Ameristar Casinos, Inc. (NASDAQ: ASCA)

- 4Q and Full-Year Records Set for Adjusted

EBITDA and Adjusted EBITDA Margin

- 4Q Net Revenues Increased $2.1 Million (0.7%)

YOY to $296.2 Million

- 4Q Adjusted EBITDA Improved $6.7 Million

(8.7%) YOY to $84.3 Million

- 4Q Adjusted EBITDA Margin Improved 2.0

Percentage Points YOY to 28.4%

- 4Q Adjusted EPS Improved by $0.02 YOY to

$0.21

Ameristar Casinos, Inc. (NASDAQ: ASCA) today announced financial

results for the fourth quarter and year ended Dec. 31, 2011.

"Ameristar's fourth quarter financial performance capped off a

record-breaking year that was driven by our consistent delivery of

a superior guest experience, focus on cost management and effective

marketing," said Gordon Kanofsky, Ameristar's Chief Executive

Officer. "On an annual basis, we broke the prior Adjusted EBITDA

record by $18.6 million on the strength of a 30.1% consolidated

Adjusted EBITDA margin that set a new record by 1.6 percentage

points. Our ability to generate significant free cash flow has

allowed us to make substantial debt repayments, increase our

quarterly dividend and opportunistically repurchase shares and

pursue growth."

Fourth Quarter 2011 Results

Consolidated net revenues for the fourth quarter improved year

over year by $2.1 million, or 0.7%, to $296.2 million, aided by

promotional efficiencies and better weather conditions at most

properties during late December in 2011 than in 2010. Consolidated

promotional allowances decreased $1.7 million (2.5%) from the

prior-year fourth quarter. Promotional costs were reduced as a

percentage of gross gaming revenues, from 23.1% in the fourth

quarter of 2010 to 22.5% in the fourth quarter of 2011. Council

Bluffs, with net revenue growth of 6.1%, also benefited from market

share growth and overall market strength. Other properties with

year-over-year net revenue growth were Jackpot (8.0%) and Vicksburg

(4.1%). East Chicago had a 2.6% year-over-year decline in net

revenues that was mostly attributable to a new competitor in Des

Plaines, Illinois, partially offset by market share growth in the

more immediate Northwest Indiana market.

For the fourth quarter of 2011, growth in consolidated Adjusted

EBITDA outpaced the growth in net revenues by more than three

times, with a $6.7 million, or 8.7%, increase over the prior-year

quarter, to $84.3 million. Six of our properties generated improved

Adjusted EBITDA on a year-over-year basis, led by Jackpot (52.8%),

Black Hawk (15.7%) and Council Bluffs (14.6%). Five properties set

fourth quarter Adjusted EBITDA records, including our two Missouri

properties. Both Kansas City and St. Charles, which are our two

largest Adjusted EBITDA contributors, continued their streaks of

year-over-year quarterly Adjusted EBITDA improvement to six

quarters and five quarters, respectively.

Consolidated Adjusted EBITDA margin improved from 26.4% in the

fourth quarter of 2010 to 28.4% in the current-year fourth quarter.

The application of our efficient operating model contributed to

year-over-year improvement in the Adjusted EBITDA margin at all of

our properties. Notably, Jackpot and Black Hawk delivered Adjusted

EBITDA margin improvements of 8.4 percentage points and 5.3

percentage points, respectively. We generated operating income of

$44.1 million in the fourth quarter of 2011, compared to $44.6

million in the same period in 2010. The decline in operating income

from the 2010 fourth quarter was mostly attributable to an $8.6

million increase in non-cash stock-based compensation expense,

resulting from equity award modifications that accelerated the

recognition of the expense.

For the quarter ended December 31, 2011, we reported net income

of $7.4 million, compared to net income of $10.9 million for the

same period in 2010. The year-over-year decline in net income was

mostly attributable to the increase in non-cash stock-based

compensation expense. Our Adjusted EPS of $0.21 for the quarter

ended December 31, 2011 represents an increase of $0.02 over

Adjusted EPS for the 2010 fourth quarter. Fourth quarter 2011

Adjusted EPS was favorably impacted by the reduction from the

prior-year fourth quarter of approximately 25.4 million

weighted-average number of diluted shares.

