UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-Q

|

x

|

QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF

1934 for the quarterly period ended December 31,

2010

|

|

o

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For the

transition period from __________ to _________

Commission

File Number: 000-31026

ELECTRONIC

CONTROL SECURITY INC.

(Exact

name of registrant as specified in its charter)

|

NEW

JERSEY

|

|

22-2138196

|

|

(State

or other jurisdiction

|

|

(IRS

Employer Identification No.)

|

|

of

incorporation or organization

|

|

|

790

BLOOMFIELD AVENUE, CLIFTON, NEW JERSEY 07012

(Address

of principal executive offices)

(973)

574-8555

(registrant's

telephone number, including area code)

Indicate

by checkmark whether the registrant has (1) filed all reports required to be

filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or

for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90

days.

Yes

x

No

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files). Yes

¨

No

¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company.

|

Large

accelerated filer

|

o

|

|

|

Accelerated

filer

|

o

|

|

Non-accelerated

filer

|

o

|

|

|

Smaller

reporting company

|

x

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act). Yes

o

No

x

As of

February 10, 2010, Electronic Control Security Inc. had outstanding 10,429,911

shares of common stock, par value $.001 per share.

INDEX

PAGE

|

PART

I — FINANCIAL INFORMATION

|

|

|

|

|

|

Forward

Looking Statements

|

|

|

|

|

|

Item

1 - Financial Statements*

|

|

|

Consolidated

Balance Sheets December 31, 2010 (Unaudited) and June 30,

2010

|

F-3

|

|

Unaudited

Consolidated Statements of Operations for the six and three

months ended December 31, 2010 and 2009

|

F-4

|

|

Unaudited

Consolidated Statements of Cash Flows for the six months ended December

31, 2010 and 2009

|

F-5

|

|

Notes

to Consolidated Financial Statements

|

6

|

|

|

|

|

Item

2 - Management's Discussion and Analysis of Financial Condition

and Results of Operations

|

8

|

|

|

|

|

Item

4 - Controls and Procedures

|

12

|

|

|

|

|

PART

II — OTHER INFORMATION

|

|

|

|

|

|

Item

5 Other Information

|

12

|

|

|

|

|

Item

6 – Exhibits

|

12

|

|

|

|

|

Signatures

|

13

|

Electronic

Control Security Inc.

Consolidated

Balance Sheets

|

|

|

December 31,

|

|

|

June 30,

|

|

|

|

|

2010

|

|

|

2010

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

Current

assets

|

|

|

|

|

|

|

|

Cash

and cash equivalents

|

|

$

|

261,188

|

|

|

$

|

168,465

|

|

|

Accounts

receivable, current portion, net of allowance

|

|

|

|

|

|

|

|

|

|

of

$25,000

|

|

|

467,460

|

|

|

|

1,932,910

|

|

|

Inventories

|

|

|

2,151,498

|

|

|

|

1,875,243

|

|

|

Other

current assets

|

|

|

164,735

|

|

|

|

165,854

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

current assets

|

|

|

3,044,881

|

|

|

|

4,142,472

|

|

|

|

|

|

|

|

|

|

|

|

|

Property,

equipment and software development costs - net

|

|

|

474,755

|

|

|

|

142,386

|

|

|

Intangible

assets - net

|

|

|

991,736

|

|

|

|

1,032,469

|

|

|

Goodwill

|

|

|

196,962

|

|

|

|

196,962

|

|

|

Deferred

income taxes

|

|

|

437,350

|

|

|

|

437,350

|

|

|

Other

assets

|

|

|

8,786

|

|

|

|

8,786

|

|

|

|

|

$

|

5,154,470

|

|

|

$

|

5,960,425

|

|

|

LIABILITIES

AND SHAREHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current

Liabilities

|

|

|

|

|

|

|

|

|

|

Accounts

payable and accrued expenses

|

|

$

|

1,487,678

|

|

|

$

|

2,442,683

|

|

|

Due

to officers and shareholders

|

|

|

82,087

|

|

|

|

259,778

|

|

|

Current

maturities of debt

|

|

|

24,714

|

|

|

|

43,754

|

|

|

8%

Convertible debentures

|

|

|

-

|

|

|

|

100,000

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

current liabilities

|

|

|

1,594,479

|

|

|

|

2,846,215

|

|

|

|

|

|

|

|

|

|

|

|

|

Noncurrent

liabilities

|

|

|

|

|

|

|

|

|

|

Deferred

income taxes

|

|

|

43,550

|

|

|

|

43,550

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

liabilities

|

|

|

1,638,029

|

|

|

|

2,889,765

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders'

equity

|

|

|

|

|

|

|

|

|

|

Series

A Convertible Preferred stock, cumulative, $.01 par value;

