primarily due to a settlement agreement with Tucson Electric Power

Company resolving a transmission dispute that resulted in one-time

income of $3.9 million, pre-tax and annual revenue of $1.1 million

per year.

Earnings for the twelve months ended December 31, 2011, when

compared to the same period last year were negatively affected

by:

- Decreased off-system sales margins

primarily due to lower average market prices for power and an

increase in sharing of off-system sales margins with customers from

25% to 90% effective in July 2010.

- Decreased AFUDC primarily due to lower

balances of construction work in progress subject to AFUDC.

- Increased maintenance at our local

gas-fired generating plants largely as a result of weather-related

damage during severe winter weather in February 2011 and freeze

protection upgrades.

- Increased customer care expense

primarily due to increased costs for customer-related activities,

an increase in uncollectible customer accounts, and an increase in

payroll costs.

- Increased transmission and distribution

operations and maintenance expense primarily due to increased

wheeling expense, a reliability study for the North American

Electric Reliability Corporation, and an increase in payroll

costs.

Retail Non-fuel Base Revenues

Retail non-fuel base revenues increased by $2.1 million,

pre-tax, or 1.8% in the fourth quarter of 2011, compared to the

same period in 2010 primarily due to: (i) a $0.8 million increase

in revenues from large commercial and industrial customers

reflecting a 6.8% increase in kWh sales; (ii) a $0.8 million

increase in revenues from small commercial and industrial customers

reflecting a 4.0% increase in the average number of customers

served; (iii) a $0.5 million increase in revenues from residential

customers reflecting a 1.1% growth in the average number of

customers served. Revenues from other public authorities remained

relatively unchanged in the fourth quarter of 2011 compared to the

same period last year. Non-fuel base revenues and kilowatt-hour

sales are provided by customer class on page 10 of the Release.

For the twelve months ended December 31, 2011, retail non-fuel

base revenues increased by $33.6 million, pre-tax, or 6.3%

compared to the same period in 2010 primarily due to a 3.1%

increase in kWh sales to retail customers, reflecting hotter summer

weather when we have higher non-fuel base summer rates, and 1.4%

growth in the average number of retail customers served. During the

twelve months ended December 31, 2011, cooling degree days were 14%

above the same period in 2010 and 30% above the 30-year average.

KWh sales to residential customers and small commercial and

industrial customers increased 5.0% and 2.5%, respectively, during

the twelve months ended December 31, 2011, compared to the same

period last year. Sales to other public authorities increased due

to increased sales to Fort Bliss at higher non-fuel base rates.

Non-fuel base revenues and kilowatt-hour sales are provided by

customer class on page 12 of the Release.

Off-system Sales

We make off-system sales in the wholesale power markets when

competitively priced excess power is available from our generating

plants and purchased power contracts. Off-system sales margins were

negatively affected by lower costs of natural gas that impact the

average market prices in the wholesale power markets. Off-system

sales margins were also negatively impacted by power purchases

required for system reliability during extremely cold weather in

February 2011. The Company shared 25% of off-system sales margins

with customers and retained 75% of off-system sales margins through

June 30, 2010 pursuant to rate agreements in prior years. Effective

July 1, 2010, we share 90% of off-system sales margins with

customers and retain 10% of off-system sales margins. Retained

margins from off-system sales decreased approximately $0.2 million

and $6.2 million for the three and twelve months ended December 31,

2011, respectively, compared to the corresponding periods in

2010.

Palo Verde License Extension

On April 21, 2011, the Nuclear Regulatory Commission granted

extensions in the operating licenses for all three units at Palo

Verde. The operating licenses for Units 1, 2 and 3 will now expire

in 2045, 2046, and 2047, respectively. For the second, third and

fourth quarters of 2011 combined, the extension of the operating

licenses reduced depreciation and amortization expense by

approximately $8.2 million and reduced the accretion expense on the

Palo Verde asset retirement obligation by approximately $3.1

million.

