UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the quarterly period ended June 30, 2011

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the transition period from ___________ to ____________

Commission file number: 333-139669

CYTTA CORP.

(Exact name of Registrant as specified in its charter)

Nevada 98-0505761

(State or other jurisdiction (IRS Employer

of incorporation or organization) Identification No.)

|

Suite 101- 6490 West Desert Inn Road, Las Vegas Nevada 89146

(Address of principal executive offices)

(702) 307-1680

(Registrant's telephone number, including area code)

(Former name, former address and former fiscal year,

if changed since last report)

Indicate by check mark whether the Registrant (1) has filed all reports required

to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during

the preceding 12 months (or for such shorter period that the Registrant was

required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and

posted on its corporate Web site, if any, every Interactive Data File required

to be submitted and posted pursuant to Rule 405 of Regulation S-T (ss.232.405 of

this chapter) during the preceding 12 months (or for such shorter period that

the registrant was required to submit and post such files). Yes [ ] No [X]

Indicate by check mark whether the Registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of "large accelerated filer," "accelerated filer," and "smaller

reporting company" in Rule 12b-2 of the Exchange Act (Check one).

Large accelerated filer [ ] Accelerated filer [ ]

Non-accelerated filer [ ] Smaller reporting company [X]

(Do not check if a smaller reporting company)

|

Indicate by check mark whether the Registrant is a shell company (as defined in

Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

As of August 15th, 2011, there were 1,328,078,203 shares of the issuer's common

stock, par value $0.00001, outstanding.

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

The accompanying unaudited financial statements have been prepared in accordance

with accounting principles generally accepted in the United States of America

and the rules of the Securities and Exchange Commission ("SEC"), and should be

read in conjunction with the audited financial statements and notes thereto

contained in the Company's September 30, 2010 Form 10-K filed with the SEC on

January 13, 2011. In the opinion of management, all adjustments, consisting of

normal recurring adjustments, necessary for a fair presentation of financial

position and the results of operations for the periods presented have been

reflected herein. The results of operations for the periods presented are not

necessarily indicative of the results to be expected for the full year.

2

Cytta Corp.

(A Development Stage Company)

Consolidated Balance Sheets

June 30, September 30,

2011 2010

------------ ------------

(Unaudited)

ASSETS

CURRENT ASSETS

Cash and cash equivalents $ 214,593 $ 19,927

Inventory 5,440 --

Investment in joint venture 25,000 --

Prepaid fees and services -- 51,935

------------ ------------

Total Current Assets 245,033 71,862

------------ ------------

PROPERTY AND EQUIPMENT, net 7,262 --

------------ ------------

TOTAL ASSETS $ 252,295 $ 71,862

============ ============

LIABILITIES AND STOCKHOLDERS' DEFICIT

CURRENT LIABILITIES

Accounts payable and accrued liabilities $ 8,739 $ 9,272

Due to related parties 191,531 53,026

------------ ------------

TOTAL LIABILITIES 200,270 62,298

------------ ------------

STOCKHOLDERS' DEFICIT

Authorized:

100,000,000 preferred shares, $0.001 par value

1,900,000,000 common shares, $0.00001 par value

Issued and outstanding shares:

1,328,078,203 and 1,078,078,203 common shares 12,721 10,221

Additional paid-in capital 802,219 489,719

Subscriptions payable 568,000 --

Common shares pending cancellation 560 560

Deficit accumulated during the development stage (1,341,475) (490,936)

------------ ------------

Noncontrolling interest in joint venture 10,000 --

------------ ------------

Total Stockholders' Equity 52,025 9,564

------------ ------------

TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIT $ 252,295 $ 71,862

============ ============

|

3

Cytta Corp.