|

|

|

|

|

|

|

|

|

|

$2.00

liquidation preference; 5,000,000 shares authorized,

|

|

|

|

|

|

|

|

|

|

300,000

and 300,000 shares issued and outstanding, respectively

|

|

|

3,000

|

|

|

|

3,000

|

|

|

Series

B 10% Convertible Preferred stock, cumulative, $.001 par

value;

|

|

|

|

|

|

|

|

|

|

$1,902

and $1,809 per share liquidation preference; 2,000 shares

authorized,

|

|

|

|

|

|

|

|

|

|

791

shares issued and outstanding, respectively

|

|

|

1

|

|

|

|

1

|

|

|

Common

Stock, $.001 par value; 30,000,000 shares authorized;

|

|

|

|

|

|

|

|

|

|

10,529,911

and 10,259,259 shares issued; 10,429,911 and 10,159,259

|

|

|

|

|

|

|

|

|

|

shares

outstanding

|

|

|

10,530

|

|

|

|

10,259

|

|

|

Additional

paid-in capital

|

|

|

13,262,019

|

|

|

|

13,105,624

|

|

|

Accumulated

deficit

|

|

|

(9,753,899

|

)

|

|

|

(10,043,014

|

)

|

|

Accumulated

other comprehensive income

|

|

|

4,790

|

|

|

|

4,790

|

|

|

Treasury

stock, at cost, 100,000 shares

|

|

|

(10,000

|

)

|

|

|

(10,000

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total

shareholders' equity

|

|

|

3,516,441

|

|

|

|

3,070,660

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

5,154,470

|

|

|

$

|

5,960,425

|

|

See Notes

to Consolidated Financial Statements.

Consolidated

Statements of Operations

|

|

|

Six Months

|

|

|

Three Months

|

|

|

|

|

Ended

|

|

|

Ended

|

|

|

|

|

December 31,

|

|

|

December 31,

|

|

|

|

|

2010

|

|

|

2009

|

|

|

2010

|

|

|

2009

|

|

|

|

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

$

|

1,881,963

|

|

|

$

|

1,635,704

|

|

|

|

1,080,411

|

|

|

$

|

1,245,047

|

|

|

Cost

of revenues

|

|

|

717,390

|

|

|

|

562,332

|

|

|

|

455,098

|

|

|

|

456,418

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross

profit

|

|

|

1,164,573

|

|

|

|

1,073,372

|

|

|

|

625,313

|

|

|

|

788,629

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research

and development

|

|

|

61,211

|

|

|

|

80,668

|

|

|

|

36,605

|

|

|

|

40,334

|

|

|

Selling,

general and administrative expenses

|

|

|

680,580

|

|

|

|

745,753

|

|

|

|

338,765

|

|

|

|

518,437

|

|

|

Stock

based compensation

|

|

|

31,041

|

|

|

|

12,374

|

|

|

|

6,843

|

|

|

|

7,721

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income

from operations

|

|

|

391,741

|

|

|

|

234,577

|

|

|

|

243,100

|

|

|

|

222,137

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other

expenses (income)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest

expense

|

|

|

31,638

|

|

|

|

53,704

|

|

|

|

13,714

|

|

|

|

26,493

|

|

|

Interest

income

|

|

|

(2,063

|

)

|

|

|

-

|

|

|

|

(867

|

)

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

other expenses (income)

|

|

|

29,575

|

|

|

|

53,704

|

|

|

|

12,847

|

|

|

|

26,493

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income

before income taxes

|

|

|

362,166

|

|

|

|

180,873

|

|

|

|

230,253

|

|

|

|

195,644

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income

taxes

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income

before dividends

|

|

|

362,166

|

|

|

|

180,873

|

|

|

|

230,253

|

|

|

|

195,644

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends

related to convertible preferred stock

|

|

|

73,051

|

|

|

|

66,181

|

|

|

|

36,980

|

|

|

|

33,502

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

income attributable to common shareholders

|

|

$

|

289,115

|

|

|

$

|

114,692

|

|

|

|

193,273

|

|

|

$

|

162,142

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

income per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

0.03

|

|

|

$

|

0.01

|

|

|

|

0.02

|

|

|

$

|

0.02

|

|

|

Diluted

|

|

$

|

0.03

|

|

|

$

|

0.01

|

|

|

|

0.02

|

|

|

$

|

0.02

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted

average number of

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

common

shares and equivalents:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

10,380,266

|

|

|

|

10,149,259

|

|

|

|

10,429,911

|

|

|

|

10,149,259

|

|

|

Diluted

|

|

|

10,661,123

|

|

|

|

10,231,612

|

|

|

|

10,675,875

|

|

|

|

10,233,213

|

|

See Notes

to Consolidated Financial Statements.

Electronic

Control Security Inc.