Rate Matters

We filed a request with the Public Utility Commission of Texas

(the “PUCT”) (Docket No. 40094), the City of El Paso, and other

Texas cities on February 1, 2012 for a $26.3 million increase in

rates charged to customers in Texas. The rate filing was made in

response to a resolution adopted by the El Paso City Council

requiring us to show cause why our base rates for customers in El

Paso city limits should not be reduced. The City of El Paso has

until August 4, 2012 to make a determination regarding our base

rates in the city. The rate filing used a historical test year

ended September 30, 2011, adjusted for known and measurable items,

and a return on equity of 10.6%. The filing at the PUCT also

includes a request to reconcile $356.5 million of fuel expense for

the period July 1, 2009 through September 30, 2011.

On November 15, 2011, the El Paso City Council adopted a

resolution that established current rates as temporary rates for

our customers residing within the city limits of El Paso. Temporary

rates will be effective from November 15, 2011 until a final

determination in the rate case is rendered by the PUCT.

While cities in Texas have jurisdiction over rates within their

city limits, the PUCT has appellate authority over city rate

decisions on a “de novo” basis. Therefore, the ultimate authority

to set our Texas electric rates is vested in the PUCT. The Company

cannot predict the outcome of this proceeding. If the rate case

results in the implementation of lower rates, then the resulting

lower rates would have a negative impact on our revenues, net

income, and cash from operations.

Capital and Liquidity

We continue to maintain a strong capital structure to ensure

access to capital markets at reasonable rates. At December 31,

2011, common stock equity represented 46.3% of our capitalization

(common stock equity, long-term debt and the current maturities of

long-term debt, and short-term borrowings under the revolving

credit facility). At December 31, 2011, we had a balance of

$8.2 million in cash and cash equivalents.

Cash flows from operations for the twelve months ended December

31, 2011 were $251.5 million compared to $239.4 million in the

corresponding period in 2010. The increase in cash flows from

operations reflects the increase in net income before a non-cash

extraordinary gain in 2010. Cash flows were also impacted by an

increase in deferred income taxes and an increase in accounts

payable, offset by the timing of collection of fuel revenues to

recover actual fuel expenses in 2011 compared to 2010. The

difference between fuel revenues collected and fuel expense

incurred is deferred to be either refunded (over-recoveries) or

surcharged (under-recoveries) to customers in the future. During

the twelve months ended December 31, 2011, the Company had an

under-recovery of fuel costs, net of refunds, of $26.0 million as

compared to an over-recovery, net of refunds, of $1.0 million

during the twelve months ended December 31, 2010. At December 31,

2011, we had a net fuel under-recovery balance of $7.0 million,

including an under-recovery balance of $9.1 million in Texas

partially offset by an over-recovery balance of $2.1 million in New

Mexico.

During the twelve months ended December 31, 2011, our primary

capital requirements were for the construction and purchase of

electric utility plant, the repurchase of common stock, purchases

of nuclear fuel, and payment of common stock dividends. Capital

requirements for new electric plant were $178.0 million for

the twelve months ended December 31, 2011 and

$170.0 million for the twelve months ended December 31,

2010.

On March 21, 2011, the Board of Directors authorized repurchases

of up to 2.5 million additional shares of the Company’s outstanding

common stock (the “2011 Plan”). During the twelve months ended

December 31, 2011, we repurchased 2,782,455 shares of common

stock in the open market at an aggregate cost of $86.5 million,

including 280,389 shares repurchased in the fourth quarter at an

aggregate cost of $9.2 million as authorized under both our

previously authorized plan and under the 2011 Plan. As of December

31, 2011, 393,816 shares remain available for repurchase under the

2011 Plan. The Company may repurchase shares in the open market

from time to time.

We maintain a $200 million revolving credit facility for working

capital and general corporate purposes and the financing of nuclear

fuel through the Rio Grande Resources Trust (“RGRT”). RGRT is the

trust through which we finance our portion of nuclear fuel for Palo

Verde and is consolidated in the Company’s financial statements. In

November 2011, we refinanced and extended our $200 million

revolving credit facility, which includes an option, subject to

lenders’ approval, to expand the size to $300 million. The amended

facility reduces our borrowing costs and extends the maturity from

September 2014 to September 2016. The total amount borrowed for

nuclear fuel by RGRT was $123.4 million at December 31, 2011, of

which $13.4 million had been borrowed under the revolving credit

facility and $110 million was borrowed through senior notes. At

December 31, 2010, the total amount borrowed for nuclear fuel by

RGRT was $114.7 million of which $4.7 million was borrowed under

the revolving credit facility and $110 million was borrowed through

senior notes. Interest costs on borrowings to finance nuclear fuel

are accumulated by RGRT and charged to us as fuel is consumed and

recovered from customers through fuel recovery charges. At December

31, 2011, $20.0 million was outstanding under the revolving credit

facility for working capital and general corporate purposes.