(A Development Stage Company)

Consolidated Statements of Operations

Cumulative from

For the Three Months Ended For the Nine Months Ended Inception on

June 30, June 30, May 30, 2006 to

-------------------------------- -------------------------------- June 30,

2011 2010 2011 2010 2011

-------------- -------------- -------------- -------------- --------------

REVENUES $ 2,000 $ -- $ 2,000 $ -- $ 2,000

Cost of Goods Sold 1,360 -- 1,360 -- 1,360

-------------- -------------- -------------- -------------- --------------

Gross Margin 640 -- 640 -- 640

OPERATING EXPENSES

Professional fees 32,653 16,605 113,356 31,927 249,863

Management fees 113,028 45,000 362,504 52,662 501,389

General and administrative 26,670 8,747 49,500 10,420 148,463

Impairment of licensing agreement -- -- 325,000 -- 441,581

-------------- -------------- -------------- -------------- --------------

Total Operating Expenses 172,351 70,352 850,360 95,009 1,341,296

-------------- -------------- -------------- -------------- --------------

NET LOSS FROM OPERATIONS (171,711) (70,352) (849,720) (95,009) (1,340,656)

OTHER INCOME (EXPENSE)

Interest income 84 -- 217 -- 217

Interest expense (325) (234) (1,036) (381) (1,036)

-------------- -------------- -------------- -------------- --------------

Total Other Income (Expense) (241) (234) (819) (381) (819)

NET LOSS BEFORE TAXES (171,952) (70,586) (850,539) (95,390) (1,341,475)

-------------- -------------- -------------- -------------- --------------

Provision for income taxes -- -- -- -- --

-------------- -------------- -------------- -------------- --------------

NET LOSS $ (171,952) $ (70,586) $ (850,539) $ (95,390) $ (1,341,475)

============== ============== ============== ============== ==============

PER SHARE DATA:

Basic and diluted income (loss)

per common share $ (0.00) $ (0.00) $ (0.00) $ (0.00)

-------------- -------------- -------------- --------------

Weighted average number of

common shares outstanding 1,328,078,203 1,014,616,666 1,291,448,166 809,044,872

============== ============== ============== ==============

|

4

Cytta Corp.

(A Development Stage Company)

Consolidated Statements of Cash Flows

Cumulative from

For the Nine Months Ended Inception on

June 30, May 30, 2006 to

------------------------------- June 30,

2011 2010 2011

------------ ------------ ------------

OPERATING ACTIVITIES

Net income (loss) $ (850,539) $ (95,391) $ (1,341,475)

Adjustments to reconcile net income (loss) to net

cash from operating activities:

Depreciation and amortization -- -- 3,419

Impairment of licensing agreement 325,000 -- 441,581

Issuance of common stock for services and expenses -- -- 187,570

Operating expenses paid on behalf of the Company

by a related party 198,500 16,660 253,892

Changes in Operating Assets and Liabilities:

Accounts payable and accrued laibilities (534) (283) 15,188

Inventory (5,440) -- (5,440)

Prepaid fees and services 51,935 73,662 --

------------ ------------ ------------

Net cash from operating activities (281,078) (5,352) (445,265)

------------ ------------ ------------

INVESTING ACTIVITIES

Investment in joint venture (25,000) -- (25,000)

Purchase of property and equipment (7,262) -- (7,262)

------------ ------------ ------------

Net cash from investing activities (32,262) -- (32,262)

------------ ------------ ------------

FINANCING ACTIVITIES

Common stock issued for cash -- -- 161,000

Proceeds from stock subscriptions payable 568,000 -- 568,000

Advances from related parties 103,100 7,700 126,214

Repayment of advances from related parties (163,094) -- (163,094)

------------ ------------ ------------

Net cash from financing activities 508,006 7,700 692,120

------------ ------------ ------------

NET CHANGE IN CASH 194,666 2,348 214,593

CASH AT BEGINNING OF PERIOD 19,927 136 --

------------ ------------ ------------

CASH AT END OF PERIOD $ 214,593 $ 2,484 $ 214,593

============ ============ ============

SUPPLEMENTAL CASH FLOW DISCLOSURES

Cash paid for interest $ -- $ -- $ --

Cash paid for income taxes $ -- $ -- $ --

NON-CASH INVESTING AND FINANCING ACTIVITIES

Common stock issued for fees and services $ -- $ 180,000 $ 31,930

Common stock issued for debt -- 31,930 31,930

Common stock issued for licensing agreements $ 325,000 $ -- $ 445,000

|

5

Cytta Corp.

