DineWise, Inc. Provides Company Update

April 27 2011 - 4:24PM

Business Wire

DineWise, Inc. (OTCPK: DWIS), today provides this corporate

update to current and prospective shareholders.

"The Company is currently undergoing a full review of its

financial and operational requirements to facilitate funding of its

ongoing operations over the next year, a potential

recapitalization, and financing its potential merger and

acquisition strategy. In preparation for next steps, the Board of

Directors recommended, and its majority shareholders by written

consent approved increasing the Company’s authorized common shares

from 50 million to 250 million. In addition, the Company has hired

a consultant to improve market awareness in the financial community

and announces that it intends to update its regulatory filings,

upon completion of the necessary financing, including filing Form

10 for the fiscal year ended 2010. This will mark a re-entry into

the market as a reporting company. In the interim, the following

information provided by the Company should prove helpful to

shareholders," stated Mr. Paul Roman, the Company's Chief Executive

Officer.

Issued and Outstanding Stock and Warrants (as of the quarter

ended March 27, 2011):

Total Authorized Common Stock – 250,000,000, outstanding –

33,148,915;

Total Authorized Preferred Stock – 10,000,000, outstanding –

none;

Total Outstanding Warrants – 7,550,505 with exercise prices from

$.25 to $1.5.

Stock Ownership of Officers and Directors:

Paul Roman, President, CEO and Director: –5,040,386 shares,

15.2% of outstanding stock, Options - none;

Thomas McNeill, Vice President, CFO and Director: – 500,000

shares, 1.5% of outstanding stock, Options – 1,950,000 at

$.495/share;

Thomas Hillman, Director, an executive with NYCIC and NYSBVF;

none.

Debenture Obligations as of the quarter ended March 27,

2011:

Total Debt outstanding is $3.2 million as of the quarter ended

March 27, 2011. The first Debenture has $2.224 million outstanding,

an interest rate of 8% per annum and has conversion rights.

However, under a past amendment and waiver the Company no longer is

required to file a registration statement to cover the potential

conversion and sale of the securities. The second debenture has

$.976 million outstanding and its interest rate is currently 6.25%

per annum. The second debenture accrues interest only, with

principal and interest not due until the first debenture is paid in

full.

Evaluating Acquisition Oriented Expansion Plans:

The Company has elected to explore whether it should supplant

the organic growth of its core business with other similar

businesses. In doing so, Management believes it can substantially

increase the size of its business, and leverage larger revenues

into a more profitable operation. It is evaluating a number of

merger candidates, including several food delivery related entities

in adjacent markets, and those whose processes could be leveraged

to vertically integrate existing operations.

Audit of the Company's Financials:

It is the intention of the Company to file a Form 10 with the

Securities and Exchange Commission and related materials upon the

successful completion of a financing, and become a fully reporting

company. In the interim, Company financial information can be found

on the Pink Sheets site, under

http://www.otcmarkets.com/stock/DWIS/financials

About DineWise, Inc.

Headquartered in Farmingdale, New York, Dinewise, Inc. is a

national distributor of nutritional, fully prepared meals assisting

time-impaired, temporarily or permanently homebound consumers and

their caregivers via its DineWise® brand. Its branded product lines

Home Bistro® and Colorado Prime® cater to the growing demand for

gourmet products and services that address prevailing consumer

trends for convenience. To learn more, visit www.DineWise.com and

find a complete menu of nutritious and convenient dining

solutions.

Safe Harbor Statement

This document contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended.

Such statements are subject to risks and uncertainties that could

cause actual results to vary materially from those projected in the

forward-looking statements. The company may experience significant

fluctuations in future operating results due to a number of

economic, competitive, and other factors. These factors and others

could cause operating results to vary significantly from those in

prior periods, and those projected in forward-looking statements.

Additional information with respect to these and other factors,

which could materially affect the Company and its operations are

included in certain forms DineWise has filed with the Securities

and Exchange Commission.

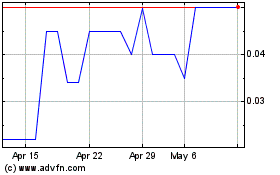

Dinewise (PK) (USOTC:DWIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dinewise (PK) (USOTC:DWIS)

Historical Stock Chart

From Apr 2023 to Apr 2024