Full Year 2011 Results Consolidated net

revenues for fiscal year 2011 were $1.21 billion, a $25.2 million

(2.1%) increase from $1.19 billion in 2010. A 2.9 percentage point

improvement in the Adjusted EBITDA margin from 27.2% in 2010 to a

record 30.1% in 2011 fueled a $41.6 million (12.9%) year-over-year

increase in Adjusted EBITDA, reflecting a flow-through rate of 165%

and establishing a new Adjusted EBITDA record of $365.1

million.

Every property improved year-over-year in all our key financial

metrics -- net revenues, Adjusted EBITDA and Adjusted EBITDA margin

-- with the exception of net revenues at Jackpot, which were

essentially flat. We believe the record-breaking financial

performance in 2011 was mostly attributable to our high quality

guest experience, our detailed attention to cost containment and

effective marketing.

For the full year, consolidated net income decreased from $8.6

million in 2010 to $6.8 million in 2011. A pre-tax loss on early

retirement of debt of $85.3 million ($55.1 million on an after-tax

basis) adversely impacted 2011, while an East Chicago impairment

charge negatively impacted 2010 by $33.2 million on an after-tax

basis.

Adjusted EPS was $1.74 for the year ended December 31, 2011,

compared to $0.73 for 2010. Adjusted EPS for 2011 was favorably

impacted by the reduction from 2010 of approximately 17.7 million

weighted-average number of diluted shares outstanding. The increase

in Adjusted EPS from the prior year was also attributable to

efficient revenue flow-through and decreased interest expense

resulting from the termination of our interest rate swap agreements

in July 2010 and the lower interest rates achieved through our

April 2011 debt refinancing.

Additional Financial Information

Debt. At December 31, 2011, the face amount

of our outstanding debt was $1.93 billion, an increase of $394.2

million from December 31, 2010. The increase in debt was

attributable to the April share repurchase and refinancing,

partially offset by approximately $194.3 million in 2011 debt

repayments, equaling one-third of the incremental debt from the

April transactions. After taking into consideration $11.8 million

in fourth-quarter net repayments, we have $257.0 million available

for borrowing under the revolving credit facility. At December 31,

2011, our Total Net Leverage Ratio (as defined in the senior credit

facility) was required to be no more than 7.00:1. As of that date,

our Total Net Leverage Ratio was 5.04:1, representing significant

improvement over our pro forma Total Net Leverage Ratio as of March

31, 2011 of 5.95:1, which gives effect to our debt refinancing.

Capital Expenditures. For the fourth

quarters of 2011 and 2010, capital expenditures were $36.5 million

and $19.8 million, respectively. The fourth quarter 2011 capital

expenditures included a $9.3 million settlement payment to the

general contractor for our St. Charles hotel construction project

completed in 2008. For the years ended December 31, 2011 and 2010,

capital expenditures were $82.6 million and $58.4 million,

respectively.

Stock Repurchase Program. On September 15,

2011, our Board of Directors approved the repurchase of up to $75

million of Ameristar common stock through September 30, 2014.

During the fourth quarter of 2011, we repurchased approximately 0.2

million shares of common stock at a total cost of approximately

$2.4 million under the stock repurchase program. During 2011, we

repurchased approximately 0.3 million shares of common stock, or 1%

of our outstanding stock, under the program at an average price of

$16.23 per share, for a total cost of $5.2 million.

Dividend. During the fourth quarter of

2011, our Board of Directors declared a cash dividend of $0.105 per

share, which we paid on December 15, 2011. On January 27, 2012, the

Board declared a cash dividend of $0.125 per share, payable on

March 15, 2012.

Outlook

In the first quarter of 2012, we currently expect:

- depreciation to range from $26.5 million to $27.5 million.

- interest expense, net of capitalized interest, to be between

$26.5 million and $27.5 million, including non-cash interest

expense of approximately $1.4 million.

- the combined state and federal income tax rate to be in the

range of 43% to 44%.

- capital spending of $31 million to $36 million, including a $16

million Massachusetts land purchase.

- non-cash stock-based compensation expense of $4.5 million to

$5.0 million.

- corporate expense, excluding corporate's portion of non-cash

stock-based compensation expense, to be between $12.5 million and

$13.0 million.

For the full year 2012, we currently expect:

- depreciation to range from $105 million to $110 million.

- interest expense, net of capitalized interest, to be between

$103.5 million and $108.5 million, including non-cash interest

expense of approximately $5.5 million.

- the combined state and federal income tax rate to be in the

range of 43% to 44%.

- capital spending of $85 million to $90 million, including the

Massachusetts land purchase.