(A Development Stage Company)

Condensed Notes to Consolidated Financial Statements

June 30, 2011 and September 30, 2010

NOTE 1 - CONDENSED FINANCIAL STATEMENTS

The accompanying financial statements have been prepared by the Company without

audit. In the opinion of management, all adjustments (which include only normal

recurring adjustments) necessary to present fairly the financial position,

results of operations, and cash flows at June 30, 2011, and for all periods

presented herein, have been made.

Certain information and footnote disclosures normally included in financial

statements prepared in accordance with accounting principles generally accepted

in the United States of America have been condensed or omitted. It is suggested

that these condensed financial statements be read in conjunction with the

financial statements and notes thereto included in the Company's September 30,

2010 audited financial statements. The results of operations for the period

ended June 30, 2011 is not necessarily indicative of the operating results for

the full year.

NOTE 2 - GOING CONCERN

The Company's financial statements are prepared using generally accepted

accounting principles in the United States of America applicable to a going

concern which contemplates the realization of assets and liquidation of

liabilities in the normal course of business. The Company has not yet

established an ongoing source of revenues sufficient to cover its operating

costs and allow it to continue as a going concern. The ability of the Company to

continue as a going concern is dependent on the Company obtaining adequate

capital to fund operating losses until it becomes profitable. If the Company is

unable to obtain adequate capital, it could be forced to cease operations.

In order to continue as a going concern, the Company will need, among other

things, additional capital resources. Management's plan is to obtain such

resources for the Company by obtaining capital from management and significant

shareholders sufficient to meet its minimal operating expenses and seeking

equity and/or debt financing. However management cannot provide any assurances

that the Company will be successful in accomplishing any of its plans.

The ability of the Company to continue as a going concern is dependent upon its

ability to successfully accomplish the plans described in the preceding

paragraph and eventually secure other sources of financing and attain profitable

operations. The accompanying financial statements do not include any adjustments

that might be necessary if the Company is unable to continue as a going concern.

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

USE OF ESTIMATES

The preparation of financial statements in conformity with accounting principles

generally accepted in the United States of America requires management to make

estimates and assumptions that affect the reported amounts of assets and

liabilities at the date of the financial statements and the reported amounts of

revenue and expenses during the reporting period. Actual results could differ

from those estimates.

RECENT ACCOUNTING PRONOUNCEMENTS

Below is a listing of the most recent accounting pronouncements issued since the

September 31, 2009 audited financial statements of the Company were released and

through February 18, 2011. The Company has evaluated these pronouncements and

does not expect their adoption to have a material impact on the Company's

financial position, or statements.

6

Cytta Corp.

(A Development Stage Company)

Condensed Notes to Consolidated Financial Statements

June 30, 2011 and September 30, 2010

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

RECENT ACCOUNTING PRONOUNCEMENTS (CONTINUED)

* Accounting Standards Update 2010-17 Revenue Recognition- Milestone

Method (Topic 605): Milestone Method of Revenue Recognition - a

consensus of the FASB emerging issues task force. Effective for fiscal

years on or after June 15, 2010.

* Accounting Standards Update 2010-12 Income Taxes (Topic 740):

Accounting for Certain Tax Effects of the 2010 Health Care Reform Acts

(SEC Update). Effective July 1, 2010.

* Accounting Standards Update 2010-11Derivatives and Hedging (Topic

815): Scope Exception Related to Embedded Credit Derivatives.

Effective July 1, 2010.

* Accounting Standards Update 2010-09 Subsequent Events (topic 855):

Amendments to Certain Recognition and Disclosure Requirements.

Effective July 1, 2010.

* Accounting Standards Update 2010-06 Fair Value Measurements and

Disclosures (Topic 820): Improving Disclosures about Fair Value

Measurements. Effective July 1, 2010.

* Accounting Standards Update 2010-05 Compensation-Stock Compensation

(Topic718): Escrowed share arrangements and the Presumption of

Compensation (SEC Update). Effective July 1, 2010.

