UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

[X]

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarter ended:

September 30, 2011

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period from ___________ to____________

Commission File Number:

333-150029

Bergio International, Inc.

(Exact name of Registrant as specified in its charter)

|

|

| |

|

Delaware

|

|

27-1338257

|

|

(State or other jurisdiction of

|

|

(IRS Employer I.D. No.)

|

|

incorporation)

|

|

|

12 Daniel Road E.

Fairfield, New Jersey 07004

(Address of principal executive offices and zip Code)

(973) 227-3230

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceeding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [ ] No [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

|

|

|

|

| |

|

Large accelerated filer

|

[ ]

|

|

Accelerated filer

|

[ ]

|

|

|

|

|

|

|

|

Non-accelerated filer

|

[ ]

|

|

Smaller reporting company

|

[X]

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No[X]

As of November 7, 2011, there were 25,257,413 shares outstanding of the registrant’s common stock.

TABLE OF CONTENTS

2

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements.

BERGIO INTERNATIONAL, INC.

INDEX TO FINANCIAL STATEMENTS

|

| |

|

|

PAGES

|

|

|

|

|

|

|

|

BALANCE SHEETS AS OF SEPTEMBER 30, 2011 AND

|

|

|

DECEMBER 31, 2010 (UNAUDITED)

|

F-1

|

|

|

|

|

STATEMENTS OF OPERATIONS FOR THE THREE AND NINE MONTHS ENDED

|

|

|

SEPTEMBER 30, 2011 AND 2010 (UNAUDITED)

|

F-3

|

|

|

|

|

STATEMENTS OF CASH FLOWS FOR THE NINE MONTHS ENDED

|

|

|

SEPTEMBER 30, 2011 AND 2010 (UNAUDITED)

|

F-4

|

|

|

|

|

NOTES TO FINANCIAL STATEMENTS

|

F-6

|

3

|

|

|

|

| |

|

BERGIO INTERNATIONAL, INC.

|

|

BALANCE SHEETS (UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30,

|

|

December 31,

|

|

|

|

2011

|

|

2010

|

|

|

|

|

|

|

|

Assets:

|

|

|

|

|

|

Current Assets:

|

|

|

|

|

|

Cash

|

|

$ --

|

|

$ 4,262

|

|

Accounts Receivable - Net

|

|

345,976

|

|

474,212

|

|

Inventory

|

|

1,536,852

|

|

1,602,680

|

|

Prepaid Expenses

|

|

4,989

|

|

9,353

|

|

Other Receivables

|

|

137,500

|

|

175,000

|

|

|

|

|

|

|

|

Total Current Assets

|

|

2,025,317

|

|

2,265,507

|

|

|

|

|

|

|

|

Property and Equipment - Net

|

|

111,671

|

|

118,135

|

|

|

|

|

|

|

|

Other Assets:

|

|

|

|

|

|

Investment in Unconsolidated Affiliate

|

|

5,000

|

|

5,000

|

|

|

|

|

|

|

|

Total Assets

|

|

$ 2,141,988

|

|

$ 2,388,642

|

See notes to financial statements.

F-1

|

|

|

|

| |

|

BERGIO INTERNATIONAL, INC.

|

|

BALANCE SHEETS (UNAUDITED)

|

|

|

|

|

|

|

|

|

|

September 30,

|

|

December 31,

|

|

|

|

2011

|

|

2010

|

|

|

|

|

|

|

|

Liabilities and Stockholders' Equity:

|

|

|

|

|

|

Liabilities

|

|

|

|

|

|

Current Liabilities:

|

|

|

|

|

|

Cash Overdraft

|

|

$ 5,051

|

|

$ --

|

|

Accounts Payable and Accrued Expenses

|

|

195,075

|

|

417,144

|

|

Bank Lines of Credit - Net

|

|

191,905

|

|

200,866

|

|

Convertible Debt - Net

|

|

110,921

|

|

112,069

|

|

Current Maturities of Notes Payable

|

|

92,255

|

|

110,060

|

|

Current Maturities of Capital Leases

|

|

--

|

|

14,656

|

|

Advances from Stockholder - Net

|

|

368,075

|

|

317,601

|

|

Derivative Liability

|

|

90,775

|

|

67,988

|

|

|

|

|

|

|

|

Total Current Liabilities

|

|

1,054,057

|

|

1,240,384

|

|

|

|

|

|

|

|

Long-Term Liabilities

|

|

|

|

|

|

Notes Payable

|

|

38,140

|

|

51,626

|

|

|

|

|

|

|

|

Total Long-Term Liabilities

|

|

38,140

|

|

51,626

|

|

|

|

|

|

|

|

Commitments and Contingencies

|

|

--

|

|

--

|

|

|

|

|

|

|

|

Total Liabilities

|

|

1,092,197

|

|

1,292,010

|

|

|

|

|

|

|

|

Stockholders' Equity

|

|

|

|

|

|

Series A Preferred Stock - $.001 Par Value, 51 Shares Authorized, 51 and 0 Shares Issued and Outstanding as of September 30, 2011 and December 31, 2010, respectively

|

|

--

|

|

--

|

|

Common Stock - $.001 Par Value, 200,000,000 Shares Authorized, 24,857,413 and 11,159,574 Shares Issued and Outstanding as of September 30, 2011 and December 31, 2010, respectively

|

|

24,857

|

|

11,159

|

|

Additional Paid-In Capital

|

|

4,222,619

|

|

4,021,593

|

|

Accumulated Deficit

|

|

(3,197,685)

|

|

(2,936,120)

|

|

Total Stockholders' Equity

|

|

1,049,791

|

|

1,096,632

|

|

|

|

|

|

|

|

Total Liabilities and Stockholders' Equity

|

|

$ 2,141,988

|

|

$ 2,388,642

|

See notes to financial statements.

F-2

|

|

|

|

|

|

|

| |

|

BERGIO INTERNATIONAL, INC.

|

|

STATEMENTS OF OPERATIONS (UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended

|

|

Nine months ended

|

|

|

September 30,

|

|

September 30,

|

|

|

2011

|

|

2010

|

|

2011

|

|

2010

|

|

|

|

|

|

|

|

|

|

|

Sales - Net

|

$ 394,562

|

|

$ 343,514

|

|

$ 1,029,774

|

|

$ 892,509

|

|

Cost of Sales

|

363,421

|

|

226,031

|

|

666,764

|

|

428,244

|

|

Gross Profit

|

31,141

|

|

117,483

|

|

363,010

|

|

464,265

|

|

|

|

|

|

|

|

|

|

|

Selling Expenses

|

40,357

|

|

51,790

|

|

236,598

|

|

186,030

|

|

|

|

|

|

|

|

|

|

|

General and Administrative Expenses

|

|

|

|

|

|

|

|

|

Share-Based Services

|

--

|

|

--

|

|

--

|

|

242,900

|

|

Other

|

103,780

|

|

94,107

|

|

406,083

|

|

342,234

|

|

|

|

|

|

|

|

|

|

|

Total General and Administrative Expenses

|

103,780

|

|

94,107

|

|

406,083

|

|

585,134

|

|

|

|

|

|

|

|

|

|

|

Total Operating Expenses

|

144,137

|

|

145,897

|

|

642,681

|

|

771,164

|

|

|

|

|

|

|

|

|

|

|

Loss from Operations

|

(112,996)