Consolidated

Statements of Cash Flows

|

|

|

Six Months

|

|

|

|

|

Ended

|

|

|

|

|

December 31,

|

|

|

|

|

2010

|

|

|

2009

|

|

|

|

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

INCREASE

IN CASH AND CASH EQUIVALENTS

|

|

|

|

|

|

|

|

Cash

flows from operating activities:

|

|

|

|

|

|

|

|

Net

income before deemed dividends

|

|

$

|

362,166

|

|

|

$

|

180,873

|

|

|

Adjustments

to reconcile income

|

|

|

|

|

|

|

|

|

|

to

net cash provided by operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation

and amortization

|

|

|

92,187

|

|

|

|

87,312

|

|

|

Stock

based compensation

|

|

|

31,041

|

|

|

|

12,374

|

|

|

Issuance

of shares in repayment of amounts owed

|

|

|

19,076

|

|

|

|

|

|

|

Increase

(decrease) in cash attributable to changes in

|

|

|

|

|

|

|

|

|

|

Accounts

receivable

|

|

|

1,465,450

|

|

|

|

(162,735

|

)

|

|

Inventories

|

|

|

(276,255

|

)

|

|

|

(10,684

|

)

|

|

Other

current assets

|

|

|

1,119

|

|

|

|

3,860

|

|

|

Accounts

payable and accrued expenses

|

|

|

(955,012

|

)

|

|

|

10,242

|

|

|

Customer

deposits

|

|

|

-

|

|

|

|

150,000

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

cash provided by operating activities

|

|

|

739,772

|

|

|

|

271,242

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

flows from investing activities:

|

|

|

|

|

|

|

|

|

|

Acquisition

of property plant and equipment

|

|

|

(383,818

|

)

|

|

|

(12,886

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net

cash used in investing activities

|

|

|

(383,818

|

)

|

|

|

(12,886

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Cash

flows from financing activities:

|

|

|

|

|

|

|

|

|

|

Principal

payments on 8% convertible debentures

|

|

|

(100,000

|

)

|

|

|

(87,500

|

)

|

|

Payments

on debt

|

|

|

(19,040

|

)

|

|

|

(3,866

|

)

|

|

Increase

(decrease) in loans from officers

|

|

|

(144,191

|

)

|

|

|

2,355

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

cash used in financing activities

|

|

|

(263,231

|

)

|

|

|

(89,011

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net

increase in cash and cash equivalents

|

|

|

92,723

|

|

|

|

169,345

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

and cash equivalents at beginning of period

|

|

|

168,465

|

|

|

|

15,735

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

and cash equivalents at end of period

|

|

$

|

261,188

|

|

|

$

|

185,080

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental

disclosures of cash flow information

|

|

|

|

|

|

|

|

|

|

Cash

paid during the period for:

|

|

|

|

|

|

|

|

|

|

Interest

|

|

$

|

31,638

|

|

|

$

|

45,183

|

|

|

Taxes

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental

disclosures of noncash financing activities:

|

|

|

|

|

|

|

|

|

|

Exercise

price of stock options paid via reduction in shareholder

loans

|

|

$

|

33,500

|

|

|

|

|

|

See Notes

to Consolidated Financial Statements.

ELECTRONIC

CONTROL SECURITY INC.

NOTES TO

THE CONSOLIDATED FINANCIAL STATEMENTS

Note 1 –

Basis of Presentation

The

accompanying unaudited consolidated financial statements of Electronic Control

Security Inc. and its subsidiaries (collectively "the Company") have been

prepared in accordance with generally accepted accounting principles for interim

financial information and Article 8.03 of Regulation S-X. Accordingly, they do

not include all of the information and footnotes required by generally accepted

accounting principles for complete financial statements. In the

opinion of management, all adjustments (consisting of normal recurring accruals)

considered necessary for a fair presentation have been

included. Operating results for the six months ended December 31,

2010 are not necessarily indicative of the results that may be expected for the

year ending June 30, 2011. These unaudited consolidated financial

statements should be read in conjunction with the audited consolidated financial

statements and footnotes thereto included in the Company's Form 10-K

for the year ended June 30, 2010, as filed with the Securities and Exchange

Commission.

Note 2 -

Earnings Per Share

Basic

earnings per share is computed based on the weighted-average number of shares of

the Company’s common stock outstanding. Diluted earnings per share is

computed based on the weighted-average number of shares of the Company’s common

stock, including common stock equivalents outstanding. Certain common

shares consisting of stock options, warrants, convertible debentures and

convertible preferred stock that would have an anti-dilutive effect were not

included in the diluted earnings per share attributable to common stockholders

for the three and six months ended December 31, 2010 and 2009.

