Fiscal Cliff 2013 - United States Fiscal Cliff Impact on GDP

Written By - Elisa Lee

InvestorsHub, Harrisonville MO

The Fiscal Cliff is a group of changes to United States federal tax code that is currently scheduled to happen on January 1, 2013. The term was created very recently to express negative attitude towards upcoming tax changes. The first set of changes is tax cuts created during the George W. Bush presidency will expire. Another set of both spending cuts and tax increases created during the Barack Obama's presidency will begin. The day the tax code changes has been termed the Fiscal Cliff because proponents insist the tax changes will destroy our economy and GDP, similar to your well being if you drove off a cliff.

The Fiscal Cliff is a bad term because the event is not a cliff in any way. Nobody will die if a resolution is not reached by the deadline. To put it in perspective, when the Black Tuesday Wall Street crash of 1929 happened there were quite a few people who did jump off buildings and bridges as a result. If you want to know about a real cliff, each year since 2009 the United States Federal Government has failed to agree on a federal budget in time. Funding for the entire government stops when this cliff happens. Government employees are not required to work and social security does not get paid out. This means we are open for invasion by a foreign military, emergency police services can be denied, and every government agency can simply turn off.

Currently scheduled events for the Fiscal Cliff deadline are tax increases and spending cuts. Some of the Fiscal Cliff tax increases have been scheduled for years now and are should be no surprise. Tax cuts made as early as 2001 will expire when 2013 arrives. How was 12 years not enough for plans to be made by now? As a reaction, various companies like Costco (NASDAQ:COST) and Dish Network (NASDAQ:DISH) are announcing special dividend payment to occur before the end of the calendar year in order to avoid the Fiscal Cliff.

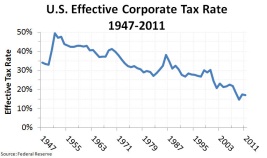

Many opponents of tax increases argue the Fiscal Cliff 2013 will ruin the economy. Probably the same babblers that say Obama Communism is going to ruin the country. The effective United States Corporate Tax Rate is near an all time low according to data from the US Federal Reserve. But clearly the economy is not steaming ahead full power. Maybe instead of worrying about the Fiscal Cliff we should try giving up democracy and try a constitutional monarchy. The government system works well for both Qatar and Luxembourg, the two countries consistently rated as richest countries by GDP in the world. They seem to not have any Fiscal Cliff problems to worry about.

The ridiculous "Fiscal Cliff" term was made up by the media and is being used to make the audience worked up into an agitated state. If you start with the assumption that the panic is being caused for profit, the most obvious conclusion seems that the media are scaring people to sell at a loss. This in turn implies a market rally is coming. If the market is already bearish and heading down then nothing needs to be done to purchase equities at a discount.

A market rally is coming and it is inevitable. This quarter the Dow, Nasdaq, and S&P500 almost surpassed all time highs. As time increases so does the market capitalization value and powerful is that correlation. Don't be panicked into selling your portfolio for a loss over worries about the United States Government Fiscal Cliff 2013.

InvestorsHub

1-888-992-3836

help@advfn.com