- non-cash stock-based compensation expense of $14.8 million to

$15.8 million.

- corporate expense, excluding corporate's portion of non-cash

stock-based compensation expense, to be between $52.0 million to

$53.0 million.

Conference Call Information We will hold a

conference call to discuss our fourth quarter and full year results

on Wednesday, February 1, 2012 at 11 a.m. EST. The call may be

accessed live by dialing toll-free 888-490-2762 domestically, or

719-325-2448, and referencing pass code number 9990471. Conference

call participants are requested to dial in at least five minutes

early to ensure a prompt start. Interested parties wishing to

listen to the conference call and view corresponding informative

slides on the Internet may do so live at our website --

www.ameristar.com -- by clicking on "About Us/Investor Relations"

and selecting the "Webcasts and Events" link. A copy of the slides

will be available in the corresponding "Earnings Releases" section

one-half hour before the conference call. In addition, the call

will be recorded and can be replayed from 2 p.m. EST, February 1,

2012, until 11:59 p.m. EST, February 15, 2012. To listen to the

replay, call toll-free 888-203-1112 domestically, or 719-457-0820,

and reference the pass code number above.

Forward-Looking Information This release

contains certain forward-looking information that generally can be

identified by the context of the statement or the use of

forward-looking terminology, such as "believes," "estimates,"

"anticipates," "intends," "expects," "plans," "is confident that,"

"should" or words of similar meaning, with reference to Ameristar

or our management. Similarly, statements that describe our future

plans, objectives, strategies, financial results or position,

operational expectations or goals are forward-looking statements.

It is possible that our expectations may not be met due to various

factors, many of which are beyond our control, and we therefore

cannot give any assurance that such expectations will prove to be

correct. For a discussion of relevant factors, risks and

uncertainties that could materially affect our future results,

attention is directed to "Item 1A. Risk Factors" and "Item 7.

Management's Discussion and Analysis of Financial Condition and

Results of Operations" in our Annual Report on Form 10-K for the

year ended December 31, 2010, "Item 1A. Risk Factors" in our

Quarterly Report on Form 10-Q for the quarter ended June 30, 2011

and "Item 2. Management's Discussion and Analysis of Financial

Condition and Results of Operations" in our Quarterly Report on

Form 10-Q for the quarter ended September 30, 2011.

About Ameristar Ameristar Casinos is an

innovative casino gaming company featuring the newest and most

popular slot machines. Our 7,500 dedicated team members pride

themselves on delivering consistently friendly and appreciative

service to our guests. We continuously strive to increase the

loyalty of our guests through the quality of our slot machines,

table games, hotel, dining and other leisure offerings. Our eight

casino hotel properties primarily serve guests from Colorado,

Idaho, Illinois, Indiana, Iowa, Kansas, Louisiana, Mississippi,

Missouri, Nebraska and Nevada. We have been a public company since

1993, and our stock is traded on the Nasdaq Global Select Market.

We generate more than $1 billion in net revenues annually.

Visit Ameristar Casinos' website at www.ameristar.com (which

shall not be deemed to be incorporated in or a part of this news

release).

Please refer to the tables near the end of this release for the

reconciliation of the non-GAAP financial measures Adjusted EBITDA

and Adjusted EPS reported throughout this release. Additionally,

more information on these non-GAAP financial measures can be found

under the caption "Use of Non-GAAP Financial Measures" at the end

of this release.

AMERISTAR CASINOS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in Thousands, Except Per Share Data)

(Unaudited)

Three Months Ended Year Ended

December 31, December 31,

2011 2010 2011 2010

---------- ---------- ----------- -----------

REVENUES:

Casino $ 305,040 $ 305,061 $ 1,248,616 $ 1,247,034

Food and beverage 34,067 33,475 138,192 134,854

Rooms 18,842 19,168 77,870 79,403

Other 6,954 6,878 28,905 30,559

---------- ---------- ----------- -----------

364,903 364,582 1,493,583 1,491,850

Less: promotional

allowances (68,741) (70,489) (279,077) (302,568)

---------- ---------- ----------- -----------

Net revenues 296,162 294,093 1,214,506 1,189,282

OPERATING EXPENSES:

Casino 132,895 136,762 537,094 544,001

Food and beverage 15,207 16,648 59,467 64,451

Rooms 3,928 3,808 14,904 17,591

Other 2,608 2,739 10,519 12,419

Selling, general and

administrative 69,808 61,705 259,151 244,964

Depreciation and

amortization 27,264 27,249 105,922 109,070

Impairment of goodwill - - - 21,438

Impairment of other

intangible assets - - - 34,791

Impairment of fixed

assets 245 220 245 224

Net loss (gain) on

disposition of assets 79 350 (45) 255

---------- ---------- ----------- -----------

Total operating

expenses 252,034 249,481 987,257 1,049,204

Income from

operations 44,128 44,612 227,249 140,078

OTHER INCOME (EXPENSE):

Interest income 12 114 15 452

Interest expense, net of

capitalized interest (27,090) (24,668) (106,623) (121,233)

Loss on early retirement

of debt - - (85,311) -

Other 508 808 (784) 1,463

---------- ---------- ----------- -----------

INCOME BEFORE INCOME TAX

PROVISION 17,558 20,866 34,546 20,760

Income tax provision 10,179 9,945 27,752 12,130

---------- ---------- ----------- -----------

NET INCOME $ 7,379 $ 10,921 $ 6,794 $ 8,630

========== ========== =========== ===========

EARNINGS PER SHARE:

Basic $ 0.23 $ 0.19 $ 0.17 $ 0.15

========== ========== =========== ===========

Diluted $ 0.22 $ 0.18 $ 0.17 $ 0.15

========== ========== =========== ===========

CASH DIVIDENDS DECLARED PER

SHARE $ 0.11 $ 0.11 $ 0.42 $ 0.42

========== ========== =========== ===========

WEIGHTED-AVERAGE SHARES

OUTSTANDING:

Basic 32,681 58,253 40,242 58,025

========== ========== =========== ===========

Diluted 34,014 59,458 41,136 58,818

========== ========== =========== ===========

AMERISTAR CASINOS, INC. AND SUBSIDIARIES

SUMMARY CONSOLIDATED FINANCIAL DATA

(Dollars in Thousands)

(Unaudited)

December 31, 2011 December 31, 2010

----------------- -----------------

Balance sheet data

Cash and cash equivalents $ 85,719 $ 71,186

Total assets $ 2,012,039 $ 2,061,542

Total debt, net of discounts of

$8,258 and $10,315 $ 1,926,064 $ 1,529,798

Stockholders' (deficit) equity $ (90,578) $ 351,020

Three Months Ended Year Ended

December 31, December 31,

2011 2010 2011 2010

-------- -------- ---------- ----------

Consolidated cash flow

information

Net cash provided by operating

activities $ 44,070 $ 41,750 $ 253,349 $ 218,827

Net cash used in investing

activities $(33,608) $(24,898) $ (52,283) $ (70,006)

Net cash used in financing

activities $(16,658) $(32,935) $ (186,533) $ (174,128)

Net revenues

Ameristar St. Charles $ 66,129 $ 66,560 $ 269,759 $ 267,139

Ameristar Kansas City 55,939 56,430 226,054 223,404

Ameristar Council Bluffs 40,675 38,328 164,523 154,468

Ameristar Black Hawk 38,143 38,291 153,203 152,254

Ameristar Vicksburg 28,133 27,028 118,094 114,516

Ameristar East Chicago 52,773 54,156 221,893 216,514

Jackpot Properties 14,370 13,300 60,980 60,987

-------- -------- ---------- ----------

Consolidated net revenues $296,162 $294,093 $1,214,506 $1,189,282

======== ======== ========== ==========

Operating income (loss)

Ameristar St. Charles $ 14,347 $ 14,660 $ 68,908 $ 59,658

Ameristar Kansas City 15,268 14,855 66,088 59,134

Ameristar Council Bluffs 13,977 10,883 57,962 47,027

Ameristar Black Hawk 9,877 7,598 37,562 33,060

Ameristar Vicksburg 7,923 7,071 38,365 33,528

Ameristar East Chicago 3,920 4,366 22,445 (41,874)

Jackpot Properties 2,419 1,238 13,642 11,526

Corporate and other (23,603) (16,059) (77,723) (61,981)

-------- -------- ---------- ----------

Consolidated operating

income $ 44,128 $ 44,612 $ 227,249 $ 140,078

======== ======== ========== ==========

Adjusted EBITDA

Ameristar St. Charles $ 22,333 $ 21,566 $ 96,885 $ 86,561

Ameristar Kansas City 19,195 18,712 81,448 74,209

Ameristar Council Bluffs 15,671 13,670 66,182 58,012

Ameristar Black Hawk 14,518 12,548 56,009 53,018

Ameristar Vicksburg 11,773 10,787 53,361 48,709

Ameristar East Chicago 8,477 8,527 39,921 30,405

Jackpot Properties 4,119 2,696 19,507 17,343

Corporate and other (11,834) (10,976) (48,177) (44,764)