On December 30, 2011, we paid $8.8 million of quarterly

dividends to shareholders. We have paid a total of $27.2 million in

cash dividends during the twelve months ended December 31, 2011. On

January 26, 2012, our Board of Directors declared a quarterly cash

dividend of $0.22 per share payable on March 30, 2012 to

shareholders of record on March 15, 2012. At the current payout

rate, we would expect to pay total cash dividends of approximately

$35.2 million during 2012. The Board of Directors plans to review

the Company’s dividend policy annually, in conjunction with the

annual shareholders meeting held in the second quarter of each

year. Our current expectation is that our payout ratio will trend

upward from its current level, with a payout ratio of approximately

45% being the anticipated target for 2012.

We believe we have adequate liquidity through our current cash

balances, cash from operations, and our revolving credit facility

to meet all of our anticipated cash requirements for the next

twelve months. In addition, we anticipate issuing long-term debt in

the capital markets to finance capital requirements in 2012. In

October 2011, we received approval from the New Mexico Public

Regulation Commission and the Federal Energy Regulatory Commission

to incrementally issue up to $300 million of long-term debt as and

when needed. Obtaining the ability to issue up to $300 million of

new long-term debt, from time to time, provides us with the

flexibility to access the debt capital markets when needed and when

conditions are favorable.

2012 Earnings Guidance

We are providing earnings guidance for 2012 within a range of

$2.15 to $2.55 per basic share excluding any impacts of the Texas

rate case filed on February 1, 2012.

Conference Call

A conference call to discuss fourth quarter 2011 earnings is

scheduled for 10:30 a.m. Eastern Time, February 22, 2012. The

dial-in number is 800-598-5161 with a conference ID of 6676054. The

conference leader will be Steven P. Busser, Vice President –

Treasurer of EE. A replay will run through March 7, 2012 with a

dial-in number of 888-203-1112 and a conference ID of 6676054. The

conference call and presentation slides will be webcast live on

EE’s website found at http://www.epelectric.com. A replay of the

webcast will be available shortly after the call.

Safe Harbor

This news release includes statements that may constitute

forward-looking statements made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

This information may involve risks and uncertainties that could

cause actual results to differ materially from such forward-looking

statements. Factors that could cause or contribute to such

differences include, but are not limited to: (i) our rates in Texas

following the rate case filed on February 1, 2012 pursuant to the

El Paso City Council’s resolution ordering EE to show cause why our

base rates for El Paso customers should not be lower; (ii)

increased prices for fuel and purchased power and the possibility

that regulators may not permit EE to pass through all such

increased costs to customers or to recover previously incurred fuel

costs in rates; (iii) recovery of capital investments and

operating costs through rates in Texas and New Mexico; (iv)

uncertainties and instability in the general economy and the

resulting impact on EE’s sales and profitability; (v) unanticipated

increased costs associated with scheduled and unscheduled outages;

(vi) the size of our construction program and our ability to

complete construction on budget and on time; (vii) costs at

Palo Verde; (viii) deregulation and competition in the

electric utility industry; (ix) possible increased costs of

compliance with environmental or other laws, regulations and

policies; (x) possible income tax and interest payments as a

result of audit adjustments proposed by the IRS;

(xi) uncertainties and instability in the financial markets

and the resulting impact on EE's ability to access the capital and

credit markets; and (xii) other factors detailed by EE in its

public filings with the Securities and Exchange Commission. EE’s

filings are available from the Securities and Exchange Commission

or may be obtained through EE’s website, http://www.epelectric.com.

Any such forward-looking statement is qualified by reference to

these risks and factors. EE cautions that these risks and factors

are not exclusive. EE does not undertake to update any

forward-looking statement that may be made from time to time by or

on behalf of EE except as required by law.

