The Hartford Financial Services Group, Inc. (NYSE:HIG):

- Core earnings* of $545

million

- Core earnings per diluted share*

of $0.14 includes after-tax charges for CPP repurchase, litigation

accrual and new federal healthcare legislation totaling $1.18 per

diluted share

- Book value per common share

increased 61% over prior year period to $38.94

- With successful capital raise

and CPP repurchase, company is focused on execution of go-forward

strategy

The Hartford Financial Services Group, Inc. (NYSE:HIG) today

reported first quarter 2010 net income of $319 million. Due to the

repurchase of the government’s CPP preferred shares, the company

also recorded a $440 million charge to retained earnings that

impacts the calculation of net income per diluted share,

contributing to a reported net loss per diluted share of $0.42. In

the first quarter of 2009, the company reported a net loss of $1.2

billion, or $3.77 per diluted share.

Core earnings for the first quarter of 2010 were $545 million,

or $0.14 per diluted share, compared with a core loss of $1.2

billion, or $3.66 per diluted share, for the prior year period.

“The company’s first quarter results reflect building momentum,

with year-over-year top-line improvements in many businesses,” said

Liam E. McGee, The Hartford’s Chairman, President and Chief

Executive Officer. “We also benefited from capital market

improvements, disciplined underwriting and a continued focus on

execution across the organization. Our goal is to deliver superior

shareholder value by generating sustained, profitable growth over

time.”

“In the first quarter, we made significant progress on our path

forward. We completed a successful capital raise, which enabled us

to strengthen the company’s balance sheet and return the

government’s investment in The Hartford. We are now focused on

executing our go-forward strategy, which leverages our product

breadth, distribution strength and broad customer base,” added

McGee.

FIRST QUARTER 2010 FINANCIAL RESULTS

(in millions except per share

data)

Quarterly Results

1Q '10 1Q '09

Change Net income (loss)

$319 $(1,209) NM Net

income (loss) available to common shareholders per diluted share

$(0.42) $(3.77)

89% Core earnings (losses) $545

$(1,175) NM Core earnings

(losses) available tocommon shareholders per diluted share*

$0.14 $(3.66)

NM Assets under management* $396,353

$330,187 20% Book value

per common share $38.94

$24.15 61% Book value per common share (ex.

AOCI)* $44.29 $48.13

(8%)

The Hartford defines increases or decreases greater than or

equal to 200%, or changes from a net gain to a net loss position,

or vice versa, as “NM” or not meaningful.

REVIEW OF BUSINESS RESULTS

PROPERTY AND CASUALTY OPERATIONS

First Quarter 2010 Highlights:

- Strong profitability, with net

income of $257 million and a 92.1% current accident year combined

ratio (excluding catastrophes) in ongoing operations

- Current accident year

catastrophe losses of $79 million, or 3.3 points, in line with the

company’s expectations

- Key indicators in small

commercial and middle market continue to trend favorably, with

policy count retention up 4% over first quarter 2009 levels and

renewal written pricing became positive for the first time in six

years

- Innovative product rollouts

drove year-over-year new business premium growth of 9% and 3%,

respectively, in small commercial and middle market

Property and casualty net income was $257 million for the first

quarter of 2010, compared with $112 million for the prior year

period. The first quarter of 2010 included a net realized capital

loss of $49 million, after-tax, compared with a net realized

capital loss of $211 million, after-tax, for the prior year

period.

Core earnings were $304 million for the first quarter of 2010,

including the effect of a $19 million charge related to the new

federal healthcare reform legislation, compared with $321 million

in the prior year period. The first quarter of 2010 also included

$89 million, pre-tax, of net prior year reserve releases across a

number of lines of business, compared with $68 million for the

prior year period.

Written premiums* for the first quarter of 2010 were $2.5

billion, equal to the first quarter of 2009. Increased small

commercial and middle market new business premiums and policy

retention were offset by economy-driven exposure reductions across

the commercial segments and lower new business premium in personal

lines resulting from the company’s rate and underwriting

actions.

The first quarter 2010 combined ratio for ongoing operations,

including prior year development and catastrophes, was 91.7%,

compared with 89.9% in the prior year period. Excluding

catastrophes, the current accident year combined ratio for ongoing

operations for the first quarter of 2010 was 92.1%, compared with

90.0% for the prior year period.