* Accounting Standards Update 2010-04 (ASU 2010-04), Accounting for

Various Topics-Technical Corrections to SEC Paragraphs. Effective July

1, 2010.

NOTE 3 - ACQUISITION OF LICENSING AGREEMENT

On November 10th, 2010, the Company entered into an MVNO Mobile Virtual Network

Operator Agreement (herein "MVNO Agreement") with Vonify Inc of Toronto, Canada

and Georgetown, Grand Cayman Island, BWI (herein "Vonify") and MVNO Mobile

Virtual Network Operator Corp (herein "MVNO") of New Westminster, Canada for a

license to provide all the "Services" of the Vonify Network to third parties, in

the medical marketplace in the USA. The Vonify Network includes those integrated

mobile switching facilities, servers, cell sites, telecom and internet

connections, billing systems, validation systems, gateways, landline switches

and other related facilities used to provide the Services. The Services to be

marketed by Cytta are defined as wireless telecommunications services for the

Global System for Mobile (GSM) communications. In exchange for the MVNO

Agreement, Cytta issued 250,000,000 shares of the Company's common stock to

Vonify on November 10, 2010. This transaction will result in Vonify becoming a

greater than 10% shareholder of the Company. In connection with the transaction,

a controlling shareholder of Vonify became a Director of the Company.

Subsequent to the transaction, the Company determined the carrying value of the

licensing agreement to be less than the fair value of the asset. As such, in

accordance with ASC 350-30-35 the Company has determined the value of the asset

to be fully impaired as of December 31, 2010 and recognized $325,000 of

impairment expense during the nine month period ended June 30, 2010.

NOTE 4 - JOINT VENTURE

On June 24, 2011, the Company entered into a joint venture agreement with

Promia, Inc., ("Promia") to utilize Promia's proprietary information security

technologies to create security enabled software and hardware solutions for the

Company. Under the terms of the joint venture agreement, the Company has agreed

to install and market the Promia security technology on all systems they deploy

in the United States and abroad and Promia has agreed to create the hardware and

software development necessary to integrate their technology with the Company's

mobile network applications.

7

Cytta Corp.

(A Development Stage Company)

Condensed Notes to Consolidated Financial Statements

June 30, 2011 and September 30, 2010

NOTE 4 - JOINT VENTURE (CONTINUED)

To fulfill the objectives, the Company and Promia agreed to form a Joint Venture

LLC named Cytta Connects, LLC ("JV"), wherein 60 percent of the JV is owned by

the Company and 40 percent of the JV is owed by Promia. Under the terms of the

agreement, initial funding for the JV was to be $250,000 to be provided by the

Company. As of June 30, 2011 the Company has funded $25,000 as an Investment in

Joint Venture and has been accounted for in accordance with ASC 810 (see Note

5).

NOTE 5 - NONCONTROLLING INTEREST

On June 24, 2011, the Company entered into a joint venture Agreement with

Promia, Inc., ("Promia") to utilize Promia's proprietary information security

technologies to create security enabled software and hardware solutions for the

Company. See Note 4 for description of Joint Venture.

Per the terms of the agreement, the JV is 60 percent is owned by the Company and

40 percent by Promia. According to ASC 810, the Company is required to

consolidate the all the assets, liabilities and operations of the JV and record

a noncontrolling interest for the portion of net assets controlled by Promia

within stockholders' equity.

As of June 24th, 2011, the Company recorded a noncontrolling interest of

$10,000 or 40% of the net assets of $25,000 as a noncontrolling interest to

Promia. As of June 30, 2011, the JV did not have any operations or expenses.

NOTE 6 - RELATED PARTY NOTES PAYABLE

As of June 30, 2011 and September 30, 2010 the Company owed various related

parties $191,531 and $53,026, respectively. The notes are unsecured, bear no

interest and are due on demand.

NOTE 7 - STOCKHOLDERS' EQUITY

COMMON STOCK ISSUANCES

During the period ended June 30, 2011, the Company's Board of Directors resolved

to issue 250,000,000 shares of common stock in a non-monetary transaction to

acquire a licensing agreement at $0.0013 per share.