The

following is a reconciliation of the denominators of the basic and diluted

earnings per share computations:

|

|

|

Three Months

|

|

|

Six Months

|

|

|

|

|

Ended Dec. 31

,

|

|

|

Ended Dec. 31

,

|

|

|

|

|

2010

|

|

|

2009

|

|

|

2010

|

|

|

2009

|

|

|

Denominators:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average

shares outstanding used to compute basic earnings per

share

|

|

|

10,429,911

|

|

|

|

10,149,259

|

|

|

|

10,380,266

|

|

|

|

10,149,259

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Effect

of dilutive stock options

|

|

|

245,964

|

|

|

|

83,954

|

|

|

|

280,857

|

|

|

|

82,353

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average

shares outstanding and dilutive securities used to compute dilutive

earnings per share

|

|

|

10,675,875

|

|

|

|

10,233,213

|

|

|

|

10,661,123

|

|

|

|

10,231,612

|

|

For the

six months ended December 31, 2010, there were outstanding potential common

equivalent shares of 4,436,423 compared to 3,895,564 in the same period in 2009

which were excluded from the computation of diluted earnings per share because

the effect would have been anti-dilutive. These potential dilutive

common equivalent shares may be dilutive to future diluted earnings per

share.

Note 3 -

Inventories

Inventories

consist of the following:

|

|

|

December

|

|

|

June

|

|

|

|

|

2010

|

|

|

2010

|

|

|

|

|

|

|

|

|

|

|

Raw

materials

|

|

$

|

431,402

|

|

|

$

|

307,935

|

|

|

Work-in-process

|

|

|

322,666

|

|

|

|

215,188

|

|

|

Finished

goods

|

|

|

1,397,430

|

|

|

|

1,352,120

|

|

|

|

|

$

|

2,151,498

|

|

|

$

|

1,875,243

|

|

Note 4 -

Due to Officers and Shareholders

In July

2010, a reduction of $33,500 was made to the balance in the loan accounts in

lieu of the exercise price on a total of 200,000 shares issued to Officers and

Shareholders.

Note 5 —

New Authoritative Pronouncements

In

January 2010, the Financial Accounting Standards Board issued amended standards

that require additional fair value disclosures. These amended

standards require disclosures about inputs and valuation techniques used to

measure fair value as well as disclosures about significant transfers, beginning

in the first quarter of 2010. Additionally, these amended standards

require presentation of disaggregated activity within the reconciliation of fair

value measurements using significant unobservable inputs (level 3), beginning in

the first quarter of 2011. Management does not expect these new

standards to significantly impact its consolidated financial

statements.

Note 6 -

Subsequent Event

On

February 8, 2011, the Company entered into an equity financing and registration

rights agreement (collectively the "Agreements") with Auctus Private Equity

Fund, LLC ("Auctus") pursuant to which Auctus has committed, subject

to certain conditions, to purchase up to $10 million of Common Stock over a term

of up to five years commencing from the effective date of a Registration

Statement.

The

Company is not required to sell shares under the Agreements. The

Agreements give the Company the option to sell to Auctus shares of Common Stock

at a per share purchase price of equal to 96% of the lowest closing volume

weighted average price (VWAP) during the five trading days following the

delivery to Auctus of a draw-down notice (the "Notice"). At the

Company's option, they may set a floor price under which Auctus may not sell the

shares which were the subject of the Notice. The maximum amount of

Common Stock that the Company can sell pursuant to any Notice is the greater of:

(i) an amount of shares with an aggregate maximum purchase price of $200,000 or

(ii) 200% of the average daily volume based on the trailing ten (10) days

preceding the Notice date, whichever is of a larger value.

Auctus is

not required to purchase the shares, unless the shares which are subject to the

Notice have been registered for resale and are freely tradable in accordance

with the Federal securities laws, including the Securities Act of 1933, as

amended. The Company is obligated to file with the U.S. Securities

and Exchange Commission (the "SEC") a registration statement on Form S-1 (the

“Registration Statement”) within 180 days from the date of the Agreements and to

use all commercially reasonable efforts to have such registration statement

declared effective by the SEC within 120 days of filing.

|

ITEM

2.

|

MANAGEMENT'S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION OR RESULTS OF

OPERATIONS.

|

The

following discussion should be read in conjunction with our financial statements

and the notes related to those statements. Some of our discussion is

forward-looking and involves risks and uncertainties. For information

regarding risk factors that could have a material adverse effect on our

business, refer to the risk factors section of the annual report for the year

ended June 30, 2010 on Form 10-K.