|

|

(28,414)

|

|

(279,671)

|

|

(306,899)

|

|

|

|

|

|

|

|

|

|

|

Other Income [Expense]

|

|

|

|

|

|

|

|

|

Interest Expense

|

(15,080)

|

|

(17,929)

|

|

(44,855)

|

|

(49,007)

|

|

Amortization of Debt Discount

|

(30,818)

|

|

(39,340)

|

|

(62,323)

|

|

(85,184)

|

|

Change in Fair Value of Derivative

|

149,550

|

|

39,125

|

|

123,934

|

|

57,431

|

|

Gain on Sale of Subsidiary

|

--

|

|

--

|

|

--

|

|

225,000

|

|

Financing Costs - Shared Based

|

--

|

|

--

|

|

--

|

|

(595,160)

|

|

Loss on Disposal of Equipment

|

--

|

|

--

|

|

--

|

|

(18,945)

|

|

Other income

|

--

|

|

--

|

|

1,350

|

|

--

|

|

|

|

|

|

|

|

|

|

|

Total Other Income [Expense]

|

103,652

|

|

(18,144)

|

|

18,106

|

|

(465,865)

|

|

|

|

|

|

|

|

|

|

|

Net Loss

|

$ (9,344)

|

|

$ (46,558)

|

|

$ (261,565)

|

|

$ (772,764)

|

|

|

|

|

|

|

|

|

|

|

Net Loss Per Common Share - Basic and Diluted

|

$ --

|

|

$ --

|

|

$ (0.01)

|

|

$ (0.10)

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Common Shares Outstanding - Basic and Diluted

|

24,457,248

|

|

10,050,617

|

|

18,915,122

|

|

7,935,213

|

See notes to financial statements.

F-3

|

|

|

|

| |

|

BERGIO INTERNATIONAL, INC.

|

|

STATEMENTS OF CASH FLOWS (UNAUDITED)

|

|

|

|

|

|

|

|

Nine Months Ended

|

|

|

|

September 30,

|

|

|

|

2011

|

|

2010

|

|

Operating Activities

|

|

|

|

|

|

Net Loss

|

|

$ (261,565)

|

|

$ (772,764)

|

|

Adjustments to Reconcile Net Loss to Net Cash Used

|

|

|

|

|

|

for by Operating Activities:

|

|

|

|

|

|

Depreciation and Amortization

|

|

32,377

|

|

40,891

|

|

Share-Based Services

|

|

--

|

|

242,900

|

|

Share-Based Financing Costs

|

|

--

|

|

595,160

|

|

Allowance for Doubtful Accounts

|

|

(35,787)

|

|

(6,000)

|

|

Amortization of Debt Discount

|

|

62,323

|

|

85,184

|

|

Change in Fair Value of Derivative

|

|

(123,934)

|

|

(57,431)

|

|

Gain on Sale of Subsidiary

|

|

--

|

|

(225,000)

|

|

Loss on Disposal of Equipment

|

|

--

|

|

18,945

|

|

Sales returns and allowances reserve

|

|

--

|

|

(34,808)

|

|

Changes in Assets and Liabilities

|

|

|

|

|

|

[Increase] Decrease in:

|

|

|

|

|

|

Accounts Receivable

|

|

164,023

|

|

(94,344)

|

|

Inventory

|

|

65,828

|

|

(169,406)

|

|

Prepaid Expenses

|

|

4,364

|

|

(5,677)

|

|

Increase [Decrease] in:

|

|

|

|

|

|

Accounts Payable and Accrued Expenses

|

|

(126,595)

|

|

(1,981)

|

|

Total Adjustments

|

|

42,599

|

|

388,433

|

|

|

|

|

|

|

|

Net Cash Used for Operating Activities

|

|

(218,966)

|

|

(384,331)

|

|

|

|

|

|

|

|

Investing Activities:

|

|

|

|

|

|

Capital Expenditures

|

|

(25,913)

|

|

(21,016)

|

|

Proceeds from Sale of Subsidiary

|

|

37,500

|

|

50,000

|

|

Payments for Disposal

|

|

--

|

|

(2,145)

|

|

Net Cash Provided by Investing Activities

|

|

11,587

|

|

26,839

|

|

|

|

|

|

|

|

Financing Activities:

|

|

|

|

|

|

Increase in Cash Overdraft

|

|

5,051

|

|

12,121

|

|

Advances under Bank Lines of Credit - Net

|

|

(8,961)

|

|

(17,439)

|

|

Proceeds from Convertible Debt

|

|

202,500

|

|

160,000

|

|

Repayments of Notes Payable

|

|

(31,291)

|

|

(26,649)

|

|

Advances from Stockholder - Net

|

|

50,474

|

|

217,767

|

|

Repayments of Capital Leases

|

|

(14,656)

|

|

(18,308)

|

|

Proceeds from Sale of Stock

|

|

--

|

|

30,000

|

|

|

|

|

|

|

|

Net Cash Provided by Financing Activities

|

|

203,117

|

|

357,492

|

|

|

|

|

|

|

|

Net Change in Cash

|

|

(4,262)

|

|

--

|

|

|

|

|

|

|

|

Cash - Beginning of Periods

|

|

4,262

|

|

--

|

|

|

|

|

|

|

|

Cash - End of Periods

|

|

$ --

|

|

$ --

|

See notes to financial statements.

F-4

|

|

|

|

| |

|

BERGIO INTERNATIONAL, INC.

|

|

STATEMENTS OF CASH FLOWS (UNAUDITED)

|

|

|

|

|

|

|

|

|

|

Nine Months Ended

|

|

|

|

September 30,

|

|

|

|

2011

|

|

2010

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Disclosures of Cash Flow Information:

|

|

|

|

|

|

Cash paid during the years for:

|

|

|

|

|

|

Interest

|

|

$ 28,000

|

|

$ 53,000

|

|

Income Taxes

|

|

$ --

|

|

$ --

|

|

|

|

|

|

|

|

Supplemental Disclosures of Non-Cash Investing and Financing Activities:

|

|

|

|

|

|

Debt Discount from Fair Value of Imbedded Derivative

|

|

$ 146,721

|

|

$ 118,336

|

|

Issuance of Common Stock for Convertible Debt and Accrued Interest

|

|

$ 131,485

|

|

$ 43,250

|

|

Issuance of Common Stock for Accrued Payroll - Related Party

|

|

$ 23,558

|

|

$ 66,666

|

|

Issuance of Convertible Note for Settlement Agreement

|

|

$ 25,000

|

|

$ --

|

|

Issuance of Common Stock for Vendor Payables and Accrued Expenses

|

|

$ 34,681

|

|

$ 247,000

|

|

Issuance of Common Stock for Deferred Offering Costs

|

|

$ --

|

|

$ 535,160

|

|

Issuance of Common Stock for Bank Line of Credit

|

|

$ --

|

|

$ 699,999

|

|

Issuance of Common Stock for Stockholder Advances

|

|

$ --

|

|

$ 401,759

|

|

Notes Payable Settled with Inventory

|

|

$ --

|

|

$ 21,500

|

|

Issuance of Common Stock for Share Liability

|

|

$ --

|

|

$ 180,000

|

See notes to financial statements.