COMMON STOCK SUBSCRIPTIONS

During the period ended June 30, 2011, the Company received $301,000 from

related parties and $221,000 from related parties and $80,000 from unrelated

third parties in exchange for 267,251,516 shares of common stock and no less

than 2,100,000 convertible preferred shares to be issued at a future date. These

amounts have been recorded as stock subscriptions in the Company's financial

statements. As of the date of this report, the Company has not satisfied its

subscriptions obligation through the issuance of shares of stock.

On March 31, 2011, the Company provided an offering to potential investors of a

maximum of 10 units at $25,000 per unit or $0.001 per share. Each unit consist

of 25,000,000 shares of common stock and 25,000,000 warrants to purchase the

Company's common stock at $0.01 per share. The warrants are exercisable at any

time from their initial issue date until March 30, 2012.

During the period ended June 30, 2011, the Company sold 10.98 units and received

$267,000 in cash which has been thus been recorded as a stock subscription

payable until upon such time that the Company issues the shares of common stock.

8

Cytta Corp.

(A Development Stage Company)

Condensed Notes to Consolidated Financial Statements

June 30, 2011 and September 30, 2010

Each warrant is exercisable are exercisable at any time from their initial issue

date until March 30, 2012 at an exercise price of $0.01 per shares. The warrants

were valued using the Black-Scholes Option Pricing model using the following

assumptions: 1 year or less term, $0.09-$0.19 stock price, $0.01 exercise price,

180-221% volatility, 0.22-0.80% risk free rate. The Company has allocated

$51,865 of the total $267,000 proceeds to the value of the warrants.

NOTE 6 - WARRANTS

During the period ended June 30, 2011, the Company issued 269,500,000 warrants

in conjunction with the stock offering noted in Note 5. The warrants are

exercisable at $0.01 per share and expire on March 30, 2012.

Summary information regarding common stock warrants issued and outstanding as of

June 30, 2011 is as follows:

Weighted

Average

Warrants Share Price

-------- -----------

Outstanding at September 30, 2010 -- $ --

Granted 269,500,000 0.01

Exercised -- --

Expired -- --

----------- ------

Outstanding at June 30, 2011 269,500,000 $ 0.01

=========== ======

|

Summary of warrants outstanding and exercisable as of June 30, 2011 is as

follows:

Outstanding Exercisable

Exercise Number of Remaining Number of

Price Shares Life Shares

----- ------ ---- ------

$ 0.01 269,500,000 0.67 269,500,000

|

NOTE 8 - SUBSEQUENT EVENTS

In accordance with ASC 855-10 the Company has evaluated all material subsequent

events from the balance sheet date through the date of this report. There have

been no other reportable subsequent events.

9

ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS

OF OPERATIONS

FORWARD-LOOKING STATEMENTS

Except for historical information, this report contains forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. Such forward-looking

statements involve risks and uncertainties, including, among other things,

statements regarding our business strategy, future revenues and anticipated

costs and expenses. Such forward-looking statements include, among others, those

statements including the words "expects," "anticipates," "intends," "believes"

and similar language. Our actual results may differ significantly from those

projected in the forward-looking statements. Factors that might cause or

contribute to such differences include, but are not limited to, those discussed

herein as well as in the "Description of Business - Risk Factors" section in our

Annual Report on Form 10-K for the year ended September 30, 2010. You should

carefully review the risks described in our Annual Report and in other documents

we file from time to time with the Securities and Exchange Commission. You are

cautioned not to place undue reliance on the forward-looking statements, which

speak only as of the date of this report. We undertake no obligation to publicly

release any revisions to the forward-looking statements or reflect events or

circumstances after the date of this document.

Although we believe that the expectations reflected in these forward-looking

statements are based on reasonable assumptions, there are a number of risks and

uncertainties that could cause actual results to differ materially from such

forward-looking statements.

All references in this Form 10-Q to the "Company," "Cytta," "we," "us," or "our"

are to Cytta Corp.