CAUTION

REGARDING FORWARD-LOOKING STATEMENTS

Electronic

Control Security Inc. (the “Company”) and its representatives may from time to

time make written or verbal forward-looking statements, including statements

contained in this report and other Company filings with the Securities and

Exchange Commission and in our reports to shareholders. Statements

that relate to other than strictly historical facts, such as statements about

our plans and strategies, expectations for future financial performance, new and

existing products and technologies, and markets for our products are

forward-looking statements. Generally, the words "believe," "expect,"

"intend," "estimate," "anticipate," "will" and other similar expressions

identify forward-looking statements. The forward-looking statements are and will

be based on our management's then-current views and assumptions regarding future

events and operating performance, and speak only as of their

dates. Investors are cautioned that such statements involve risks and

uncertainties that could cause actual results to differ materially from

historical or anticipated results due to many factors including, but not limited

to, our Company's current and future capital needs, uncertainty of capital

funding, our clients' ability to cancel contracts with little or no penalty,

government initiatives to implement Homeland Security measures, the likelihood

of completing transactions for which we have entered into letters of intent, the

state of the worldwide economy, competition, our customer's ability to pay our

invoices within our standard credit terms, and other risks detailed in our

Company's most recent Annual Report on Form 10-K and other Securities and

Exchange Commission filings. We undertake no obligation to publicly

update or revise any forward-looking statements.

OVERVIEW

We are

engaged in the design, develop, manufacture and marketing of technology-based

integrated entry control and perimeter security solutions.. We also

perform support services consisting of risk assessment and vulnerability studies

to ascertain a client's security requirements in developing a comprehensive risk

management and mitigation program as well as product design and engineering

services in support of the systems integrators and dealers/installers providing

these services to a client.

We market

our products domestically and internationally to:

|

|

·

|

security

system integrators;

|

|

|

·

|

national

and local government entities;

|

|

|

·

|

large

industrial facilities and major office

complexes;

|

|

|

·

|

energy

facilities, including nuclear power stations, power utilities and

pipelines; and commercial transportation centers, such as airports and

seaports.

|

We

believe we are one of the few true comprehensive security solution providers in

the industry. We are able to analyze a security risk and develop

security solutions specifically tailored to mitigate that risk, including

design, engineering and manufacturing individual components of a system as may

be necessary to deliver a fully integrated security system customized to a

client's requirements. We are frequently engaged by security system integrators,

security system dealers/installers, and commercial architects and engineers

because we are able to deliver the integrated platform of design, engineering

services and fully integrated security solutions that support their requirements

for the completion of a given project.

We

believe that we have developed a superior reputation as a provider of integrated

security systems since our inception in 1976 because we:

|

|

·

|

offer

the complete range of solutions-driven responses to accommodate our

customers' needs;

|

|

|

·

|

offer

technologically superior products;

|

|

|

·

|

are

able to design, engineer and manufacture systems customized to our

clients' specific requirements;

|

|

|

·

|

deliver

systems that are easy to operate and maintain while providing superior

life cycle cost performance compared to systems offered by

competitors;

|

|

|

·

|

have

established solid credentials in protecting high value targets;

and

|

|

|

·

|

offer

customers perhaps the best warranty in the

industry.

|

As

reported previously, the Company submitted proposals during fiscal 2010 on

projects for Department of Defense (DoD) facilities and certain nuclear power

stations in the United States and southeast Asia valued at approximately

$13,650,000. Approximately $2.2 million of these DoD and nuclear

projects were awarded and partially shipped during the fourth quarter of fiscal

2010 and the first quarter of fiscal 2011. An additional $850,000 of

these proposals were awarded during the second quarter of fiscal

2011. We anticipate decisions relating to the remaining proposals

during the second half of fiscal 2011 with deliveries scheduled through the last

six months of fiscal 2011 and the first half of fiscal 2012.

CRITICAL

ACCOUNTING POLICIES

Our

consolidated financial statements and accompanying notes have been prepared in

accordance with U.S. generally accepted accounting principles. The

preparation of these financial statements requires that we make estimates,

judgments and assumptions that affect the reported amounts of assets,

liabilities, revenues and expenses. Management continually evaluates

the accounting policies and estimates it uses to prepare the consolidated

financial statements. We base our estimates on historical experience

and assumptions believed to be reasonable under current facts and

circumstances. Actual amounts and results could differ from these

estimates made by management.

We do not

participate in, nor has there been created, any off-balance sheet special

purpose entities or other off-balance sheet financing. In addition,

we do not enter into any derivative financial instruments for speculative

purposes.

We have

identified the following critical accounting policies that affect the more

significant judgments and estimates used in the preparation of our condensed

consolidated financial statements.

INVENTORY

VALUATION

Inventories

are valued at the lower of cost or market. We routinely evaluate the

composition of our inventory to identify obsolete or otherwise impaired

inventories. Inventories identified as impaired are evaluated to

determine if reserves are required. We do not currently have any reserves

against inventory.