-------- -------- ---------- ----------

Consolidated Adjusted EBITDA $ 84,252 $ 77,530 $ 365,136 $ 323,493

======== ======== ========== ==========

AMERISTAR CASINOS, INC. AND SUBSIDIARIES

SUMMARY CONSOLIDATED FINANCIAL DATA - CONTINUED

(Dollars in Thousands)

(Unaudited)

Three Months

Ended Year Ended

December 31, December 31,

2011 2010 2011 2010

------- ------- ------- -------

Operating income (loss) margins (1)

Ameristar St. Charles 21.7% 22.0% 25.5% 22.3%

Ameristar Kansas City 27.3% 26.3% 29.2% 26.5%

Ameristar Council Bluffs 34.4% 28.4% 35.2% 30.4%

Ameristar Black Hawk 25.9% 19.8% 24.5% 21.7%

Ameristar Vicksburg 28.2% 26.2% 32.5% 29.3%

Ameristar East Chicago 7.4% 8.1% 10.1% -19.3%

Jackpot Properties 16.8% 9.3% 22.4% 18.9%

Consolidated operating income margin 14.9% 15.2% 18.7% 11.8%

Adjusted EBITDA margins (2)

Ameristar St. Charles 33.8% 32.4% 35.9% 32.4%

Ameristar Kansas City 34.3% 33.2% 36.0% 33.2%

Ameristar Council Bluffs 38.5% 35.7% 40.2% 37.6%

Ameristar Black Hawk 38.1% 32.8% 36.6% 34.8%

Ameristar Vicksburg 41.8% 39.9% 45.2% 42.5%

Ameristar East Chicago 16.1% 15.7% 18.0% 14.0%

Jackpot Properties 28.7% 20.3% 32.0% 28.4%

Consolidated Adjusted EBITDA margin 28.4% 26.4% 30.1% 27.2%

(1) Operating income (loss) margin is operating income (loss) as

a percentage of net revenues.

(2) Adjusted EBITDA margin is Adjusted EBITDA as a percentage of

net revenues.

RECONCILIATION OF OPERATING INCOME (LOSS) TO ADJUSTED

EBITDA

(Dollars in Thousands) (Unaudited)

The following tables set forth reconciliations of operating income (loss), a

GAAP financial measure, to Adjusted EBITDA, a non-GAAP financial measure.

Three Months Ended December 31, 2011

Impairment

Loss and

(Gain) Loss

Operating Depreciation on

Income and Disposition

(Loss) Amortization of Assets

---------- ------------ -----------

Ameristar St.

Charles $ 14,347 $ 7,468 $ (10)

Ameristar Kansas

City 15,268 3,700 -

Ameristar Council

Bluffs 13,977 1,885 -

Ameristar Black

Hawk 9,877 4,401 -

Ameristar Vicksburg 7,923 3,546 -

Ameristar East

Chicago 3,920 4,337 89

Jackpot Properties 2,419 1,283 -

Corporate and other (23,603) 644 245

---------- ------------ -----------

Consolidated $ 44,128 $ 27,264 $ 324

========== ============ ===========

Three Months Ended December 31, 2011

Deferred Net River

Compensation Flooding

Stock-Based Plan Expense (Reimbursements) Adjusted

Compensation (1) Expenses (2) EBITDA

------------ ------------ ---------------- -----------

Ameristar St.

Charles $ 528 $ - $ - $ 22,333

Ameristar Kansas

City 227 - - 19,195

Ameristar Council

Bluffs 303 - (494) 15,671

Ameristar Black

Hawk 240 - - 14,518

Ameristar Vicksburg 303 - 1 11,773

Ameristar East

Chicago 131 - - 8,477

Jackpot Properties 417 - - 4,119

Corporate and other 10,186 694 - (11,834)