Combined Ratio for Ongoing Operations (including prior year

development and catastrophes):

1Q ‘10 1Q

‘09 Personal Lines 94.5%

92.4% Small Commercial

86.9%

86.6% Middle Market 97.6%

87.5% Specialty Commercial

81.9%

92.8% Ongoing Operations

91.7% 89.9%

LIFE OPERATIONS

First Quarter 2010 Highlights:

- Net income of $186 million marks

second consecutive quarter of profitability

- Assets under management of $345

billion, up 22% from March 31, 2009

- Retirement plans deposits were

$2.6 billion, up 15% over the prior year period

- Mutual fund deposits were $4.4

billion, net flows were $1.5 billion

- Life insurance sales were up 5%

over the prior year period

Life reported net income of $186 million for the first quarter

of 2010, compared with a net loss of $1.3 billion for the prior

year period. First quarter 2010 net income included a $178 million

after-tax net realized capital loss, compared with a $113 million

after-tax net realized capital gain for the prior year period.

First quarter 2010 net income included a DAC unlock benefit of $85

million, after tax, compared with a DAC unlock charge of $1.5

billion, after-tax, for the prior year period.

Core earnings for the first quarter of 2010 were $365 million,

compared with core losses of $1.4 billion for the prior year

period. First quarter 2010 core earnings included a $79 million

after-tax DAC unlock benefit, compared with a $1.5 billion

after-tax DAC unlock charge for the prior year period.

Account Values (in billions)

March

31, 2010 March 31, 2009

Change Global Annuity – U.S.

$98.1 $79.9 23%

Global Annuity – Japan $34.7

$30.9 12%

Mutual Funds**

$97.7 $69.4

41% Retirement Plans $46.5

$36.0 29% Institutional

$56.3 $59.5

(5%)

** Beginning with the first quarter of 2010, investment-only

mutual funds, Canadian mutual funds and insurance product mutual

fund assets and results were transferred to the Mutual Funds

business for reporting purposes on a prospective basis. The chart

above provides the 2009 mutual fund account values on a proforma

basis. Insurance product mutual fund assets of $44.4 billion and

$36.7 billion in years 2010 and 2009, respectively, are included in

mutual funds and in other segments to the extent that they generate

earnings for those segments. The primary drivers of the increase in

mutual fund account values were deposits and improving equity

markets.

INVESTMENTS

First Quarter 2010 Highlights:

- Net investment income, excluding

trading securities, increased 15% over the prior year period,

primarily driven by improved returns on limited partnerships and

other alternative investments

- Net pre-tax unrealized loss on

securities declined to $3.2 billion at March 31, 2010, down 36%

from the end of 2009

- Pre-tax impairment losses and

additions to the mortgage loan loss reserve totaled $264 million,

the lowest quarterly total since the second quarter of 2008

- Continued to reduce risk in the

investment portfolio with more than $1 billion of real

estate-related holdings sold during the quarter

The Hartford's total invested assets, excluding trading

securities, were $95.3 billion as of March 31, 2010, compared with

$88.5 billion as of March 31, 2009. Net investment income,

excluding trading securities, was $1.1 billion, pre-tax, in the

first quarter of 2010, a 15% increase over the prior year

period.

Impairments and the net increase to the mortgage loan loss

reserve totaled $264 million, pre-tax, in the first quarter of

2010. The majority of the impairments were the result of collateral

deterioration on commercial real estate-related assets, primarily

CMBS and CRE CDOs. The loss reserve increase resulted primarily

from valuation allowances established on mortgage loans that the

company intends to sell in the second and the third quarter of

2010.

The Hartford continued to reduce investment portfolio risk

during the first quarter of 2010, selling more than $1 billion of

real estate-related securities, including approximately $600

million of subordinated commercial mortgage loans, as market prices

continued to improve.

The net pre-tax unrealized loss on investments was $3.2 billion

as of March 31, 2010, compared with $5.0 billion as of December 31,

2009. The improvement was primarily driven by spread tightening

across most fixed maturity asset classes.

OTHER DEVELOPMENTS

The company reached an agreement in principle to settle a class

action lawsuit stemming from structured settlement transactions

involving the company’s P&C and Life operations. The resulting

$47 million after-tax charge was reflected in the corporate segment

of the company’s financial results for the first quarter of 2010.