ALLOWANCE

FOR DOUBTFUL ACCOUNTS

The

allowance for doubtful accounts is comprised of two parts, a specific account

analysis and a general reserve. Accounts where specific information indicates a

potential loss may exist are reviewed and a specific reserve against amounts due

is recorded. As additional information becomes available, such

specific account reserves are updated. Additionally, a general reserve is

applied to the aging categories based on historical collection and write-off

experience.

ACCOUNTING

FOR INCOME TAXES

We record

a valuation allowance to our deferred tax assets for the amount that is more

likely than not to be realized. While we consider historical levels of income,

expectations and risks associated with estimates of future taxable income and

ongoing prudent and feasible tax planning strategies in assessing the need for

the valuation allowance, in the event that we determine that we would be able to

realize deferred tax assets in the future in excess of the net amount recorded,

an adjustment to the deferred tax asset would increase income in the period such

determination has been made. Likewise, should we determine that we would not be

able to realize all or part of the net deferred tax asset in the future, an

adjustment to the deferred tax asset would be charged against income in the

period such determination was made.

FAIR

VALUE OF EQUITY INSTRUMENTS

The

valuation of certain items, including valuation of warrants or stock options

that may be offered as compensation for goods or services, involve significant

estimations with underlying assumptions judgmentally

determined. Warrants are valued using the most reliable measure of

fair value, such as the value of the goods or services rendered, if

obtainable. If such value is not readily obtainable, the valuation of

warrants and stock options are then based upon the Black-Scholes valuation

model, which involves estimates of stock volatility, expected life of the

instruments and other assumptions.

RESULTS

OF OPERATIONS

SIX

MONTHS ENDED DECEMBER 31, 2010 ("2010 PERIOD") COMPARED TO SIX MONTHS ENDED

DECEMBER 31, 2009 ("2009 PERIOD") AND THREE MONTHS ENDED DECEMBER 31, 2010

COMPARED TO THREE MONTHS ENDED DECEMBER 31, 2009.

REVENUES. We

had net revenues of $1,881,963 for the 2010 Period compared to $1,635,704 for

the 2009 Period, representing an increase of approximately 15%. Net

revenues for the three months ended December 31, 2010 were $1,080,411 as

compared to $1,245,047 for the corresponding three month period in 2009,

representing a decrease of 13%. The increase in net revenues during the 2010

Period compared to the 2009 period is primarily attributable to new orders

received in fiscal 2010 and released for shipment in fiscal 2011. The

decrease in net revenues during the three months ended December 31, 2010 as

compared to the corresponding period in 2009 is primarily attributable to the

backlog of confirmed orders awaiting approval of the Company’s submittal

drawings and change in scope by the customer.

GROSS

MARGINS. Gross margins for the 2010 Period were $1,164,573, or approximately 62%

of net revenues, compared to $1,073,372, or approximately 66% of net revenues,

for the 2009 Period. Gross margins were 58% of revenue for the three

months ended December 31, 2010 compared to 63% for the corresponding three-month

period in 2009. The decrease in gross margins for the six and three

months ended December 31, 2010 compared to the corresponding periods in

2009 is primarily attributable to a continuing shift in the order mix of

equipment sales and support services. The Company’s sales and gross

margins may vary quarter to quarter, but gross margins have remained within the

58%-68% range as stated in the previous Form 10-Q for the three-month period

ended September 30, 2010.

RESEARCH

AND DEVELOPMENT. Research and development expenses consist primarily

of expenses incurred in designing and developing upgrades to existing products

and systems. Research and development expenses for the 2010 Period were

$61,211 compared to $80,668 for the 2009 Period. For the three months

ended December 31, 2010, research and development costs were $36,605 compared to

$40,334 for the three months ending December 31, 2009. The

decrease in research and development expenses for the six and three months ended

December 31, 2010 compared to the corresponding periods in 2009 was

directly attributable to completion of the development work on our Bio-Chem

Water Infrastructure Sensing Equipment (WISE®).

SELLING,

GENERAL AND ADMINISTRATIVE EXPENSES. Selling, general and

administrative expenses for the 2010 Period and for the three months ended

December 31, 2010 were $680,580 and $338,765, respectively, compared to $745,753

and $518,437 for each of the 2009 Period. The decrease in selling, general and

administrative expenses during the 2010 periods compared to the 2009 periods was

primarily due to our efforts to reduce our marketing, sales and sales support

costs. The decrease in selling, general and administrative expenses

costs during the three-months ended December 31, 2010 compared to the

corresponding three months in 2009 was due to the write-off of certain bad debts

taken during the three months ended December 31, 2009

.

STOCK

BASED COMPENSATION. We issued stock options to our directors and various

employees and consultants. The value of these options is being amortized over

their respective vesting periods. Stock-based compensation is non-cash and,

therefore, has no impact on cash flow or liquidity.