RESULTS OF OPERATIONS

We are a development stage corporation. We have generated $2,000 in revenues

from our business operations since inception (May 30, 2006) and have incurred

$1,341,296 in expenses through June 30, 2011.

The following table provides selected financial data about our company as of

June 30, 2011 and September 30th, 2010, respectively.

Balance Sheet Data June 30, 2011 September 30, 2010

------------------ ------------- ------------------

Cash and cash equivalents $214,593 $ 19,927

Total Assets $252,295 $ 71,862

Total Liabilities $200,270 $ 62,298

Shareholder Equity (Deficit) $ 52,025 $ 9,564

|

Net cash used by operating activities since inception (May 30, 2006) through

June 30, 2011 was $445,265.

10

PLAN OF OPERATION

On June 18th, 2009, the Company entered into a Licensing Agreement with

Lifespan, Inc. Through a series of transactions and business developments

commencing in 2002 Lifespan had acquired the expertise and licenses to

manufacture, distribute and market various technology based internet access and

computing products and services, consisting of internet access devices, related

software and hardware and a series of medical peripherals designed and adapted

to provide remote non-diagnostic monitoring of home based and remote patients.

Under the terms of the Agreement with Cytta, Lifespan granted the Company the

exclusive license to manufacture, sell, distribute, operate, sub-license and

market these internet access devices, products and services in the United

States. The Company has been utilizing the License to develop a model for the

internet access devices which can incorporate the numerous technology advances

which are currently available and is currently pursuing this avenue. In exchange

for the license, Lifespan has received 120,000,000 shares of the Company's

common stock, plus a license fee equal to one half of one percent (.5%) of the

net revenue derived from the sale and use of their products and services. This

transaction is more fully described in our Current Report on Form 8-K filed with

the Securities and Exchange Commission on June 19, 2009.

On November 10th, 2010, the Company entered into an MVNO Mobile Virtual Network

Operator Agreement (herein "MVNO Agreement") with Vonify Inc of Toronto, Canada

and Georgetown, Grand Cayman Island, BWI (herein "Vonify") and MVNO Mobile

Virtual Network Operator Corp (herein "MVNO") of New Westminster, Canada for a

license to provide all the "Services" of the Vonify Network to third parties,

initially in the medical marketplace in the USA.

The Vonify Network includes those integrated mobile switching facilities,

servers, cell sites, telecom and internet connections, billing systems,

validation systems, gateways, landline switches and other related facilities

used to provide the Services. The Services to be marketed by Cytta are defined

as wireless telecommunications services for the Global System for Mobile (GSM)

communications.

In exchange for the MVNO Agreement, Cytta issued 250,000,000 shares of the

Company's common stock to Vonify Inc. This transaction resulted in Vonify Inc.

becoming a greater than 10% shareholder of the Company. Mr. William Becker, a

Director of the Company, is a controlling shareholder of Vonify Inc. This

transaction is more fully described in our Current Report on Form 8-K filed with

the Securities and Exchange Commission on November 29, 2010.

Since the acquisition of the Lifespan technology, and the rights to utilize the

Vonify cellular network through the MVNO Agreement, the Company developed a

remote medical monitoring model designed to deliver seamless, near real-time,

medical data transmission from home to Insurer. The Company's system was

designed to seamlessly collect the data generated by the home based medical

monitoring devices (such as blood pressure, scale, blood glucose, pulse oxygen

etc), utilizing Bluetooth connectivity. This medical data is seamlessly sent

from the medical device to the Company's Medical Smartphone, which is also

located in the home. The Company's Medical Smartphone, contains proprietary

programming, consisting of a "Firmware Client", which when installed on the

Cytta Medical Smartphone, automatically receives the medical data and utilizes

11

the Company's wireless telecommunication services, to transmit the data through

the cellular network to the Online Cytta Data repository. From the Online Cytta

Data repository the data can be automatically transmitted to the electronic

medical monitoring systems (EMR's) of the major Medical Groups (such as

Insurance Companies, Disease Management Companies, Health Delivery

Organizations, Health Plans, Home Health Agencies, Managed Care Organizations,

Medical Groups and IPAs) who have placed the systems in the homes of their

clients requiring remote monitoring. These Medical Groups contract with Cytta

and are responsible for placing the system in the homes of their clients who

require monitoring.