------------ ------------ ---------------- -----------

Consolidated $ 12,335 $ 694 $ (493) $ 84,252

============ ============ ================ ===========

Three Months Ended December 31, 2010

Impairment

Loss and

Operating Depreciation Loss on

Income and Disposition

(Loss) Amortization of Assets

---------- ------------ -----------

Ameristar St. Charles $ 14,660 $ 6,516 $ 229

Ameristar Kansas City 14,855 3,704 41

Ameristar Council Bluffs 10,883 2,663 10

Ameristar Black Hawk 7,598 4,826 -

Ameristar Vicksburg 7,071 3,522 2

Ameristar East Chicago 4,366 4,033 1

Jackpot Properties 1,238 1,260 75

Corporate and other (16,059) 725 212

---------- ------------ -----------

Consolidated $ 44,612 $ 27,249 $ 570

========== ============ ===========

Three Months Ended December 31, 2010

Deferred Non-

Compensation Operational

Stock-Based Plan Expense Professional Adjusted

Compensation (1) Fees EBITDA

------------ ------------ ------------ ----------

Ameristar St. Charles $ 161 $ - $ - $ 21,566

Ameristar Kansas City 112 - - 18,712

Ameristar Council Bluffs 114 - - 13,670

Ameristar Black Hawk 124 - - 12,548

Ameristar Vicksburg 192 - - 10,787

Ameristar East Chicago 127 - - 8,527

Jackpot Properties 123 - - 2,696

Corporate and other 2,776 884 486 (10,976)

------------ ------------ ------------ ----------

Consolidated $ 3,729 $ 884 $ 486 $ 77,530

============ ============ ============ ==========

(1) Deferred compensation plan expense represents the change in

the Company's non-cash liability based on plan participant

investment results. This expense is included in selling, general

and administrative expenses in the condensed consolidated

statements of operations.

(2) River flooding expenses are net of insurance reimbursements

and represent non-capitalizable costs incurred to reduce exposure

to significant property damage from extraordinary flood levels, as

well as required flood cleanup costs.

RECONCILIATION OF OPERATING INCOME (LOSS) TO ADJUSTED EBITDA - CONTINUED

(Dollars in Thousands) (Unaudited)

Year Ended December 31, 2011

Impairment

Loss and

(Gain) Loss

Operating Depreciation on

Income and Disposition Stock-Based

(Loss) Amortization of Assets Compensation

------------ ------------- ------------ -------------

Ameristar St.

Charles $ 68,908 $ 26,922 $ (6) $ 1,052

Ameristar Kansas

City 66,088 14,855 (80) 585

Ameristar Council

Bluffs 57,962 7,542 (105) 670

Ameristar Black Hawk 37,562 17,834 (21) 634

Ameristar Vicksburg 38,365 13,997 (1) 750

Ameristar East

Chicago 22,445 16,854 156 466

Jackpot Properties 13,642 5,068 13 784

Corporate and other (77,723) 2,850 244 19,404

------------ ------------- ------------ -------------

Consolidated $ 227,249 $ 105,922 $ 200 $ 24,345

============ ============= ============ =============

Year Ended December 31, 2011

Deferred Non-

Compensation Operational Net River

Plan Expense Professional Flooding Adjusted

(1) Fees Expenses (2) EBITDA

------------- ------------- ------------- ------------

Ameristar St.

Charles $ - $ - $ 9 $ 96,885

Ameristar Kansas

City - - - 81,448

Ameristar Council

Bluffs - - 113 66,182

Ameristar Black Hawk - - - 56,009

Ameristar Vicksburg - - 250 53,361

Ameristar East

Chicago - - - 39,921

Jackpot Properties - - - 19,507

Corporate and other 75 6,973 - (48,177)

------------- ------------- ------------- ------------

Consolidated $ 75 $ 6,973 $ 372 $ 365,136

============= ============= ============= ============

Year Ended December 31, 2010

Impairment

Loss and

(Gain) Loss

Operating Depreciation on

Income and Disposition

(Loss) Amortization of Assets

----------- ------------ ------------

Ameristar St. Charles $ 59,658 $ 25,902 $ 319

Ameristar Kansas City 59,134 14,548 (7)

Ameristar Council Bluffs 47,027 10,513 9

Ameristar Black Hawk 33,060 19,478 (31)