El Paso Electric Company and Subsidiary Consolidated

Statements of Operations Quarter Ended December 31, 2011 and

2010 (In thousands except for per share data)

(Unaudited)

2011 2010 Variance Operating revenues, net of energy

expenses: Base revenues $ 119,486 $ 117,389 $ 2,097

(a)

Off-system sales margins, net of sharing 137 295 (158 ) Deregulated

Palo Verde Unit 3 revenues 3,176 2,863 313 Other 7,935

5,819 2,116

Operating Revenues Net of

Energy Expenses 130,734 126,366 4,368

Other operating expenses: Other operations and maintenance

52,094 47,458 4,636 Palo Verde operations and maintenance 29,660

30,798 (1,138 ) Taxes other than income taxes 12,430 13,451 (1,021

) Other income (deductions) 446 1,065 (619 )

Earnings Before Interest, Taxes, Depreciation and

Amortization 36,996 35,724 1,272

(b)

Depreciation and amortization 20,556 20,875 (319 ) Interest

on long-term debt 13,520 13,448 72 AFUDC and capitalized interest

4,044 6,396 (2,352 ) Other interest expense 212 141

71

Income Before Income Taxes 6,752

7,656 (904 ) Income tax expense

1,299 190 1,109

Net Income

$ 5,453 $ 7,466 $ (2,013

) Basic Earnings per Share $

0.14 $ 0.18 $ (0.04 )

Diluted Earnings per Share $ 0.13

$ 0.17 $ (0.04 )

Dividends declared per share of common stock $

0.22 $ - $ 0.22

Weighted average number of shares outstanding 39,957

42,415 (2,458 ) Weighted average number of shares and

dilutive potential shares outstanding 40,210 42,669

(2,459 ) (a) Base revenues exclude fuel

recovered through New Mexico base rates of $16.3 million and $16.0

million, respectively. (b) EBITDA is a non-GAAP financial measure

and is not a substitute for net income or other measures of

financial performance in accordance with GAAP.

El Paso

Electric Company and Subsidiary Consolidated Statements of

Operations Twelve Months Ended December 31, 2011 and

2010 (In thousands except for per share data)

(Unaudited)

2011 2010 Variance Operating revenues, net of energy

expenses: Base revenues $ 572,078 $ 538,252 $ 33,826 (a) Off-system

sales margins, net of sharing (560 ) 5,687 (6,247 ) Deregulated

Palo Verde Unit 3 revenues 14,820 16,103 (1,283 ) Other

33,019 25,464 7,555 (b)

Operating

Revenues Net of Energy Expenses 619,357 585,506

33,851 Other operating expenses: Other operations and

maintenance 192,155 180,522 11,633 Palo Verde operations and

maintenance 99,507 100,522 (1,015 ) Taxes other than income taxes

55,561 54,489 1,072 Other income (deductions) 3,362

3,477 (115 )

Earnings Before Interest, Taxes,

Depreciation and Amortization 275,496

253,450 22,046 (c) Depreciation and

amortization 81,331 81,011 320 Interest on long-term debt 54,115

50,826 3,289 AFUDC and capitalized interest 18,186 19,974 (1,788 )

Other interest expense 989 254 735

Income Before Income Taxes and Extraordinary Item

157,247 141,333 15,914 Income tax

expense 53,708 51,016 2,692 (d)

Income Before Extraordinary Item 103,539 90,317

13,222 Extraordinary gain related to Texas regulatory

assets, net of income tax expense of $5,769

-

10,286 (10,286 )

Net Income $

103,539 $ 100,603 $ 2,936

Basic Earnings per Share: Income before

extraordinary item

$ 2.49 $ 2.08

$ 0.41 Extraordinary gain related to Texas regulatory

assets, net of tax

- 0.24

(0.24 ) Net Income

$ 2.49

$ 2.32 $ 0.17 Diluted

Earnings per Share: Income before extraordinary item

$

2.48 $ 2.07 $ 0.41 Extraordinary

gain related to Texas regulatory assets, net of tax

-

0.24 (0.24 ) Net Income

$ 2.48 $ 2.31 $

0.17 Dividends declared per share of common

stock $ 0.66 $ - $

0.66 Weighted average number of shares

outstanding 41,350 43,130 (1,780 )

Weighted average number of shares and dilutive potential

shares outstanding 41,587 43,294 (1,707

) (a) Base revenues exclude fuel recovered through New

Mexico base rates of $73.5 million and $71.9 million, respectively.