The Company has now finalized the testing of the Vonify network in the US

utilizing Vonify SIM cards installed on Nexus One and My Touch HTC android

smartphones deployed in various parts of the US. After comprehensive testing,

the Cytta network was found to be fully functional and compliant in regards to

voice, data and SMS connectivity. The network is suitable in all aspects for

utilization by Cytta for the movement of medical information gathered from

Bluetooth enabled remote medical monitoring devices. The Cytta Medical

smartphones are also fully functional voice, data and SMS cell phones.

The Company plans on incorporating medical monitoring devices to measure of

Blood Pressure, Glucose Values, Weight, PT/INR, ECG Rhythms, Respiration,

Temperature, Pulse, and Oxygen Saturation into the Cytta Ecosystem.

The Company and its development partners have now completed the development of

the proprietary Firmware Client and have installed the technology on several

Nexus One and HTC My Touch android smartphones. The testing of the combination

Smartphone and Firmware Client, which has collectively been described as the

Cytta Medical Smartphone, with the blood pressure, weight scale, pulse/oximetry

and blood glucose devices has been completed and are all functioning seamlessly.

The Company and its partners are now completing the development of the `Online

Data Presentation Screens" to represent the data captured by the system for its

potential clients. Upon completion of the Online Data Presentation Screens and

acquisition and programming of a supply of suitable android smartphones, the

Company will begin installing the complete Cytta Ecosystems in several test

locations in the US, with potential Medical Group clients wishing to utilize and

or participate in the Company's "medical monitoring ecosystem'. Upon conclusion

of testing, the Company will begin its deployment of its systems and commence

operations as a Medical Health Service Provider (MHSP).

The Company's integrated and completely autonomous system provides numerous

advantages over current systems, as well as a pricing structure designed to

generate a positive return on investment (ROI) for the Medical Groups utilizing

the system. To this end the Company is currently demonstrating the system to

numerous potential device manufacturing partners and Medical Group clients

wishing to utilize and or participate in the Company's "medical monitoring

ecosystem".

In an effort to respond to numerous data security concerns related to the

transmission of information through a mobile communications network, on June

24th, 2011, the Company entered into a Joint Venture and Value Added Reseller

Agreement (herein the "Agreement") with Promia, Inc of San Francisco, Ca (herein

"Promia") to utilize Promia's software and hardware development services and

12

technologies to create robust and security enabled software and hardware

solutions for the Cytta Medical Ecosystem and the Cytta mobile network. This

transaction is more fully described in our Current Report on Form 8-K filed with

the Securities and Exchange Commission on June 30, 2011

Cytta currently has minimal operating costs and expenses at the present time due

to our relatively new business activities. However we anticipate significantly

increasing our activities as a result of the MVNO Agreement. We have entered

into certain management and consulting contracts with our senior Officers and

non affiliated consultants who will be providing business services to the

Company in the health care arena. Additionally, we will be required to raise

significant capital over the next twelve months, in connection with our

operations resulting from our marketing Agreements. We do not currently engage

in any product research and development however the Company's Joint Venture

Agreement and marketing Agreements may cause us to engage in research and

development in the foreseeable future. We have no present plans to purchase or

sell any plant or significant equipment although we will have to acquire some

equipment related to the marketing Agreements. We also have no immediate plans

to add employees, other than the current management and consultants, although we

may do so in the future as a result of the operations related to the marketing

Agreements.

LIQUIDITY AND CAPITAL RESOURCES

Our cash and cash equivalents balance as of June 30, 2011 was $214,593.

We are a development stage company and currently have limited marketing

operations.

We do not have sufficient funds on hand to pursue our business objectives for

the near future or to commence full scale operations without seeking additional

funding. We currently do not have a specific plan of how we will obtain such

funding.