Ameristar Vicksburg 33,528 14,545 15

Ameristar East Chicago (41,874) 15,880 56,035

Jackpot Properties 11,526 5,185 154

Corporate and other (61,981) 3,019 214

----------- ------------ ------------

Consolidated $ 140,078 $ 109,070 $ 56,708

=========== ============ ============

Year Ended December 31, 2010

Deferred Non-

Compensation Operational

Stock-Based Plan Expense Professional Adjusted

Compensation (1) Fees EBITDA

------------ ------------ ------------- ----------

Ameristar St. Charles $ 682 $ - $ - $ 86,561

Ameristar Kansas City 534 - - 74,209

Ameristar Council Bluffs 463 - - 58,012

Ameristar Black Hawk 511 - - 53,018

Ameristar Vicksburg 621 - - 48,709

Ameristar East Chicago 364 - - 30,405

Jackpot Properties 478 - - 17,343

Corporate and other 10,672 1,779 1,533 (44,764)

------------ ------------ ------------- ----------

Consolidated $ 14,325 $ 1,779 $ 1,533 $ 323,493

============ ============ ============= ==========

(1) Deferred compensation plan expense represents the change in

the Company's non-cash liability based on plan participant

investment results. This expense is included in selling, general

and administrative expenses in the condensed consolidated

statements of operations.

(2) River flooding expenses are net of insurance reimbursements

and represent non-capitalizable costs incurred to reduce exposure

to significant property damage from extraordinary flood levels, as

well as required flood cleanup costs.

RECONCILIATION OF NET INCOME TO ADJUSTED EBITDA

(Dollars in Thousands) (Unaudited)

The following table sets forth a reconciliation of consolidated net income,

a GAAP financial measure, to consolidated Adjusted EBITDA, a non-GAAP

financial measure.

Three Months Ended Year Ended

December 31, December 31,

2011 2010 2011 2010

----------- ----------- ----------- -----------

Net income $ 7,379 $ 10,921 $ 6,794 $ 8,630

Income tax provision 10,179 9,945 27,752 12,130

Interest expense, net

of capitalized

interest 27,090 24,668 106,623 121,233

Interest income (12) (114) (15) (452)

Other (508) (808) 784 (1,463)

Net loss (gain) on

disposition of assets 79 350 (45) 255

Impairment of goodwill - - - 21,438

Impairment of other

intangible assets - - - 34,791

Impairment of fixed

assets 245 220 245 224

Depreciation and

amortization 27,264 27,249 105,922 109,070

Stock-based

compensation 12,335 3,729 24,345 14,325

Deferred compensation

plan expense 694 884 75 1,779

Loss on early

retirement of debt - - 85,311 -

Non-operational

professional fees - 486 6,973 1,533

Net river flooding

(reimbursements)

expenses (493) - 372 -

----------- ----------- ----------- -----------

Adjusted EBITDA $ 84,252 $ 77,530 $ 365,136 $ 323,493

=========== =========== =========== ===========

RECONCILIATION OF DILUTED EPS TO ADJUSTED DILUTED EPS

(Shares in Thousands) (Unaudited)

The following table sets forth a reconciliation of diluted earnings per

share (EPS), a GAAP financial measure, to adjusted diluted earnings per

share (Adjusted EPS), a non-GAAP financial measure.

Three Months Ended Year Ended

December 31, December 31,

2011 2010 2011 2010

----------- ----------- ----------- -----------

Diluted earnings per share

(EPS) $ 0.22 $ 0.18 $ 0.17 $ 0.15

Loss on early retirement

of debt - - 1.34 -

Non-operational

professional fees - 0.01 0.14 0.02

Non-cash tax provision

impact from change in

Indiana state tax rate - - 0.08 -

Net river flooding

(reimbursements) expenses (0.01) - 0.01 -

Impairment loss on East

Chicago intangible assets - - - 0.56

----------- ----------- ----------- -----------

Adjusted diluted earnings

per share (Adjusted EPS) $ 0.21 $ 0.19 $ 1.74 $ 0.73

=========== =========== =========== ===========

Weighted-average diluted

shares outstanding used in

calculating Adjusted EPS 34,014 59,458 41,136 58,818

=========== =========== =========== ===========

Use of Non-GAAP Financial Measures

Securities and Exchange Commission Regulation G, "Conditions for

Use of Non-GAAP Financial Measures," prescribes the conditions for

use of non-GAAP financial information in public disclosures. We

believe our presentation of the non-GAAP financial measures

Adjusted EBITDA and Adjusted EPS are important supplemental

measures of operating performance to investors. The following

discussion defines these terms and explains why we believe they are

useful measures of our performance.