F-5

BERGIO INTERNATIONAL, INC.

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

[1] Nature of Operations and Basis of Presentation

Nature of Operations

- Bergio International, Inc. (“Bergio” or the “Company”) was incorporated in the State of Delaware on July 24, 2007, under the name Alba Mineral Exploration, Inc. On October 21, 2009, as a result of a Share Exchange Agreement (defined below), the corporate name was changed to Bergio International, Inc. and the Company implemented a 12-for-1 forward stock split of its common shares. Effective December 27, 2010, the Company implemented a 1-for-12 reverse stock split. All share and per share data has been adjusted to reflect such stock splits. The Company is engaged in the product design, manufacturing and distribution of fine jewelry in the United States, Europe and Asia and is headquartered from its corporate office in Fairfield, New Jersey. Based on the nature of operations, the Company’s sales cycle experiences significant seasonal volatility with the first two quarters of the year representing 15% - 25% of annual sales and the remaining two quarters representing the remaining portion of annual sales.

On October 19, 2009, the Company entered into a Share Exchange Agreement (the “Exchange Agreement”) with Diamond Information Institute, Inc. (“Diamond”), a New Jersey corporation. Pursuant to the Exchange Agreement, the Company acquired all the issued and outstanding common stock of Diamond, and Diamond became a wholly-owned subsidiary of the Company. In addition, the Company acquired all of Diamond’s assets and liabilities effective as of the date of the Exchange Agreement. Per the Exchange Agreement, the Company issued 2,585,175 shares of the Company’s common stock to the shareholders of Diamond (approximately 0.21884 shares of the Company’s common stock for each share of Diamond common stock), representing approximately 60% of the Company’s aggregate issued and outstanding common stock following the closing of the Exchange Agreement and the Stock Agreement (defined below). The acquisition of Diamond was treated as a recapitalization and the business of Diamond became the business of the Company. At the time of the recapitalization, the Company was in the exploration development stage and was not engaged in any active business. The accounting rules for recapitalizations require that beginning October 19, 2009, the date of the recapitalization, the balance sheet reflects the consolidated assets and liabilities of Bergio and the equity accounts were recapitalized to reflect the newly capitalized company. The results of operations reflect the operations of Diamond, which became the operations of the Company, for all periods presented. In February 2010, the Company sold all its shares in Diamond to an unrelated third party for $225,000 and recognized a gain from the sale of $225,000.

In conjunction with the Exchange Agreement, on October 20, 2009, the Company entered into a Stock Purchase Agreement (the “Stock Agreement”) with certain stockholders of the Company (the “former stockholders”). Pursuant to the Stock Agreement, the Company spun out its 100% interest in Alba Mineral Exploration, Inc., an Alberta, Canada Corporation (“Alba Canada”) to the former stockholders for nominal consideration and the cancellation of all of the shares of common stock of the Company then owned by the former stockholders. As a result, a total of 3,310,000 shares were cancelled.

Basis of Presentation

- The accompanying unaudited interim financial statements as of September 30, 2011, and for the three and nine months ended September 30, 2011 and 2010, have been prepared in accordance with accounting principles generally accepted for interim financial statement presentation and in accordance with the instructions to Form 10-Q. Accordingly, they do not include all the information and footnotes required by accounting principles generally accepted in the United States of America for complete financial statement presentation. In the opinion of management, the financial statements contain all adjustments (consisting only of normal recurring accruals) necessary to present fairly the financial position as of September 30, 2011, results of operations for the three and nine months ended September 30, 2011 and 2010, and cash flows for the nine months ended September 30, 2011 and 2010. The results of operations for the nine months ended September 30, 2011, are not necessarily indicative of the results to be expected for the full year.

[2] Summary of Significant Accounting Policies

Other significant accounting policies are set forth in Note 2 of the audited financial statements included in the Company’s 2010 Annual Report Form 10-K.

F-6

BERGIO INTERNATIONAL, INC.

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

Use of Estimates

-

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Revenue Recognition

-

Revenue is recognized upon the shipment of products to customers with the price to the buyer being fixed and determinable and collectability reasonably assured.

Inventories

-

Inventory consists primarily of finished goods and is valued at the lower of cost or market. Cost is determined using the weighted average method and average cost is recomputed after each inventory purchase or sale.

Fair Value of Financial Instruments

- The Company follows guidance issued by the FASB on “Fair Value Measurements” for assets and liabilities measured at fair value on a recurring basis. This guidance establishes a common definition for fair value to be applied to existing generally accepted accounting principles that require the use of fair value measurements, establishes a framework for measuring fair value, and expands disclosure about such fair value measurements.

The FASB defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Additionally, the FASB requires the use of valuation techniques that maximize the use of observable inputs and minimize the use of unobservable inputs.

These inputs are prioritized below:

·

Level 1:

Observable inputs such as quoted market prices in active markets for identical assets or liabilities.

·

Level 2:

Observable market-based inputs or unobservable inputs that are corroborated by market data.

·

Level 3:

Unobservable inputs for which there is little or no market data, which require the use of the reporting entity

’

s own assumptions.

The Company discloses the estimated fair value for all financial instruments for which it is practicable to estimate fair value. As of September 30, 2011, the fair value of short-term financial instruments including cash overdraft, accounts receivable, accounts payable and accrued expenses, approximates book value due to their short-term maturity. The fair value of property and equipment is estimated to approximate its net book value. The fair value of debt obligations, other than convertible debt obligations, approximates their face values due to their short-term maturities and/or the variable rates of interest associated with the underlying obligations.

The fair value of the Company’s convertible debt is measured on a recurring basis (see Note 6).

The following table presents fair value measurements for major categories of the Company’s financial liabilities measured at fair value on a recurring basis:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

September 30, 2011

|

|

|

|

Fair Value Measurements Using

|

|

|

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

|

Total

|

|

|

Convertible Debt

|

|

$

|

--

|

|

|

$

|

110,921

|

|

|

$

|

--

|

|

|

$

|

110,921

|

|

F-7

BERGIO INTERNATIONAL, INC.

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

December 31, 2010

|

|

|

|

Fair Value Measurements Using

|

|

|

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

|

Total

|

|

|

Convertible Debt

|

|

$

|

--

|

|

|

$

|

112,069

|

|

|

$

|

--

|

|

|

$

|

112,069

|

|

In addition, the FASB issued “The Fair Value Option for Financial Assets and Financial Liabilities.” This guidance expands opportunities to use fair value measurements in financial reporting and permits entities to choose to measure many financial instruments and certain other items at fair value. The Company did not elect the fair value option for any of its qualifying financial instruments.

Subsequent Events

- The Company evaluated subsequent events, which are events or transactions that occurred after September 30, 2011, through the issuance of the accompanying financial statements.

Recently Issued Accounting Pronouncements

- There are several new accounting pronouncements issued or proposed by the FASB. Each of these pronouncements, as applicable, has been or will be adopted by the Company. Management does not believe any of these accounting pronouncements has had or will have a material impact on the Company’s financial position or results of operations.