LOANS TO THE COMPANY

We have been receiving loans from shareholders of the company to pay general

operating costs. As of June 30, 2011, we had $191,531 in loans outstanding.

We have minimal operating costs and expenses at the present time due to our

limited business activities. Currently our operating activities in the

healthcare arena are conducted by our senior Officers and engaged consultants.

We will, however, be required to raise additional capital over the next twelve

months to meet our current administrative expenses and to develop our

operations. This financing may take the form of additional sales of our equity

or debt securities to, or loans from, stockholders, or from our officers and

directors or other individuals. There is no assurance that additional financing

will be available from these or other sources, or, if available, that it will be

on terms favorable to us.

GOING CONCERN

Our auditors have included an explanatory paragraph in their report on our

financial statements relating to the uncertainty of our business as a going

concern, due to our limited operating history, our lack of historical

profitability, and our limited funds. We believe that we will be able to raise

the required funds for operations and to achieve our business plan.

13

OFF-BALANCE SHEET ARRANGEMENTS

We have never entered into any off-balance sheet financing arrangements and have

not formed any special purpose entities with the exception of the Cytta Connect

LLC joint venture. We have not guaranteed any debt or commitments of other

entities or entered into any options on non-financial assets.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not applicable.

ITEM 4T. CONTROLS AND PROCEDURES

EVALUATION OF OUR DISCLOSURE CONTROLS

Under the supervision and with the participation of our senior management,

including our chief executive officer and chief financial officer, Stephen

Spalding, we conducted an evaluation of the effectiveness of the design and

operation of our disclosure controls and procedures, as defined in Rules

13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as amended

(the "Exchange Act"), as of the end of the period covered by this quarterly

report (the "Evaluation Date"). Based on this evaluation, our chief executive

officer and chief financial officer concluded as of the Evaluation Date that our

disclosure controls and procedures were not effective such that the information

relating to us, required to be disclosed in our Securities and Exchange

Commission ("SEC") reports (i) is recorded, processed, summarized and reported

within the time periods specified in SEC rules and forms, and (ii) is

accumulated and communicated to our management, including our chief executive

officer and chief financial officer, as appropriate to allow timely decisions

regarding required disclosure.

CHANGES IN INTERNAL CONTROL OVER FINANCIAL REPORTING

There have been no changes in our internal control over financial reporting that

occurred during the quarter ended June 30, 2011 that have materially affected or

are reasonably likely to materially affect our internal control over financial

reporting.

PART II - OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

In the ordinary course of our business, we may from time to time become subject

to routine litigation or administrative proceedings which are incidental to our

business. We are not a party to nor are we aware of any existing, pending or

threatened lawsuits or other legal actions involving us.

ITEM 1A. RISK FACTORS

Not applicable.

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

None.

14

ITEM 3. DEFAULTS UPON SENIOR SECURITIES

None.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

None.

ITEM 5. OTHER INFORMATION

None.

ITEM 6. EXHIBITS

The following exhibits are included as part of this report:

Exhibit No. Description

----------- -----------

31.1 / 31.2 Rule 13(a)-14(a)/15(d)-14(a) Certification of Principal

Executive and Financial Officer

32.1 / 32.2 Rule 1350 Certification of Principal Executive and Financial

Officer

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

Registrant has duly caused this report to be signed on its behalf by the

undersigned thereunto duly authorized.

CYTTA CORP.

Dated: August 19, 2011

By: /s/ Stephen Spalding

----------------------------------------------

Stephen Spalding

CEO, Principal Executive and Financial Officer

|

15

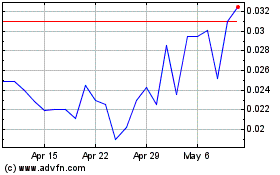

Cytta (QB) (USOTC:CYCA)

Historical Stock Chart

From Mar 2024 to Apr 2024

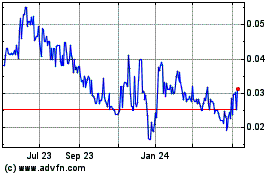

Cytta (QB) (USOTC:CYCA)

Historical Stock Chart

From Apr 2023 to Apr 2024