The settlement is contingent upon court approval.

2010 GUIDANCE

Based on the assumptions below, The Hartford currently expects

2010 core earnings per diluted share to be between $2.70 and $3.00.

The previous guidance was a range of $2.60 to $2.90. The guidance

contained within this news release is subject to unusual or

unpredictable benefits or charges that might occur in 2010, as well

as factors noted below. Historically, the company has frequently

experienced unusual or unpredictable benefits and charges that were

not anticipated in previously provided guidance.

This guidance assumes the following:

-- U.S. equity markets produce an annualized return of 9.0%

(including 7.2% stock appreciation and 1.8% dividends) from the

S&P 500 level of 1,169 on March 31, 2010;

-- This guidance incorporates no estimate of the effect of

unlocks for the last three quarters of 2010 of the account values

and related assumptions underlying the company's estimate of future

gross profits used in the determination of certain asset and

liability balances, principally life deferred acquisition

costs;

-- A pre-tax underwriting loss of $160 million from other

operations in property and casualty. In the last several years,

underwriting losses in other operations have differed materially

from the assumptions incorporated in guidance;

-- A property and casualty catastrophe ratio of 3.0% to

3.5%;

-- An annualized yield on limited partnerships and other

alternative investments of 0% for the last three quarters of 2010.

In the last several years, yields have differed materially from the

assumptions incorporated in guidance; and

-- Diluted weighted average shares of common stock outstanding

of approximately 490 million for 2010.

The economy and market conditions remain uncertain and

persistent stress in financial markets and recessionary global

economic conditions increase the likelihood that the company’s 2010

earnings guidance will turn out to be incorrect. The company’s

actual experience in 2010 will almost certainly differ from many of

the assumptions described above, and investors should consider the

risks and uncertainties that may cause the company’s actual results

to differ, potentially materially, from the 2010 earnings guidance,

including, but not limited to, those set forth in the discussion of

forward looking statements at the end of this release and the risk

factors included in the company’s quarterly report on Form 10-Q for

the quarter ended March 31, 2010 and the annual report on Form 10-K

for the year ended December 31, 2009.

CONFERENCE CALL

The Hartford will discuss its first quarter 2010 results in a

conference call on Friday, April 30th at 9:00 a.m. EDT. The call,

along with a slide presentation, can be simultaneously accessed

through The Hartford's Web site at ir.thehartford.com. More

detailed financial information can be found in The Hartford's

Investor Financial Supplement for the first quarter of 2010, which

is available on The Hartford's Web site, ir.thehartford.com.

ABOUT THE HARTFORD

Celebrating 200 years of helping its customers achieve what’s

ahead, The Hartford (NYSE: HIG) is an insurance and wealth

management company. Through its unique focus on customer needs, the

company serves businesses and consumers by providing the products

and solutions they need to protect their assets and income from

risks and manage their wealth and retirement needs. A Fortune 100

company, The Hartford is recognized widely for its service

expertise and as one of the world's most ethical companies. More

information on the company and its financial performance is

available at www.thehartford.com.

HIG-F

*Denotes financial measures not calculated based on generally

accepted accounting principles ("non-GAAP"). More information is

provided in the Discussion of Non-GAAP and Other Financial Measures

section below.

DISCUSSION OF NON-GAAP AND OTHER FINANCIAL MEASURES

The Hartford uses non-GAAP and other financial measures in this

press release to assist investors in analyzing the company's

operating performance for the periods presented herein. Because The

Hartford's calculation of these measures may differ from similar

measures used by other companies, investors should be careful when

comparing The Hartford's non-GAAP and other financial measures to

those of other companies.

The Hartford uses the non-GAAP financial measure core earnings

(loss) as an important measure of the company's operating

performance. The Hartford believes that the measure core earnings

(loss) provides investors with a valuable measure of the

performance of the company's ongoing businesses because it reveals

trends in the company's insurance and financial services businesses

that may be obscured by the net effect of certain realized capital

gains and losses. Some realized capital gains and losses are

primarily driven by investment decisions and external economic

developments, the nature and timing of which are unrelated to the

insurance and underwriting aspects of the company's business.