[3] Property and Equipment

Property and equipment and accumulated depreciation and amortization are as follows:

|

|

September 30,

|

|

December 31,

|

|

|

2011

|

|

2010

|

|

|

|

|

|

|

Selling Equipment

|

$ 8,354

|

|

$ 8,354

|

|

Office and Equipment

|

351,443

|

|

325,530

|

|

Leasehold Improvements

|

7,781

|

|

7,781

|

|

Furniture and Fixtures

|

18,487

|

|

18,487

|

|

|

|

|

|

|

Total - At Cost

|

386,065

|

|

360,152

|

|

Less: Accumulated Depreciation and Amortization

|

274,394

|

|

242,017

|

|

|

|

|

|

|

Property and Equipment - Net

|

$ 111,671

|

|

$ 118,135

|

Depreciation and amortization expense for the three months ended September 30, 2011 and 2010, and the nine months ended September 30, 2011 and 2010, amount to approximately $11,000, $13,000, $32,000 and $41,000, respectively.

[4] Notes Payable

|

|

September 30,

|

December 31,

|

|

|

2011

|

|

2010

|

|

|

|

|

|

|

Notes payable due in equal monthly installments, of $2,500 and one payment on June 30, 2011 equal to the outstanding balance; interest rate of 7.60%. The notes are collateralized by the assets of the Company. (1)

|

$ 72,371

|

|

$ 91,517

|

|

|

|

|

|

|

Notes payable due in equal monthly installments, over 60 months, maturing through April 2014 at interest rates of 10.52%. The notes are collateralized by specific assets of the Company.

|

58,024

|

|

70,169

|

|

|

|

|

|

|

Total

|

130,395

|

|

161,686

|

|

Less: Current Maturities Included in Current Liabilities

|

92,255

|

|

110,060

|

|

|

|

|

|

|

Total Long-Term Portion of Debt

|

$ 38,140

|

|

$ 51,626

|

F-8

BERGIO INTERNATIONAL, INC.

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

Maturities of long-term debt are as follows:

|

Twelve months ended

|

|

|

|

September 30,

|

|

|

|

2012

|

|

$ 92,255

|

|

2013

|

|

22,081

|

|

2014

|

|

16,059

|

|

|

|

|

|

Total

|

|

$ 130,395

|

(1) Terms are per the Post Judgment Payment and Forbearance Agreement dated October 9, 2009, between the Company and the bank. In the event of a default, the bank may immediately enforce its rights of collection for the full amount under the judgment, less credits for payment made through the date of default. The Company is in the process of negotiating an extension of the payment terms with the bank.

[5] Bank Lines of Credit

A summary of the Company’s credit facilities is as follows:

|

|

September 30,

|

December 31,

|

|

|

2011

|

2010

|

|

|

|

|

|

Credit Line of $55,000 monthly payments of $500 and one payment on June 30, 2011 equal to outstanding balance; interest at the bank’s prime rate plus .75%. At September 30, 2011 and December 31, 2010, the interest rate was 4.00%. Collateralized by the assets of the Company. (1)

|

$ 36,971

|

40,153

|

|

|

|

|

|

Various unsecured Credit Cards of $161,000, minimum payment of principal and interest are due monthly at the credit card’s annual interest rate. At September 30, 2011 and December 31, 2010, the interest rates ranged from 3.99% to 24.90%.

|

154,934

|

160,713

|

|

|

|

|

|

Total

|

191,905

|

200,866

|

|

|

|

|

|

Less: Current maturities included in current liabilities

|

191,905

|

200,866

|

|

|

|

|

|

Total Long-Term Portion

|

$ --

|

$ --

|

The Company’s Chief Executive Officer and majority shareholder also serves as a guarantor of the Company’s debt.

(1) Terms are per the Post Judgment Payment and Forbearance Agreement dated October 9, 2009, between the Company and the bank. In the event of a default, the bank may immediately enforce its rights of collection for the full amount under the judgment, less credits for payment made through the date of default. The Company is in the process of negotiating an extension of the payment terms with the bank.

F-9

BERGIO INTERNATIONAL, INC.

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

[6] Convertible Debt

Asher

On February 1, 2010, the Company issued an 8% secured convertible note (the “February 2010 Note”) in the amount of $50,000 to Asher Enterprises, Inc. (“Asher”). The principal and accrued interest is payable on January 2, 2011, or such earlier date as defined in the note. The note is convertible by Asher at any time after the six month anniversary of the issue date and by the Company at any time after issue with conversion periods as defined in the note. The note is convertible into shares of the Company’s common stock at a price of 62.5% of the average of the three lowest trading prices of the stock during the ten trading day period ending one day prior to the date of conversion. In 2010, $47,000 of the principal was converted into 538,829 shares of company common stock. In January 2011, the balance of the convertible note of $3,000 and $2,000 of accrued interest was converted into 100,000 shares of the Company’s common stock.

On March 12, 2010, the Company issued an 8% secured convertible note (the “March 2010 Note”) in the amount of $30,000 to Asher. The principal and accrued interest is payable on December 13, 2010, or such earlier date as defined in the note. The note is convertible by Asher at any time after the six month anniversary of the issue date and by the Company at any time after issue with conversion periods as defined in the note. The note is convertible into shares of the Company’s common stock at a price of 62.5% of the average of the three lowest trading prices of the stock during the ten trading day period ending one day prior to the date of conversion. In February and March 2011, the convertible note of $30,000 and accrued interest of $1,200 was converted into 1,121,975 shares of the Company’s common stock.

In April 2010, the Company issued an 8% secured convertible note (the “April 2010 Note”) in the amount of $40,000 to Asher. The principal and accrued interest is payable on January 13, 2011, or such earlier date as defined in the note. The note is convertible by Asher at any time after the six month anniversary of the issue date and by the Company at any time after issue with conversion periods as defined in the note. The note is convertible into shares of the Company’s common stock at a price of 62.5% of the average of the three lowest trading prices of the stock during the ten trading day period ending one day prior to the date of conversion. In April 2011, the convertible note and accrued interest was converted into 3,847,321 shares of the Company’s common stock.

In May 2010, the Company issued an 8% secured convertible note (the “May 2010 Note”) in the amount of $40,000 to Asher. The principal and accrued interest is payable on February 11, 2011, or such earlier date as defined in the note. The note is convertible by Asher at any time after the six month anniversary of the issue date and by the Company at any time after issue with conversion periods as defined in the note. The note is convertible into shares of the Company’s common stock at a price of 62.5% of the average of the three lowest trading prices of the stock during the ten trading day period ending one day prior to the date of conversion. In May and June 2011, the convertible note and accrued interest was converted into 3,999,843 shares of the Company’s common stock.

In April 2011, the Company issued an 8% convertible note (the “April 2011 Note”) in the amount of $50,000 to Asher. The principal and accrued interest is payable on January 18, 2012, or such earlier date as defined in the note. The note is convertible by Asher at any time after the six month anniversary of the issue date and by the Company at any time after issue with conversion periods as defined in the note. The note is convertible into shares of the Company’s common stock at a price of 62.5% of the average of the three lowest trading prices of the stock during the ten day trading period ending one day prior to the date of conversion.