INCOME

FROM OPERATIONS. The income from operations for the 2010 Period was

$391,741 compared to $234,577 for the 2009 Period. For the three

months ended December 31, 2010, we had income from operations of $243,100

compared to $222,137 for the corresponding three months in 2009. The

increase in income from operations during the 2010 periods compared to the 2009

periods was attributable to the receipt of higher gross margin purchase orders,

a more profitable mix of design and engineering support services billings, and

controlled selling, general and administrative expenses.

INTEREST

EXPENSE. Interest expense in the 2010 Period was $31,638 compared to

$53,704 incurred during the 2009 Period. The decrease is due to lower

amounts of principal outstanding during the respective periods.

INCOME. Income

before dividends related to preferred stock for the 2010 Period was $362,166 as

compared to $180,873 in 2009 Period. For the three months ended

December 31, 2010, there was income of $230,253 compared to income of $195,644

in the corresponding period in 2009. The increase in income is

directly related to the deliverables of design and engineering support

services.

DIVIDENDS

RELATED TO PREFERRED STOCK.

We

recorded dividends totaling $73,051 on our Series B Convertible Preferred Stock

in the 2010 period as compared to $66,181 in the 2009 period. In lieu of a cash

payment, we have elected, under the terms of these securities, to add this

amount to the stated value of the Series B Convertible Preferred

Stock.

These

dividends are non-cash and, therefore, have no impact on our net worth, cash

flow or liquidity.

LIQUIDITY

AND CAPITAL RESOURCES

We

believe that cash on hand, together with anticipated collection of accounts

receivable during the short term, will be sufficient to provide for our working

capital needs for the next twelve months. However, we may need to

raise funds in order to allow for shortfalls in anticipated revenue or to expand

existing capacities and/or to satisfy any additional significant purchase order

that we may receive. At the present time, we have no commitments or

assurances of additional revenue beyond the firm purchase orders we have

received. Additionally, a leading provider of receivables-based

financing, has advised us that it is affording us a $3.5 million (or more as our

business grows) line of credit for large government and/or private sector

contracts which we used previously during the Integrated Base Defense Security

System (IBDSS) program. The line of credit has been reaffirmed (on an informal

basis).

At

December 31, 2010, we had working capital of approximately $1.5 million compared

to approximately $1.3 million at June 30, 2010. Net cash

provided by operating activities for the 2010 period was $739,772 as compared to

$271,242 for the 2009 period.

Inventory

increased by $276,255 during the six months ended December 31, 2010 over

the corresponding six months in 2009. Inventories have still remained relatively

high due to an increase of the Company’s work in process in preparation for

shipments on our committed projects.

Accounts

receivable have decreased by $1,465,450 to $467,460 for the six months ended

December 31, 2010 over the corresponding six months in 2009. The

decrease is due to a change in the Company’s new payment terms and conditions

and to substantial collections in December 2010.

Accounts

payable and accrued expenses have decreased by $955,012 to $1,487,678 for the

six months ended December 31, 2010 over the corresponding six months in

2009.. Included in accrued expenses are accrued salaries to officers

and other key employees in the amount of $496,560. The decrease in

accounts payable and accrued expenses from June 30, 2010 was directly

related to a decrease in our accounts receivable due to increased

collections. This afforded the Company the ability to pay

down our trade payables and decrease the accrued salaries due to officers and

other key employees.

The

Company purchased equipment in the aggregate of $383,818 during the six months

ended December 31, 2010. This equipment was directly related to our

new integrated entry control systems and to the WISE® Water Infrastructure

Sensing Equipment, both of which will generate significant sales in the years

ahead. We do not have any material commitments for capital

expenditures going forward.

ITEM 4.

CONTROLS AND PROCEDURES.

We

maintain disclosure controls and procedures designed to ensure that information

required to be disclosed in our reports filed or submitted under the Securities

Exchange Act of 1934 (the “Exchange Act”) is recorded, processed, summarized and

reported within the time periods specified in the Securities and Exchange

Commission's rules and forms. As of the end of the period covered by this

Quarterly Report on Form 10-Q, we carried out an evaluation, under the

supervision and with the participation of management, including our Chief

Executive Officer (and Principal Financial Officer and Accounting Officer), of

the effectiveness of the design and operation of our disclosure controls and

procedures pursuant to Exchange Act Rule 13a-15. Based upon that evaluation,

management and our Chief Executive Officer (and Principal Financial Officer and

Accounting Officer) concluded that our disclosure controls and procedures were

effective to ensure that information required to be disclosed by us in the

reports that we file or submit under the Exchange Act is recorded,

processed, summarized and reported within the time periods specified in the

Securities and Exchange Commission's rules and forms.