(b) 2011 includes a one-time $3.9 million settlement of a

transmission dispute with Tucson Electric Power Company. (c) EBITDA

is a non-GAAP financial measure and is not a substitute for net

income or other measures of financial performance in accordance

with GAAP. (d) Income tax expense for the twelve months ended

December 31, 2010 includes a charge of $4.8 million related to the

Patient Protection and Affordable Care Act which eliminated the tax

benefit associated with the Medicare Part D subsidies beginning in

2013.

El Paso Electric Company and Subsidiary

Cash Flow Summary Twelve Months Ended December 31, 2011

and 2010 (In thousands and Unaudited)

2011 2010 Cash flows from

operating activities: Net income $ 103,539 $ 100,603

Adjustments to reconcile net income to net cash provided by

operations: Depreciation and amortization of electric plant in

service 81,331 81,011 Extraordinary gain on Texas regulatory

assets, net of tax - (10,286 ) Deferred income taxes, net 45,688

27,456 Other 49,768 36,359 Change in working capital items: Net

recovery (deferral) of fuel revenues (26,001 ) 958 Accounts

receivable (4,663 ) (1,303 ) Accounts payable 4,401 (9,634 ) Other

(2,546 ) 14,186

Net cash provided by

operating activities 251,517

239,350 Cash flows from investing

activities: Cash additions to utility property, plant and

equipment (178,041 ) (169,966 ) Cash additions to nuclear fuel

(39,551 ) (34,277 ) Decommissioning trust funds (12,515 ) (11,536 )

Other (7,298 ) (8,872 )

Net cash used for

investing activities (237,405 )

(224,651 ) Cash flows from financing

activities: Repurchase of common stock (86,508 ) (33,726 )

Dividends paid (27,223 ) - Borrowings under the revolving credit

facility 28,675 (102,294 ) Proceeds from issuance of long-term

private placement notes - 110,000 Other (32 ) (1,285

)

Net cash used for financing activities

(85,088 ) (27,305 )

Net decrease in cash and cash equivalents (70,976

) (12,606 ) Cash and cash

equivalents at beginning of period 79,184

91,790 Cash and cash equivalents at

end of period $ 8,208 $

79,184 El Paso Electric Company and

Subsidiary Quarter Ended December 31, 2011 and 2010

Sales and Revenues Statistics

Increase (Decrease) 2011

2010 Amount Percentage

MWh

sales:

Retail: Residential 555,143 550,164 4,979 0.9 % Commercial and

industrial, small 536,137 533,313 2,824 0.5 % Commercial and

industrial, large 278,491 260,860 17,631 6.8 % Sales to public

authorities 378,968 362,167

16,801 4.6 % Total retail sales 1,748,739

1,706,504 42,235 2.5 % Wholesale: Sales

for resale 10,611 10,103 508 5.0 % Off-system sales 524,838

658,966 (134,128 ) (20.4 %) Total

wholesale sales 535,449 669,069

(133,620 ) (20.0 %) Total MWh sales 2,284,188

2,375,573 (91,385 ) (3.8 %)

Operating

revenues (in thousands):

Non-fuel base revenues: Retail: Residential $ 47,710 $ 47,216 $ 494

1.0 % Commercial and industrial, small 40,890 40,096 794 2.0 %

Commercial and industrial, large 10,704 9,897 807 8.2 % Sales to

public authorities 19,782 19,757

25 0.1 % Total retail non-fuel base revenues 119,086 116,966

2,120 1.8 % Wholesale:

Sales for resale

400 423 (23 ) (5.4 %) Total

non-fuel base revenues 119,486 117,389 2,097 1.8 % Fuel

revenues (a):

Recovered from customers during the period

(b)

35,959 34,707 1,252 3.6 % Under (over) collection of fuel (3,607 )

(13,613 ) 10,006 (73.5 %) New Mexico fuel in base rates

16,303 15,982 321 2.0 % Total

fuel revenues 48,655 37,076 11,579 31.2 % Off-system sales:

Fuel cost 13,959 17,874 (3,915 ) (21.9 %) Shared margins 1,161

2,514 (1,353 ) (53.8 %) Retained margins 137

295 (158 ) (53.6 %) Total off-system sales 15,257

20,683 (5,426 ) (26.2 %) Other 8,265

6,196 2,069 33.4 % Total operating revenues $

191,663 $ 181,344 $ 10,319 5.7 %

Average number of

retail customers:

Residential 337,498 333,844 3,654 1.1 % Commercial and industrial,

small 38,154 36,704 1,450 4.0 % Commercial and industrial, large 50

49 1 2.0 % Sales to public authorities 4,477

4,720 (243 ) (5.1 %) Total 380,179

375,317 4,862 1.3 %

Number of retail

customers (end of period):

Residential 337,659 334,729 2,930 0.9 % Commercial and industrial,

small 37,942 37,202 740 2.0 % Commercial and industrial, large 49

50 (1 ) (2.0 %) Sales to public authorities 4,596

4,841 (245 ) (5.1 %) Total 380,246

376,822 3,424 0.9 %

Weather

statistics

30 Yr Average

Heating degree days 1,097 795 1,049 Cooling degree days 138 131 93

(a)

Includes deregulated Palo Verde Unit 3

revenues for the New Mexico jurisdiction of $3.2 million and $2.9

million, respectively.

(b) Excludes $11.5 million refund in 2010 related to prior periods

Texas deferred fuel revenues.

El Paso Electric Company and Subsidiary Quarter Ended

December 31, 2011 and 2010 Generation and Purchased Power

Statistics

Increase (Decrease)

2011

2010 Amount Percentage Generation and

purchased power (MWh): Palo Verde 1,107,404 1,177,149 (69,745 )

(5.9 %) Four Corners 161,325 188,904 (27,579 ) (14.6 %) Gas plants

682,962 613,654 69,308 11.3 % Total generation

1,951,691 1,979,707 (28,016 ) (1.4 %) Purchased power 435,515

496,248 (60,733 ) (12.2 %) Total available energy

2,387,206 2,475,955 (88,749 ) (3.6 %) Line losses and Company use

103,018 100,382 2,636 2.6 % Total MWh sold

2,284,188 2,375,573 (91,385 ) (3.8 %) Palo

Verde capacity factor 80.6 % 85.8 % (5.2 %) Four Corners capacity

factor 71.7 % 83.3 % (11.6 %)

El Paso Electric

Company and Subsidiary Twelve Months Ended December 31, 2011

and 2010 Sales and Revenues Statistics

Increase (Decrease)

2011 2010 Amount Percentage

MWh

sales:

Retail: Residential 2,633,390 2,508,834 124,556 5.0 % Commercial

and industrial, small 2,352,218 2,295,537 56,681 2.5 % Commercial

and industrial, large 1,096,040 1,087,413 8,627 0.8 % Sales to

public authorities 1,579,565 1,542,389

37,176 2.4 % Total retail sales 7,661,213

7,434,173 227,040 3.1 % Wholesale: Sales for

resale 62,656 53,637 9,019 16.8 % Off-system sales 2,687,631

2,822,732 (135,101 ) (4.8 %) Total wholesale

sales 2,750,287 2,876,369 (126,082 )

(4.4 %) Total MWh sales 10,411,500 10,310,542

100,958 1.0 %

Operating

revenues (in thousands):

Non-fuel base revenues: Retail: Residential $ 234,086 $ 217,615 $

16,471 7.6 % Commercial and industrial, small 196,093 188,390 7,703

4.1 % Commercial and industrial, large 45,407 43,844 1,563 3.6 %

Sales to public authorities 94,370 86,460

7,910 9.1 % Total retail non-fuel base revenues

569,956 536,309 33,647 6.3 % Wholesale: Sales for resale

2,122 1,943 179 9.2 % Total non-fuel

base revenues 572,078 538,252 33,826 6.3 % Fuel revenues

(a):

Recovered from customers during the period

(b)