Accordingly, core earnings (loss) excludes the effect of all

realized gains and losses (net of tax and the effects of deferred

policy acquisition costs) that tend to be highly variable from

period to period based on capital market conditions. The Hartford

believes, however, that some realized capital gains and losses are

integrally related to the company's insurance operations, so core

earnings (loss) includes net realized gains and losses such as net

periodic settlements on credit derivatives and net periodic

settlements on the Japan fixed annuity cross-currency swap. These

net realized gains and losses are directly related to an offsetting

item included in the statement of operations such as net investment

income (loss). Core earnings (loss) is also used by management to

assess the company's operating performance and is one of the

measures considered in determining incentive compensation for the

company's managers. Net income (loss) is the most directly

comparable GAAP measure. Core earnings (loss) should not be

considered as a substitute for net income (loss) and does not

reflect the overall profitability of the company's business.

Therefore, The Hartford believes that it is useful for investors to

evaluate both net income (loss) and core earnings (loss) when

reviewing the company's performance. A reconciliation of net income

(loss) to core earnings (loss) for the three months ended March 31,

2009 and 2010 is set forth in the results by segment table. The

2010 earnings guidance presented in this release is based in part

on core earnings (loss). A quantitative reconciliation of The

Hartford's net income (loss) to core earnings (loss) is not

calculable on a forward-looking basis because it is not possible to

provide a reliable forecast of realized capital gains and losses,

which typically vary substantially from period to period.

Core earnings (loss) per share is calculated based on the

non-GAAP financial measure core earnings (loss). The Hartford

believes that the measure core earnings (loss) per share provides

investors with a valuable measure of the company's operating

performance for many of the same reasons applicable to its

underlying measure, core earnings (loss). Net income (loss) per

share is the most directly comparable GAAP measure. Core earnings

(loss) per share should not be considered as a substitute for net

income (loss) per share and does not reflect the overall

profitability of the company's business. Therefore, The Hartford

believes that it is useful for investors to evaluate both net

income (loss) per share and core earnings (loss) per share when

reviewing the company's performance. A reconciliation of net income

(loss) per share to core earnings (loss) per share for the three

months ended March 31, 2009 and 2010 is set forth on page C-7 of

The Hartford's Investor Financial Supplement for the first quarter

of 2010.

Written premium is a statutory accounting financial measure used

by The Hartford as an important indicator of the operating

performance of the company's property and casualty operations.

Because written premium represents the amount of premium charged

for policies issued, net of reinsurance, during a fiscal period,

The Hartford believes it is useful to investors because it reflects

current trends in The Hartford's sale of property and casualty

insurance products. Earned premium, the most directly comparable

GAAP measure, represents all premiums that are recognized as

revenues during a fiscal period. The difference between written

premium and earned premium is attributable to the change in

unearned premium reserves. A reconciliation of written premium to

earned premium for the three months ended March 31, 2009 and 2010

is set forth on page PC-2 of The Hartford's Investor Financial

Supplement for the first quarter of 2010.

Book value per common share excluding accumulated other

comprehensive income ("AOCI") is calculated based upon a non-GAAP

financial measure. It is calculated by dividing (a) stockholders'

equity excluding AOCI, net of tax, by (b) common shares

outstanding.

The Hartford provides book value per common share excluding AOCI

to enable investors to analyze the amount of the company's net

worth that is primarily attributable to the company's business

operations. The Hartford believes book value per common share

excluding AOCI is useful to investors because it eliminates the

effect of items that can fluctuate significantly from period to

period, primarily based on changes in interest rates. Book value

per common share is the most directly comparable GAAP measure. A

reconciliation of book value per common share to book value per

common share excluding AOCI as of March 31, 2009 and 2010 is set

forth in the results by segment table.

Assets under management is an internal performance measure used

by The Hartford because a significant portion of the company's

revenues are based upon asset values. These revenues increase or

decrease with a rise or fall, correspondingly, in the level of

assets under management. Assets under management is the sum of The

Hartford's total assets, mutual fund assets, and third-party assets

managed by Hartford Investment Management Company.