In July 2011, the Company issued an 8% convertible note (the “July 2011 Note”) in the amount of $32,500 to Asher. The principal and accrued interest is payable on April 18, 2012, or such earlier date as defined in the note. The note is convertible by Asher at any time after the six month anniversary of the issue date and by the Company at any time after issue with conversion periods as defined in the note. The note is convertible into shares of the Company’s common stock at a price of 62.5% of the average of the three lowest trading prices of the stock during the ten day trading period ending one day prior to the date of conversion.

F-10

BERGIO INTERNATIONAL, INC.

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

In August 2011, the Company issued an 8% convertible note (the “August 2011 Note”) in the amount of $32,500 to Asher. The principal and accrued interest is payable on May 29, 2012, or such earlier date as defined in the note. The note is convertible by Asher at any time after the six month anniversary of the issue date and by the Company at any time after issue with conversion periods as defined in the note. The note is convertible into shares of the Company’s common stock at a price of 60.0% of the average of the three lowest trading prices of the stock during the ten day trading period ending one day prior to the date of conversion.

In September 2011, the Company issued an 8% convertible note (the “September 2011 Note”) in the amount of $37,500 to Asher. The principal and accrued interest is payable on June 28, 2012 or such earlier date as defined in the note. The note is convertible by Asher at any time after the six month anniversary of the issue date and by the Company at any time after issue with conversion periods as defined in the note. The note is convertible into shares of the Company’s common stock at a price of 62.5% of the average of the three lowest trading prices of the stock during the ten day trading period ending one day prior to the date of conversion.

Asher is entitled to have all shares issued upon conversion of the above notes listed upon each national securities exchange or other automated quotation system, if any, upon which shares of the Company’s common stock are then listed.

Tangiers

Effective January 2011, the Company entered into a 7% convertible promissory note agreement (the “January 2011 Note”) in the amount of $25,000 with Tangiers Capital, LLC (“Tangiers”) for the settlement of an accrued termination fee related to the securities purchase agreement with Tangiers. The principal and accrued interest is payable on June 18, 2012, or such earlier date as defined in the agreement. The note, including any accrued interest, is convertible into shares of the Company’s common stock at a price of 80% of the lowest trading price, determined on the then current trading market for the Company’s common stock, for the ten trading days prior to conversion, at the option of the holder. In March and April 2011, the convertible note and accrued interest was converted into 1,965,254 shares of the Company’s common stock.

On November 16, 2009, the Company issued a 7% Secured Convertible Debenture (the “November 2009 Debenture”) in the amount of $25,000 to Tangiers. The principal and accrued interest is payable on August 16, 2010, or such earlier date as defined in the debenture. Upon issuance, the November 2009 Debenture, including any accrued interest, was convertible into shares of the Company’s common stock at a price of 80% of the average of the two lowest trading prices, determined on the then current trading market for the Company’s common stock, for the ten trading days prior to conversion, at the option of the holder. The holder is entitled to “piggyback” registration rights on shares of common stock issued upon conversion. During the year ended December 31, 2010, $18,750 of the convertible note was converted into 290,144 shares of the Company’s common stock. In February 2011, the balance of the note of $6,250 and accrued interest of $1,694 was converted into 141,839 shares of the Company’s common stock.

Strategic

In May 2011, the Company issued a 15% convertible note (the “May 2011 Note”) in the amount of $50,000 to Strategic Business Initiatives, LLC (“Strategic”). The principal and accrued interest is payable on November 30, 2011, or such earlier date as defined in the note. The Company must give 10 days’ notice to Strategic about its intent to prepay the note. During the ten day period, prior to the Company’s prepayment, Strategic has the option to convert all or a portion of the principal and/or accrued interest into shares of the Company’s common stock at a price of 80% of the five day average closing price immediately prior to the conversion date.

F-11

BERGIO INTERNATIONAL, INC.

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

The Company accounts for the fair value of the conversion features in accordance with ASC Topic No. 815-15 “Derivatives and Hedging; Embedded Derivatives” (“Topic No. 815-15”).

Topic No. 815-15 requires the Company to bifurcate and separately account for the conversion features as an embedded derivative contained in the Company’s convertible debt.

The Company is required to carry the embedded derivative on its balance sheet at fair value and account for any unrealized change in fair value as a component of results of operations.

The Company valued the embedded derivative using the Black-Scholes pricing model.

The fair values upon issuance of the January 2011 Note of $12,478, the April 2011 Note of $32,704, May 2011 Note of $16,570, July 2011

N

ote of $30,962, August 2011

N

ote of $32,500, and the September 2011

N

ote of $21,507 were recorded as a derivative liability and a discount to the convertible debt.

Amortization of debt discount amounted to $62,323 and $85,184 for the nine months ended September 30, 2011 and 2010, respectively.

The derivative liability is revalued each reporting period using the Black-Scholes model.

For the nine months ended September 30, 2011 and 2010, the Company recorded an unrealized gain from the change in the fair value of the derivative liability of $123,934 and $57,431, respectively. Convertible debt as of September 30, 2011 ($202,500) and December 31, 2010 ($119,250), is shown net of debt discount in the amount of $91,579 and $7,181, respectively.

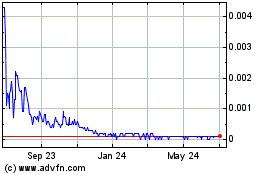

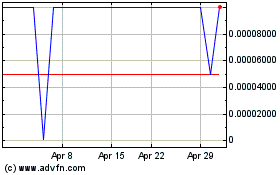

The Black-Scholes model was valued with the following inputs:

·

Stock Price - The Stock Price was based on the average closing price of the Company

’

s common stock as of the Valuation Date. Stock Prices ranged from $0.01 to $0.12 in the period 1-01-2011 through 9-30-2011.

·

Variable Conversion Price - The variable conversion price was based on: (i) 80% of the lowest Stock Price out of the last 10 trading days prior to the Valuation Date (Tangiers); and (ii) 62.5% and 60% of the average of the 3 lowest Stock Prices out of the last 10 trading days prior to the Valuation Date (Asher) and (iii) 80% of the stock price for the last 5 trading days prior to valuation date (Strategic).

·

Time to Maturity - The time to maturity was determined based on the length of time between the Valuation Date and the maturity of the debt. Time to maturity ranged from 0 months to 8 months in the period 1-01-2011 through 9-30-2011.

·

Risk Free Rate - The risk free rate was based on the Treasury Note rate as of the Valuation Dates with term commensurate with the remaining term of the debt. The risk free rate ranged from 0.11% to 0.30% in the period 1-01-2011 through 9-30-2011.

·

Volatility - The volatility was based on the historical volatility of three comparable companies as historical volatility of the Company was not useful in developing the expected volatility due to the limited trading history of its stock. The average volatility for the comparable companies ranged from 55.77% to 57.96% in the period 1-01-2011 through 9-30-2011.

F-12

BERGIO INTERNATIONAL, INC.