There

were no changes in our internal control over financial reporting (as defined in

Rule 13a-15(f) under the Exchange Act) identified in connection with the

foregoing evaluation that occurred during the period covered by this

Quarterly Report on Form 10-Q that have materially affected, or are

reasonably likely to materially affect, our internal control over financial

reporting.

PART II.

OTHER INFORMATION

ITEM

5. OTHER INFORMATION

On

February 8, 2011, we executed a drawdown equity financing agreement and

registration rights agreement (collectively the "Agreements") with Auctus

Private Equity Fund, LLC ("Auctus") pursuant to which Auctus has committed,

subject to certain conditions, to purchase up to $10 million of our Common

Stock, over a term of up to five years commencing from the effective date of the

Registration Statement (as defined below).

While we

are not required to sell shares under the Agreements, the Agreements give us the

option to sell to Auctus shares of Common Stock at a per share purchase price of

equal to 96% of the lowest closing volume weighted average price (VWAP) during

the five trading days following our delivery to Auctus of a draw-down notice

(the "Notice"). At our option, we may set a floor price under which

Auctus may not sell the shares which were the subject of the

Notice. The maximum amount of Common Stock that we can sell pursuant

to any Notice is the greater of: (i) an amount of shares with an aggregate

maximum purchase price of $200,000 or (ii) 200% of the average daily volume

based on the trailing ten (10) days preceding the Notice date, whichever is of a

larger value.

Auctus is

not required to purchase the shares, unless the shares which are subject to the

Notice have been registered for resale and are freely tradable in accordance

with the Federal securities laws, including the Securities Act of 1933, as

amended. The Company is obligated to file with the U.S. Securities

and Exchange Commission (the "SEC") a registration statement on Form S-1 (the

“Registration Statement”) within 180 days from the date of the Agreements and to

use all commercially reasonable efforts to have such registration statement

declared effective by the SEC within 120 days of filing.

The

Company has paid to Auctus a non-refundable fee of $5,000 and an additional

$7,500 will be taken out of the proceeds of the first drawdown.

ITEM 6.

EXHIBITS -

|

Exhibit No

.

|

|

Title

|

|

|

|

|

|

10.1

|

|

Drawdown

Equity Financing Agreement, dated as of February 8, 2011 by and between

Electronic Control Security Inc. Inc. and Auctus Private Equity Fund,

LLC.

|

|

|

|

|

|

10.2

|

|

Registration

Rights Agreement, dated as of February 8, 2011 by and between Electronic

Control Security Inc. Inc. and Auctus Private Equity Fund,

LLC.

|

|

|

|

|

|

31.1

|

|

Certification

of Chief Executive Officer (and Principal Financial and Accounting

Officer) pursuant to Section 302 of the Sarbanes-Oxley Act of

2002.

|

|

|

|

|

|

32.1

|

|

Certification

of Chief Executive Officer (and Principal Financial and Accounting

Officer) pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, 18

U.S.C. Section 1350

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has

duly caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

|

|

ELECTRONIC

CONTROL SECURITY INC.

|

|

|

|

|

Date: February

10, 2011

|

By:

/s/ Arthur Barchenko

|

|

|

|

|

|

|

|

|

Arthur

Barchenko

|

|

|

President,

Chief Executive Officer

|

|

|

(duly

authorized officer; principal executive officer, and

|

|

|

principal

financial and accounting

officer)

|

EXHIBIT

INDEX

|

Exhibit

No.

|

|

Description

|

|

|

|

|

|

10.1

|

|

Drawdown

Equity Financing Agreement, dated as of February 8, 2011 by and between

Electronic Control Security Inc. Inc. and Auctus Private Equity Fund,

LLC.

|

|

|

|

|

|

10.2

|

|

Registration

Rights Agreement, dated as of February 8, 2011 by and between Electronic

Control Security Inc. Inc. and Auctus Private Equity Fund,

LLC.

|

|

|

|

|

|

31.1

|

|

Certification

of Chief Executive Officer (and Principal Financial and Accounting

Officer) pursuant to Section 302 of the Sarbanes-Oxley Act of

2002.

|

|

|

|

|

|

32.1

|

|

Certification

of Chief Executive Officer (and Principal Financial and Accounting

Officer) pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, 18

U.S.C. Section 1350

|

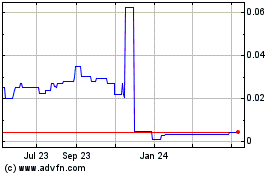

Electronic Control Secur... (CE) (USOTC:EKCS)

Historical Stock Chart

From Mar 2024 to Apr 2024

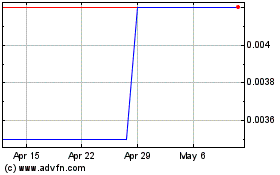

Electronic Control Secur... (CE) (USOTC:EKCS)

Historical Stock Chart

From Apr 2023 to Apr 2024