145,130 170,588 (25,458 ) (14.9 %) Under (over) collection of fuel

13,917 (35,408 ) 49,325 - New Mexico fuel in base rates 73,454

71,876 1,578 2.2 % Total fuel revenues

232,501 207,056 25,445 12.3 % Off-system sales: Fuel cost

74,736 93,516 (18,780 ) (20.1 %) Shared margins 3,883 6,114 (2,231

) (36.5 %) Retained margins (560 ) 5,687

(6,247 ) - Total off-system sales 78,059 105,317 (27,258 )

(25.9 %) Other (c) 35,375 26,626

8,749 32.9 % Total operating revenues $ 918,013 $

877,251 $ 40,762 4.6 %

Average number of

retail customers:

Residential 336,219 331,869 4,350 1.3 % Commercial and industrial,

small 37,652 36,536 1,116 3.1 % Commercial and industrial, large 50

49 1 2.0 % Sales to public authorities 4,626

4,701 (75 ) (1.6 %) Total 378,547

373,155 5,392 1.4 %

Number of retail

customers (end of period):

Residential 337,659 334,729 2,930 0.9 % Commercial and industrial,

small 37,942 37,202 740 2.0 % Commercial and industrial, large 49

50 (1 ) (2.0 %) Sales to public authorities 4,596

4,841 (245 ) (5.1 %) Total 380,246

376,822 3,424 0.9 %

Weather

statistics

30 Yr Average Heating degree days 2,402 2,273

2,426 Cooling degree days 3,135 2,738 2,410 (a)

Includes deregulated Palo Verde Unit 3

revenues for the New Mexico jurisdiction of $14.8 million and $16.1

million, respectively.

(b)

Excludes $12.0 million and $34.8 million

of refunds in 2011 and 2010, respectively, related to prior periods

Texas deferred fuel revenues.

(c) 2011 includes a one-time $3.9 million settlement of a

transmission dispute with Tucson Electric Power Company.

El Paso Electric Company &

Subsidiary Twelve Months Ended December 31, 2011 and

2010 Generation and Purchased Power Statistics

Increase (Decrease) 2011

2010 Amount Percentage Generation and

purchased power (MWh): Palo Verde 4,942,055 4,925,313 16,742 0.3 %

Four Corners 647,932 650,236 (2,304 ) (0.4 %) Gas plants (a)

3,346,789 2,890,110 456,679 15.8 % Total

generation 8,936,776 8,465,659 471,117 5.6 % Purchased power

2,112,596 2,420,869 (308,273 ) (12.7 %) Total

available energy 11,049,372 10,886,528 162,844 1.5 % Line losses

and Company use 637,872 575,986 61,886 10.7 %

Total MWh sold 10,411,500 10,310,542 100,958

1.0 % Palo Verde capacity factor 90.7 % 90.4 % 0.3 % Four

Corners capacity factor 75.6 % 72.1 % 3.5 %

(a) 2011 includes 193,460 MWhs for

pre-commercial testing of Newman Unit 5 Phase II.

El Paso Electric Company and Subsidiary

Financial Statistics At December 31, 2011 and 2010

(In thousands, except number of shares, book value per share,

and ratios)

Balance Sheet 2011 2010 Cash and cash

equivalents $ 8,208 $ 79,184 Common stock

equity $ 760,251 $ 810,375 Long-term debt 816,497

849,745 Total capitalization $ 1,576,748 $

1,660,120 Current maturities of long-term debt

$ 33,300 $ - Short-term borrowings under the

revolving credit facility $ 33,379 $ 4,704

Number of shares - end of period 39,959,154

42,571,065 Book value per common share $ 19.03

$ 19.04 Common equity ratio 46.3 % 48.7 % Debt ratio

53.7 % 51.3 %

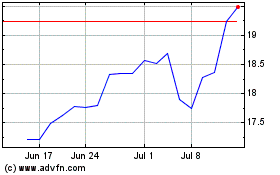

Excelerate Energy (NYSE:EE)

Historical Stock Chart

From Mar 2024 to Apr 2024

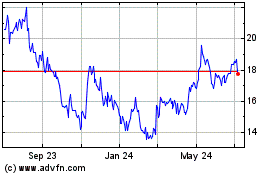

Excelerate Energy (NYSE:EE)

Historical Stock Chart

From Apr 2023 to Apr 2024