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

[7] Equipment Held Under Capital Leases

The Company’s equipment held under the capital lease obligations is summarized as follows:

|

|

September 30,

|

December 31,

|

|

|

2011

|

2010

|

|

|

|

|

|

Showroom Equipment

|

$ 40,000

|

$ 40,000

|

|

Less: Accumulated Amortization

|

30,667

|

24,667

|

|

|

|

|

|

Equipment Held under Capitalized Lease Obligations - Net

|

$ 9,333

|

$ 15,333

|

Amortization related to the equipment held under capital leases is calculated using the straight-line method over the five year useful lives of the assets. Amortization for the three months ended September 30, 2011 and 2010, and the nine months ended September 30, 2011 and 2010, amounted to approximately $2,000, $2,000, 6,000 and $6,000, respectively.

Interest expense related to capital leases for the three months ended September 30, 2011 and 2010 and the nine months ended September 30, 2011 and 2010, amounted to approximately $-0-, $1,000, $500, and $3,000, respectively.

[8] Income Taxes

Deferred income tax assets [liabilities] are as follows:

|

|

September 30,

|

|

December 31,

|

|

|

2011

|

|

2010

|

|

|

|

|

|

|

Deferred Income Tax Assets:

|

|

|

|

|

Net Operating Loss Carryforwards

|

$ 353,892

|

|

$ 289,716

|

|

Allowance for Doubtful Accounts

|

--

|

|

14,293

|

|

Start-up Costs

|

15,806

|

|

18,237

|

|

Totals

|

369,698

|

|

322,246

|

|

|

|

|

|

|

Deferred Income Tax Liabilities:

|

|

|

|

|

Property and Equipment

|

(22,102)

|

|

(20,135)

|

|

Totals

|

(22,102)

|

|

(20,135)

|

|

|

|

|

|

|

Gross Deferred Tax Asset [Liability]

|

347,596

|

|

302,111

|

|

|

|

|

|

|

Valuation Allowance for Deferred Taxes

|

(347,596)

|

|

(302,111)

|

|

Net Deferred Tax Asset [Liability]

|

$ --

|

|

$ --

|

At December 31, 2010, the Company had approximately $550,000 of federal net operating tax loss carryforwards expiring at various dates through 2030. The Tax Reform Act of 1986 enacted a complex set of rules which limits a company’s ability to utilize net operating loss carryforwards and tax credit carryforwards in periods following an ownership change. These rules define an ownership change as a greater than 50 percent point change in stock ownership within a defined testing period which is generally a three-year period. As a result of stock which may be issued by us from time to time and the conversion of warrants, options or the result of other changes in ownership of our outstanding stock, the Company may experience an ownership change and consequently our utilization of net operating loss carryforwards could be significantly limited.

F-13

BERGIO INTERNATIONAL, INC.

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

Based upon the net losses historically incurred and, the prospective global economic conditions, management believes that it is not more likely than not that the deferred tax asset will be realized and has provided a valuation allowance of 100% of the deferred tax asset. The valuation allowance increased decreased by approximately $45,000 and $127,000 in the nine months ended September 30, 2011, and the year ended December 31, 2010, respectively.

[9] Stockholders’ Equity

The Company is authorized to issue 200,000,000 shares of common stock, par value $.001 per share and 51 shares of preferred stock, par value $.001 per share. At September 30, 2011 and December 31, 2010, there were 24,857,413 and 11,159,574 common shares issued and outstanding, respectively. In October 2009, the Company effected a 12-for-1 forward split of its common stock. Effective December 27, 2010, the Company implemented a 1-for-12 reverse common stock split. All share and per share data has been retroactively adjusted to reflect such stock splits. Effective September 1, 2011, the Company designated and issued 51 shares of Series A Preferred Stock, par value $0.001 to its Chief Executive Officer (see Note 11). The Series A Preferred Stock pays no dividends and has no conversion rights. Each share of Series A Preferred Stock has voting rights such that the holder of 51 shares of Series A Preferred Stock will effectively maintain majority voting control of the Company.

In March 2011, the Company issued an aggregate of 1,988,054 shares of common stock valued at $23,558 to its Chief Executive Officer pursuant to his employment agreement (see Note 11).

During the nine months ended September 30, 2011, the Company issued an aggregate of 9,069,139 shares of common stock to Asher for conversion of $113,000 of convertible debt and $9,170 of accrued interest. The shares are valued at $122,170 per terms of the convertible note agreements (see Note 6).

During the nine months ended September 30, 2011, the Company issued an aggregate of 2,107,093 shares of common stock to Tangiers for conversion of $31,250 of convertible debt and $3,065 of accrued interest. The shares are valued at $34,315 per terms of the convertible note agreements (see Note 6).

In August 2011, the Company issued 533,553 shares of common stock for payment of legal fees. The shares are valued at $34,681, the fair value at date of issuance.

[10] Related Party Transactions

The Company receives periodic advances from its principal shareholder and Chief Executive Officer (the “CEO”) based upon the Company’s cash flow needs. At September 30, 2011 and December 31, 2010, $368,075 and $317,601, respectively was due to the shareholder. Interest expense is accrued at an average annual market rate of interest which was 3.25% at September 30, 2011 and December 31, 2010, respectively. No terms for repayment have been established. As a result, the amount is classified as a current liability.

In the nine months ended September 30, 2011, the Company issued an aggregate of 1,988,054 shares of common stock to its CEO in accordance with his employment agreement (See Note 11). The shares are valued at $23,558, which was equal to the amount of unpaid compensation owed the CEO.

[11] Commitment and Contingencies

Employment Agreement -

Effective February 28, 2010, the Company entered into an employment agreement with its CEO. The agreement, which is for a five year term, provides for an initial base salary of $175,000 per year with a 3% annual increase thereafter (the “Base Salary”). The CEO is also entitled to certain bonuses based on net profits before taxes and other customary benefits, as defined in the agreement. In addition, since it is understood that the Company is employing the CEO during a time of economic decline throughout the U.S. and at times and from time to time, the Company may not be in a position to pay the full amount of Base Salary owed to the CEO, it is understood and agreed to by the Company’s Board of Directors (the “Board”), that as long as the Company is unable to pay the CEO the full amount of his Base Salary, that the Board shall issue to him, from time to time, an amount of shares that will allow him to remain in possession of fifty-one percent (51%) of the Company’s then outstanding common stock. Such issuances shall be made to the CEO at any time when his total share holdings are reduced to an amount less than fifty-one percent (51%) as a result of issuance of shares made on behalf of the Company. The CEO waived the 3% annual increase for 2011.

F-14

BERGIO INTERNATIONAL, INC.

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

Effective September 1, 2011, the Company and CEO entered into an Amended and Restated Employment Agreement (the “Amended Agreement”) which primarily retains the term and compensation of the original agreement. The Amended Agreement, however, removes the section which previously provided for the issuance of Company common stock to the CEO, from time to time, when the Company is unable to pay the CEO the full amount of his Base Salary which would allow the CEO to maintain a fifty-one percent (51%) share of the Company’s outstanding common stock. However, the CEO does have the right to request all or a portion of his unpaid Base Salary be paid with the Company’s restricted common stock. In addition, the Amended Agreement provides for the issuance of 51 shares of newly authorized Series A Preferred Stock to be issued to the CEO. As defined in the Certificate of Designations, Preferences and Rights of the Series A Preferred Stock, each share of Series A Preferred Stock has voting rights such that the holder of 51 shares of Series A Preferred Stock will effectively maintain majority voting control of the Company. Effective November 3, 2011, the CEO notified the Company that for the one year period, retroactive from April 1, 2011, through March 31, 2012, he would reduce his Base Compensation to $100,000.

