Rocky Brands, Inc. Announces Refinancing of Term Loans

May 18 2010 - 7:00AM

Business Wire

Rocky Brands, Inc. (Nasdaq: RCKY) today announced that it has

received approval from the requisite lenders, including GMAC

Commercial Finance, LLC, under the Amended and Restated Loan and

Security Agreement, dated March 31, 2009, as amended from time to

time, to advance $15 million to the Company under the existing

revolving portion of its credit facility to prepay amounts due

under term loans with Laminar Direct Capital L.P. and Whitebox

Hedged High Yield Partners, L.P. After the prepayment, principal

under the term loans will total approximately $11 million in the

aggregate. The term loans have an interest rate of 11.5% payable

semi-annually over the five year term of the notes. Principal

repayment is due at maturity in May 2012. The interest rate for the

revolving portion of the Company’s credit facility is currently

LIBOR plus 3.75%.

The transaction is expected to generate approximately $1.1

million in interest savings annually based on the current LIBOR

rate. The transaction is expected to close on Wednesday, May 19,

2010.

About Rocky Brands,

Inc.

Rocky Brands, Inc. is a leading designer, manufacturer and

marketer of premium quality footwear and apparel marketed under a

portfolio of well recognized brand names including Rocky®, Georgia

Boot®, Durango®, Lehigh®, and the licensed brands Michelin® and

Mossy Oak®.

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995

This press release contains certain forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities and Exchange Act of

1934, as amended, which are intended to be covered by the safe

harbors created thereby. Those statements include, but may not be

limited to, all statements regarding intent, beliefs, expectations,

projections, forecasts, and plans of the Company and its management

and include statements in this press release regarding interest

savings and the closing of the transaction (paragraph 2). These

forward-looking statements involve numerous risks and

uncertainties, including, without limitation, the various risks

inherent in the Company’s business as set forth in periodic reports

filed with the Securities and Exchange Commission, including the

Company’s annual report on Form 10-K for the year ended December

31, 2009 (filed March 2, 2010) and quarterly report on Form 10-Q

for the period ended March 31, 2020 (filed May 3, 2010). One or

more of these factors have affected historical results, and could

in the future affect the Company’s businesses and financial results

in future periods and could cause actual results to differ

materially from plans and projections. Therefore there can be no

assurance that the forward-looking statements included in this

press release will prove to be accurate. In light of the

significant uncertainties inherent in the forward-looking

statements included herein, the Company, or any other person should

not regard the inclusion of such information as a representation

that the objectives and plans of the Company will be achieved. All

forward-looking statements made in this press release are based on

information presently available to the management of the Company.

The Company assumes no obligation to update any forward-looking

statements.

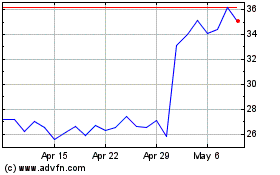

Rocky Brands (NASDAQ:RCKY)

Historical Stock Chart

From Mar 2024 to Apr 2024

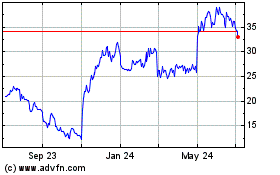

Rocky Brands (NASDAQ:RCKY)

Historical Stock Chart

From Apr 2023 to Apr 2024