The Hartford's management evaluates profitability of the

Personal Lines, Small Commercial, Middle Market and Specialty

Commercial underwriting segments primarily on the basis of

underwriting results. Underwriting results is a before-tax measure

that represents earned premiums less incurred losses, loss

adjustment expenses and underwriting expenses. Net income (loss) is

the most directly comparable GAAP measure. Underwriting results are

influenced significantly by earned premium growth and the adequacy

of The Hartford's pricing. Underwriting profitability over time is

also greatly influenced by The Hartford's underwriting discipline,

which seeks to manage exposure to loss through favorable risk

selection and diversification, its management of claims, its use of

reinsurance and its ability to manage its expense ratio, which it

accomplishes through economies of scale and its management of

acquisition costs and other underwriting expenses. The Hartford

believes that underwriting results provides investors with a

valuable measure of before-tax profitability derived from

underwriting activities, which are managed separately from the

company's investing activities. Underwriting results are presented

for Ongoing Operations, Other Operations and total Property and

Casualty in The Hartford's Investor Financial Supplement. A

reconciliation of underwriting results to net income (loss) for

total Property and Casualty, Ongoing Operations and Other

Operations is set forth on pages PC-2, PC-3 and PC-11 of The

Hartford's Investor Financial Supplement for the first quarter of

2010.

A catastrophe is a severe loss, resulting from natural or

man-made events, including fire, earthquake, windstorm, explosion,

terrorist attack and similar events. Each catastrophe has unique

characteristics. Catastrophes are not predictable as to timing or

loss amount in advance, and therefore their effects are not

included in earnings or losses and loss adjustment expense reserves

prior to occurrence. The Hartford believes that a discussion of the

effect of catastrophes is meaningful for investors to understand

the variability of periodic earnings.

Some of the statements in this release should be considered

forward-looking statements as defined in the Private Securities

Litigation Reform Act of 1995. Forward-looking statements can be

identified by words such as “anticipates,” “intends,” “plans,”

“seeks,” “believes,” “estimates,” “expects” and similar references

to the future. Examples of forward-looking statements include, but

are not limited to, statements we make regarding our future results

of operations and our guidance for 2010 core earnings per diluted

share. The Hartford cautions investors that these forward-looking

statements are not guarantees of future performance, and actual

results may differ materially. Investors should consider the

important risks and uncertainties that may cause actual results to

differ. These important risks and uncertainties include significant

risks and uncertainties related to the Company’s current operating

environment, which reflects continued volatility in financial

markets, constrained capital and credit markets and uncertainty

about the timing and strength of an economic recovery and the

impact of governmental budgetary and regulatory initiatives and

whether management’s initiatives to address these risks will be

effective; the risk that our actual sources and uses of capital in

a stress scenario may vary materially and adversely from our

modeled projected sources and uses of capital that we disclosed in

connection with our repurchase of the Series E Fixed Rate

Cumulative Preferred Stock, whether as a result of one or more

assumptions proving to be materially inaccurate or as a result of

the Company’s exposure to other risks during stressed economic

conditions that were not taken into account in preparing such

modeled projections; risks associated with our continued execution

of steps to realign our business and reposition our investment

portfolio, including the potential need to adjust our plans to take

other restructuring actions, such as divestitures; market risks

associated with our business, including changes in interest rates,

credit spreads, equity prices, foreign exchange rates, as well as

challenging or deteriorating conditions in key sectors such as the

commercial real estate market, that have pressured our results and

are expected to continue to do so in 2010; potential volatility in

our earnings resulting from our recent adjustment of our risk

management program to emphasize protection of statutory surplus;