Operating Leases

-

The Company leases certain office and manufacturing facilities and equipment. The Company’s office and manufacturing facilities are currently leased on a month to month basis at $1,800 per month.

The equipment lease agreements are non-cancelable and expire at various dates through 2011. All these leases are classified as operating leases.

Rent expense for the Company’s operating leases for the three months ended September 30, 2011 and 2010 and the nine months ended September 30, 2011 and 2010 amounted to approximately $5,000, $5,000, $16,000 and $16,000, respectively.

Litigation -

The Company, in the normal course of business, is involved in certain legal matters for which it carries insurance, subject to certain exclusions and deductibles. As of September 30, 2011, and through the date of issuance of these financial statements, there was no asserted or unasserted litigation, claims or assessments warranting recognition and/or disclosure in the financial statements.

[12] Subsequent Events

In October 2011, the Company issued 400,000 shares of common stock to a consultant for services. The shares are valued at $20,000, the fair value at date of issuance.

Effective November 3, 2011, the CEO notified the Company that for the one year period, retroactive from April 1, 2011, through March 31, 2012, he would reduce his Base Compensation to $100,000.

F-15

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Forward Looking Statements

This quarterly report on Form 10-Q and other reports (collectively, the “Filings”) filed by the Bergio International, Inc. (“Bergio” or the “Company”) from time to time with the U.S. Securities and Exchange Commission (the “SEC”) contain or may contain forward-looking statements and information that are based upon beliefs of, and information currently available to, the Company’s management as well as estimates and assumptions made by Company’s management. Readers are cautioned not to place undue reliance on these forward-looking statements, which are only predictions and speak only as of the date hereof. When used in the Filings, the words “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan,” or the negative of these terms and similar expressions as they relate to the Company or the Company’s management identify forward-looking statements. Such statements reflect the current view of the Company with respect to future events and are subject to risks, uncertainties, assumptions, and other factors, including the risks contained in the “Risk Factors” section of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2010, filed with the SEC, relating to the Company’s industry, the Company’s operations and results of operations, and any businesses that the Company may acquire. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended, or planned.

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, the Company cannot guarantee future results, levels of activity, performance, or achievements. Except as required by applicable law, including the securities laws of the United States, the Company does not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are prepared in accordance with accounting principles generally accepted in the United States (“GAAP”). These accounting principles require us to make certain estimates, judgments and assumptions. We believe that the estimates, judgments and assumptions upon which we rely are reasonable based upon information available to us at the time that these estimates, judgments and assumptions are made. These estimates, judgments and assumptions can affect the reported amounts of assets and liabilities as of the date of the financial statements as well as the reported amounts of revenues and expenses during the periods presented. Our financial statements would be affected to the extent there are material differences between these estimates and actual results. In many cases, the accounting treatment of a particular transaction is specifically dictated by GAAP and does not require management’s judgment in its application. There are also areas in which management’s judgment in selecting any available alternative would not produce a materially different result. The following discussion should be read in conjunction with our consolidated financial statements and notes thereto appearing elsewhere in this report.

Plan of Operation

We are entering into our 20th year of operations and concentrate on boutique, upscale jewelry stores. We currently sell our jewelry to approximately 150 independent jewelry retailers across the United States and have spent over $3 million in branding the Bergio name through tradeshows, trade advertising, national advertising and billboard advertising since launching the line in 1995. Our products consist of a wide range of unique styles and designs made from precious metals such as, gold, platinum, and Karat gold, as well as diamonds and other precious stones. We have approximately 50 to 75 product styles in our inventory, with prices ranging from $400 to $200,000. We have manufacturing control over our line as a result of having a manufacturing facility in New Jersey as well as subcontracts with facilities in Italy and Bangkok.

It is our intention to establish Bergio as a holding company for the purpose of acquiring established jewelry design and manufacturing firms who possess branded product lines. Branded product lines are products and/or collections whereby the jewelry manufacturers have established their products within the industry through advertising in consumer and trade magazines as well as possibly obtaining federally registered trademarks of their products and collections. This is in line with our strategy and belief that a brand name can create an association with innovation, design and quality which helps add value to the individual products as well as facilitate the introduction of new products.

4

We intend to acquire design and manufacturing firms throughout the United States and Europe. If and when we pursue any potential acquisition candidates, we intend to target the top 10% of the world’s jewelry manufactures that have already created an identity and brand in the jewelry industry. We intend to locate potential candidates through our relationships in the industry and expect to structure the acquisition through the payment of cash, which will most likely be provided from third party financing, as well as our common stock but not cash generated from our operations. In the event we obtain financing from third parties for any potential acquisitions, Bergio may agree to issue our common stock in exchange for the capital received. However, as of the date of this report, we do not have any binding agreements with any potential acquisition candidates or arrangements with any third parties for financing.

Result of Operations for the Three and Nine Months Ended September 30, 2011 and 2010

The following income and operating expenses tables summarize selected items from the statement of operations for the three and nine months ended September 30, 2011, compared to the three and nine months ended September 30, 2010.

INCOME:

|

|

|

|

|

|

|

| |

|

|

Three Months Ended

September 30,

|

|

Nine Months Ended

September 30,

|

|

|

2011

|

|

2010

|

|

2011

|

|

2010

|

|

|

|

|

|

|

|

|

|

|

Sales - net

|

$ 394,562

|

|

$ 343,514

|

|

$ 1,029,774

|

|

$ 892,509

|

|

|

|

|

|

|

|

|

|

|

Cost of Sales

|

363,421

|

|

226,031

|

|

666,764

|

|

428,244

|

|

|

|

|

|

|

|

|

|

|

Gross Profit

|

$ 31,141

|

|

$ 117,483

|

|

$ 363,010

|

|

$ 464,265

|

|

|

|

|

|

|

|

|

|

|

Gross Profit as a Percentage of Revenue

|

8%

|

|

34%

|

|

35%

|

|

52%

|

Sales

Net sales for the three months ended September 30, 2011, were $394,562, compared to $343,514 for the three months ended September 30, 2010. This resulted in an increase of $51,048 from the comparable period. Net sales for the nine months ended September 30, 2011, were $1,029,774, compared to $892,509 for the nine months ended September 30, 2010. This resulted in an increase of $137,265 from the comparable period. The three and nine month increases primarily result from bulk sales of diamonds, which have little profit margin. The decrease in higher margin sales is due to the lack of consumer confidence in the U.S. economy and the continuing high level of unemployment. Such lack of confidence has resulted in a slowdown in discretionary spending which has continued to negatively affect our higher margin sales. We have tried to offset the U.S. slowdown by expanding our customer base into Europe and Asia; however, those economies have also experienced slowdowns in the second and third quarters of 2011.