Adjusted EBITDA is a commonly used measure of performance in the

gaming industry that we believe, when considered with measures

calculated in accordance with United States generally accepted

accounting principles, or GAAP, gives investors a more complete

understanding of operating results before the impact of investing

and financing transactions, income taxes and certain non-cash and

non-recurring items and facilitates comparisons between us and our

competitors.

Adjusted EBITDA is a significant factor in management's internal

evaluation of total Company and individual property performance and

in the evaluation of incentive compensation for employees.

Therefore, we believe Adjusted EBITDA is useful to investors

because it allows greater transparency related to a significant

measure used by management in its financial and operational

decision-making and because it permits investors similarly to

perform more meaningful analyses of past, present and future

operating results and evaluations of the results of core ongoing

operations. Furthermore, we believe investors would, in the absence

of the Company's disclosure of Adjusted EBITDA, attempt to use

equivalent or similar measures in their assessment of our operating

performance and the valuation of our Company. We have reported

Adjusted EBITDA to our investors in the past and believe its

inclusion at this time will provide consistency in our financial

reporting.

Adjusted EBITDA, as used in this press release, is earnings

before interest, taxes, depreciation, amortization, other

non-operating income and expenses, stock-based compensation,

deferred compensation plan expense, non-operational professional

fees, river flooding expenses (net of insurance reimbursements) and

impairment loss. In future periods, the calculation of Adjusted

EBITDA may be different than in this release. The foregoing tables

reconcile Adjusted EBITDA to operating income (loss) and net

income, based upon GAAP.

Adjusted EPS, as used in this press release, is diluted earnings

per share, excluding the after-tax per-share impact of loss on

early retirement of debt, non-operational professional fees,

non-cash tax provision impact from state tax rate change, river

flooding expenses (net of insurance reimbursements) and impairment

loss. Management adjusts EPS, when deemed appropriate, for the

evaluation of operating performance because we believe that the

exclusion of certain items is necessary to provide the most

accurate measure of our core operating results and as a means to

compare period-to-period results. We have chosen to provide this

information to investors to enable them to perform more meaningful

analyses of past, present and future operating results and as a

means to evaluate the results of our core ongoing operations.

Adjusted EPS is a significant factor in the internal evaluation of

total Company performance. Management believes this measure is used

by investors in their assessment of our operating performance and

the valuation of our Company. In future periods, the adjustments we

make to EPS in order to calculate Adjusted EPS may be different

than, or in addition to, those made in this release. The foregoing

table reconciles EPS to Adjusted EPS.

Limitations on the Use of Non-GAAP Measures The use of Adjusted

EBITDA and Adjusted EPS has certain limitations. Our presentation

of Adjusted EBITDA and Adjusted EPS may be different from the

presentations used by other companies and therefore comparability

among companies may be limited. Depreciation expense for various

long-term assets, interest expense, income taxes and other items

have been and will be incurred and are not reflected in the

presentation of Adjusted EBITDA. Each of these items should also be

considered in the overall evaluation of our results. Additionally,

Adjusted EBITDA does not consider capital expenditures and other

investing activities and should not be considered as a measure of

our liquidity. We compensate for these limitations by providing the

relevant disclosure of our depreciation, interest and income tax

expense, capital expenditures and other items both in our

reconciliations to the GAAP financial measures and in our

consolidated financial statements, all of which should be

considered when evaluating our performance.

Adjusted EBITDA and Adjusted EPS should be used in addition to

and in conjunction with results presented in accordance with GAAP.

Adjusted EBITDA and Adjusted EPS should not be considered as an

alternative to net income, operating income or any other operating

performance measure prescribed by GAAP, nor should these measures

be relied upon to the exclusion of GAAP financial measures.

Adjusted EBITDA and Adjusted EPS reflect additional ways of viewing

our operations that we believe, when viewed with our GAAP results

and the reconciliations to the corresponding GAAP financial

measures, provide a more complete understanding of factors and

trends affecting our business than could be obtained absent this

disclosure. Management strongly encourages investors to review our

financial information in its entirety and not to rely on a single

financial measure.

Add to Digg Bookmark with del.icio.us Add to Newsvine

CONTACT: Tom Steinbauer Senior Vice President, Chief

Financial Officer Ameristar Casinos, Inc. 702-567-7000

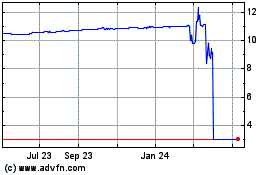

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From Mar 2024 to Apr 2024

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From Apr 2023 to Apr 2024