the impact on our statutory capital of various factors, including

many that are outside the Company’s control, which can in turn

affect our credit and financial strength ratings, cost of capital,

regulatory compliance and other aspects of our business and

results; risks to our business, financial position, prospects and

results associated with downgrades in the Company’s financial

strength and credit ratings or negative rating actions relating to

our investments; the potential for differing interpretations of the

methodologies, estimations and assumptions that underlie the

valuation of the Company’s financial instruments that could result

in changes to investment valuations; the subjective determinations

that underlie the Company’s evaluation of other-than-temporary

impairments on available-for-sale securities; losses due to

nonperformance or defaults by others; the potential for further

acceleration of DAC amortization; the potential for further

impairments of our goodwill and the potential for establishing

valuation allowances against deferred tax assets; the possible

occurrence of terrorist attacks and the Company’s ability to

contain its exposure, including the effect of the absence or

insufficiency of applicable terrorism legislation on coverage; the

difficulty in predicting the Company’s potential exposure for

asbestos and environmental claims; the possibility of a pandemic or

other man-made disaster that may adversely affect the Company’s

businesses and cost and availability of reinsurance; weather and

other natural physical events, including the severity and frequency

of storms, hail, snowfall and other winter conditions, natural

disasters such as hurricanes and earthquakes, as well as climate

change, including effects on weather patterns, greenhouse gases,

sea, land and air temperatures, sea levels, rain and snow; the

response of reinsurance companies under reinsurance contracts and

the availability, pricing and adequacy of reinsurance to protect

the Company against losses; the possibility of unfavorable loss

development; actions by our competitors, many of which are larger

or have greater financial resources than we do; the restrictions,

oversight, costs and other consequences of being a savings and loan

holding company, including from the supervision, regulation and

examination by the Office of Thrift Supervision, and arising from

our participation in the Capital Purchase Program (the “CPP”),

under the Emergency Economic Stabilization Act of 2008, certain

elements of which will continue to apply to us for so long as the

U.S. Department of the Treasury holds the warrant or shares of our

common stock received on exercise of the warrant that we issued as

part of our participation in the CPP even after the Company’s

repurchase of the preferred stock issued in connection therewith;

unfavorable judicial or legislative developments; the potential

effect of domestic and foreign regulatory developments, including

those that could adversely impact the demand for the Company’s

products, operating costs and required capital levels, including

changes to statutory reserves and/or risk-based capital

requirements related to secondary guarantees under universal life

and variable annuity products; the Company’s ability to distribute

its products through distribution channels, both current and

future; the uncertain effects of emerging claim and coverage

issues; the ability of the Company’s subsidiaries to pay dividends

to the Company; the Company’s ability to effectively price its

property and casualty policies, including its ability to obtain

regulatory consents to pricing actions or to non-renewal or

withdrawal of certain product lines; the Company’s ability to

maintain the availability of its systems and safeguard the security

of its data in the event of a disaster or other unanticipated

event; the risk that our framework for managing risks may not be

effective in mitigating risk and loss to us that could adversely

affect our businesses; the potential for difficulties arising from

outsourcing relationships; the impact of potential changes in

federal or state tax laws, including changes affecting the

availability of the separate account dividend received deduction;

the impact of potential changes in accounting principles and

related financial reporting requirements; the Company’s ability to

protect its intellectual property and defend against claims of

infringement; and other risks and uncertainties discussed in The

Hartford's Quarterly Reports on Form 10-Q, the 2009 Annual Report

on Form 10-K and other filings The Hartford makes with the

Securities and Exchange Commission. Any forward-looking statement

made by us in this release speaks only as of the date on which it

is made. Factors or events that could cause our actual results to

differ may emerge from time to time, and it is not possible for us

to predict all of them. We undertake no obligation to publicly

update any forward-looking statement, whether as a result of new

information, future developments or otherwise, except as may be

required by law.

- financial tables follow -

THE HARTFORD FINANCIAL SERVICES

GROUP, INC.

RESULTS BY SEGMENT

(in millions except per share

data)

Three Months Ended

March 31,

LIFE 2009 2010 Change

Global Annuity - U.S. $ (746 ) $ 153 NM Global

Annuity - International (293 ) 23 NM Retirement (86 ) 20 NM

Individual Life (18 ) 16 NM Group Benefits 69 51 (26 %)

Institutional (174 ) (88 ) 49 % Other (10 )

11 NM

Total Life net income

(loss) (1,258 ) 186 NM Less: Net

realized capital gains (losses), after-tax and DAC [1] [2]

123 (179 ) NM

Total

Life core earnings (losses) (1,381

) 365 NM

PROPERTY & CASUALTY Ongoing Operations

Ongoing Operations Underwriting Results Personal Lines 75 54 (28 %)

Small Commercial 87 83 (5 %) Middle Market 69 12 (83 %) Specialty

Commercial 23 52

126 % Total Ongoing Operations underwriting results 254 201 (21 %)

Net servicing income 8 7 (13 %) Net investment income 185 268 45 %

Other expenses (50 ) (54 ) (8 %) Net realized capital losses (289 )

(36 ) 88 % Income tax benefit (expense) 3

(148 ) NM

Ongoing Operations net

income 111 238 114 %

Other Operations Other Operations net income

1 19

NM Total Property & Casualty net

income 112 257 129 % Less: Net

realized capital losses, after-tax [1] [2] (209 )

(47 ) 78 %

Total Property & Casualty

core earnings 321

304 (5 %)