Typically, revenues experience significant seasonal volatility in the jewelry industry. The first two quarters of any given year typically represent approximately 15%-25% of total year revenues, based on historic results. The holiday buying season during the last two quarters of every year typically account for the remainder of annual sales.

Cost of Sales

Cost of sales for the three months ended September 30, 2011, was $363,421, an increase of $137,390 from $226,031 for the three months ended September 30, 2010. Cost of sales for the nine months ended September 30, 2011, was $666,764, an increase of $238,520 from $428,244 for the nine months ended September 30, 2010. The increase in cost of sales is primarily related to the bulk sales of diamonds which generate very low profit margins of 0% - 5% on labor costs, when incurred.

5

Gross Profit

During the three months ended September 30, 2011, our gross profit as a percentage of sales was 8%, compared to a gross profit as a percentage of sales of 34% for the three months ended September 30, 2010. During the nine months ended September 30, 2011, our gross profit as a percentage of sales was 35%, compared to a gross profit as a percentage of sales of 52% for the nine months ended September 30, 2010. Our decrease in gross profit percentage during the periods was primarily attributable to the bulk sale of diamonds as described above.

OPERATING EXPENSES:

|

|

|

|

|

|

|

| |

|

|

Three Months Ended

September 30,

|

|

Nine Months Ended

September 30,

|

|

|

2011

|

|

2010

|

|

2011

|

|

2010

|

|

|

|

|

|

|

|

|

|

|

Selling Expenses

|

$ 40,357

|

|

$ 51,790

|

|

$ 236,598

|

|

$ 186,030

|

|

|

|

|

|

|

|

|

|

|

Total General and Administrative Expenses

|

103,780

|

|

94,107

|

|

406,083

|

|

585,134

|

|

|

|

|

|

|

|

|

|

|

Total Operating Expenses

|

144,137

|

|

145,897

|

|

642,681

|

|

771,164

|

|

|

|

|

|

|

|

|

|

|

Other Income (Expenses)

|

103,652

|

|

(18,144)

|

|

18,106

|

|

(465,865)

|

|

|

|

|

|

|

|

|

|

|

Net Loss

|

$ (9,344)

|

|

$ (46,558)

|

|

$ (261,565)

|

|

$ (772,764)

|

Selling Expenses

Total selling expenses were $40,357 for the three months ended September 30, 2011, a decrease of $11,433 from $51,790 for the three months ended September 30, 2010. Total selling expenses were $236,598 for the nine months ended September 30, 2011, an increase of $50,568 from $186,030 for the nine months ended September 30, 2010. Selling expenses include advertising, trade show expenses, travel and selling commissions. The increase in selling expenses during the nine months ended September 30, 2011, is a result of increased advertising and travel expenses as we continue to implement our strategic plan to increase our customer base outside the United States.

General and Administrative Expenses

General and administrative expenses were $103,780 for the three months ended September 30, 2011, compared to $94,107 for the three months ended September 30, 2010, an increase of $9,673. General and administrative expenses were $406,083 for the nine months ended September 30, 2011, compared to $585,134 for the nine months ended September 30, 2010, a decrease of $179,051. General and administrative expenses were fairly consistent during the three month periods. The decrease in general and administrative expenses during the nine month period primarily results from a decrease in share-based costs of $242,900. This decrease was offset by increases in payroll costs and professional fees, incurred in the implementation of our plan to expand our customer base and in our efforts to raise capital.

Income (Loss) from Operations

During the three months ended September 30, 2011, we had a loss from operations totaling $112,996 which represented an increase of $84,582 from the loss from operations of $28,414 for the three months ended September 30, 2010. During the nine months ended September 30, 2011, we had a loss from operations totaling $279,671 which represented a decrease of $27,228 from the loss from operations of $306,899 for the nine months ended September 30, 2010. As discussed above, fluctuations in material and operating costs, along with several low margin sales, were the primary reason for the fluctuations in loss from operations.

6

Other Income (Expense)

We had Other Income of $103,652 in the three months ended September 30, 2011 compared to Other [Expense] of [$18,144] in the three months ended September 30, 2010, an increase of $121,796. We had Other Income of $18,106 in the nine months ended September 30, 2011 compared to Other [Expense] of [$465,865] in the nine months ended September 30, 2010, an increase of $483,971. The change in Other Income [Expense] in the three month periods was primarily a result of the fair value change in our derivative of $149,550 in 2011 compared to $39,125 in 2010. Other Income [Expense] in the nine months ended September 30, 2010 is comprised primarily of the $225,000 gain from the sale of our subsidiary, Diamond, [$595,160] from the expense of share-based financing costs, the fair value change in our derivative of $57,431, amortization of debt discount of [$85,184] and loss on disposal of equipment of [$18,945]. In the nine months ended September 30, 2011 Other Income [Expense] is comprised of the fair value change in our derivative of $123,934 and amortization of debt discount of [$62,323]. Interest expense in the three months ended September 30, 2011 and 2010 and the nine months ended September 30, 2011 and 2010 amounted to $15,080, $17,929, $44,855 and $49,007, respectively, due to lower average debt for the periods.

Net Loss

The Company incurred a net loss of $9,344 for the three months ended September 30, 2011, compared to a net loss of $46,558 for the three months ended September 30, 2010. The Company incurred a net loss of $261,565 for the nine months ended September 30, 2011, compared to a net loss of $772,764 for the nine months ended September 30, 2010. This represented decreases in our net loss of $37,214 in the three month period ended and $511,199 in the nine month period ended, respectively, attributable to the various factors as discussed above.

Liquidity and Capital Resources

The following table summarizes working capital at September 30, 2011, compared to December 31, 2010.

|

|

|

| |

|

|

September 30,

2011

|

December 31, 2010

|

Increase/

(Decrease)

|

|

|

|

|

|

|

Current Assets

|

$ 2,025,317

|

$ 2,265,507

|

$ (240,190)

|

|

|

|

|

|

|

Current Liabilities

|

$ 1,054,057

|

$ 1,240,384

|

$ (186,327)

|

|

|

|

|

|

|

Working Capital

|

$ 971,260

|

$ 1,025,123

|

$ (53,863)

|

At September 30, 2011, we had a cash overdraft of $5,051, compared to cash of $4,262 at December 31, 2010. Over the next twelve months we believe that our existing capital combined with cash flow from operations will be sufficient to sustain our current operations. It is anticipated that we will need to sell additional equity and/or debt securities in order to complete or enter into potential mergers and/or acquisitions.

Our working capital decreased by approximately $54,000 during the nine months ended September 30, 2011, primarily due to the following:

Accounts receivable at September 30, 2011, was $345,976, compared to $474,212 at December 31, 2010, which represents a decrease of approximately $128,000 or 27%. We typically offer our customers 60, 90 or 120 day payment terms on sales, depending upon the product mix purchased. When setting terms with our customers, we also consider the term of the relationship with individual customers and management’s assessed credit risk of the respective customer, and may at management’s discretion, increase or decrease payment terms based on those considerations. The decrease in accounts receivable is primarily attributable to our collection efforts during the period.

7