CORPORATE Total Corporate net loss

(63 ) (124 )

(97 %) CONSOLIDATED

Net income (loss)

(1,209 ) 319 NM Less: Net realized

capital losses, after-tax and DAC [1][2] (34 )

(226 ) NM

Core earnings (losses)

$ (1,175 ) $ 545

NM PER SHARE DATA Diluted

earnings per share

Net loss $ (3.77 )

$ (0.42 ) 89 % Core earnings

(losses) $ (3.66 ) $ 0.14

NM Book value per common share Book value per common share

(including AOCI) $ 24.15 $ 38.94 61 % Per share impact of AOCI $

(23.98 ) $ (5.35 ) 78 % Book value per common share (excluding

AOCI) $ 48.13 $ 44.29 (8 %)

[1] Includes those net realized capital gains and losses not

included in core earnings. See discussion of Non-GAAP and Other

Financial Measures section of this release.

[2] In Life, net realized capital gains (losses), after-tax and

DAC, includes DAC amortization (benefit) of $205 and $(63) for the

three months ended March 31, 2009 and 2010, respectively. In Life,

net realized capital gains (losses), after-tax and DAC, includes

tax expense of $65 and $8 for the three months ended March 31, 2009

and 2010, respectively. In P&C, net realized capital losses,

after-tax, includes tax expense (benefit) of $(111) and $9 for the

three months ended March 31, 2009 and 2010, respectively.

Consolidated net realized capital losses, after-tax and DAC,

includes DAC amortization (benefit) of $205 and $(63) for the three

months ended March 31, 2009 and 2010, respectively. Consolidated

net realized capital losses, after-tax and DAC, includes tax

expenses (benefits) of $(56) and $17 for the three months ended

March 31, 2009 and 2010, respectively.

The Hartford defines increases or decreases greater than or

equal to 200%, or changes from a net gain to a net loss position,

or vice versa, as “NM” or not meaningful

The Hartford

2010 Fiscal Year Guidance

Core Earnings Per Diluted Share

of $2.70 - $3.00*

Property and Casualty

2010 Written

PremiumGrowth Compared to

2009

2010Combined Ratio*

Ongoing Operations Flat -

4.0% 91.5% -

94.5% Personal Lines (1%) - 3% 90.5%

- 93.5% Auto (1%) - 3% Homeowners (1%) - 3%

Small

Commercial Flat -

4% 86.5% - 89.5%

Middle Market Flat -

4% 95% - 98%

Specialty Commercial 1% -

5% 99% -

102% *Excludes catastrophes and prior-year development

Life

Deposits

Net Flows

Core Earnings ROA1

U.S. Individual Annuity 36 - 40 bps Variable Annuity $1.4 -

$2.2 Billion ($10.0) - ($9.0) Billion Fixed Annuity $250 -

$750 Million ($1.0) Billion – ($500) Million

Japan Annuity 51 - 59 bps

Mutual Funds $15.5 - $17.5 Billion* $3.25 - $5.25 Billion* 8

- 12 bps * Deposits and Net Flows guidance excludes Insurance

product mutual funds.

Retirement Plans $8.0 - $9.0

Billion $1.0

- $1.5 Billion 6 - 11 bps

Group Benefits Fully Insured Premiums* $4.0

- $4.2

Billion Loss Ratio 72%

- 75% Expense Ratio 26%

- 28%

* Guidance for fully insured premiums excludes buyout premiums and

premium equivalents.

Individual Life After-tax

Margin, excluding DAC unlocks* 11%

- 13% * Guidance on

after-tax margin is core earnings divided by total core revenue.

1ROA outlooks exclude impact of DAC unlocks

* Based on 2010 guidance assumptions outlined in the “2010

GUIDANCE” section of the news release.

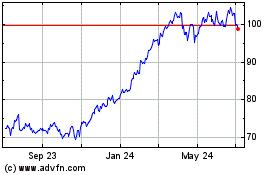

Hartford Financial Servi... (NYSE:HIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

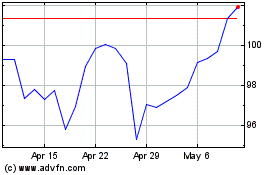

Hartford Financial Servi... (NYSE:HIG)

Historical Stock Chart

From Apr 2023 to Apr 2024